[ad_1]

AUSTRALIAN DOLLAR FORECAST: BEARISH

- The Australian Dollar has been augmented by a weaker US Dollar

- RBA rate hike pressure is eased somewhat by CPI missing estimates

- Fed action and US GDP play out but risks from China slowdown remain

The Australian Dollar has finished another tumultuous week higher than where it started.

Domestic inflation figures followed by the Federal Reserve rate hike and US GDP provided plenty of ammunition for volatility. The RBA will be making a decision on rates this Tuesday.

Australian CPI came in not as hot as anticipated and hosed down the prospect of a jumbo hike from the RBA this week.

This saw AUD/USD move lower into the Federal Reserve meeting and the 75- bp move from them hit market forecasts. It was the language from Fed Chair Jerome Powell in the aftermath that saw an adjustment lower of future hikes for the Fed.

This sent the US Dollar lower and the Aussie higher into US GDP figures that surprised to the downside, further undermining USD and boosting AUD.

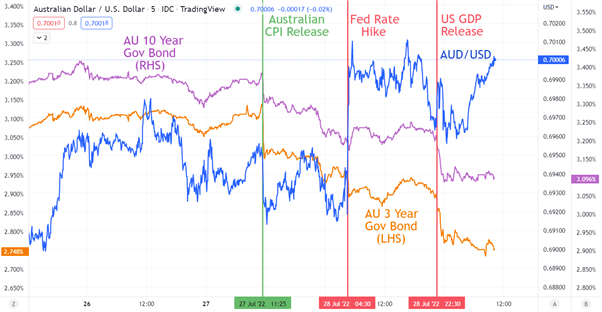

These three events saw the 3- and 10-year Australian Commonwealth Government bond (ACGB) yields go lower. This could undermine AUD if yields continue to move south.

AUD/USD, AUSTRALIAN 3- AND 10-YEAR GOVERNEMNET BOND YIELDS

The RBA will be breathing a sigh of relief at their meeting this week. Although a miss on forecasts, 6.1% headline CPI is still problematic for the central bank when they have a mandated target of 2-3%.

A 50- basis point lift is priced in by the markets. RBA Governor Philip Lowe has previously said that the debate at the August meeting is likely to focus on either a 25- or 50- basis point increase in the cash rate target.

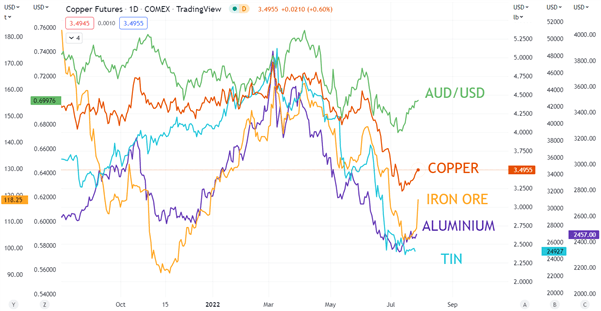

In the background, commodity prices have been steadying and mostly drifting higher on the back of a weaker US Dollar. The situation in China continues to plague global supply chains due to their zero case Covid-19 policy shutting down major centres on a rolling basis.

Compounding the deteriorating outlook in China is the ever-deteriorating property sector there. Between developers defaulting on their debt obligations, unfinished projects with no funding and buyers going on a mortgage strike, a resolution seems a long way off.

The flow on effects for AUD might be lower commodity prices at some stage down the track. Fortunately for Australian bulk commodity exporters with exposure to China, most of their contracts are long term and it will be some time before these impacts will be felt if the problems aren’t fixed.

Australian trade data will be released on Thursday and the market will be watching to see if last month’s blistering surplus of AUD 15. 97 billion can be maintained.

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.