[ad_1]

Canadian Dollar Talking Points

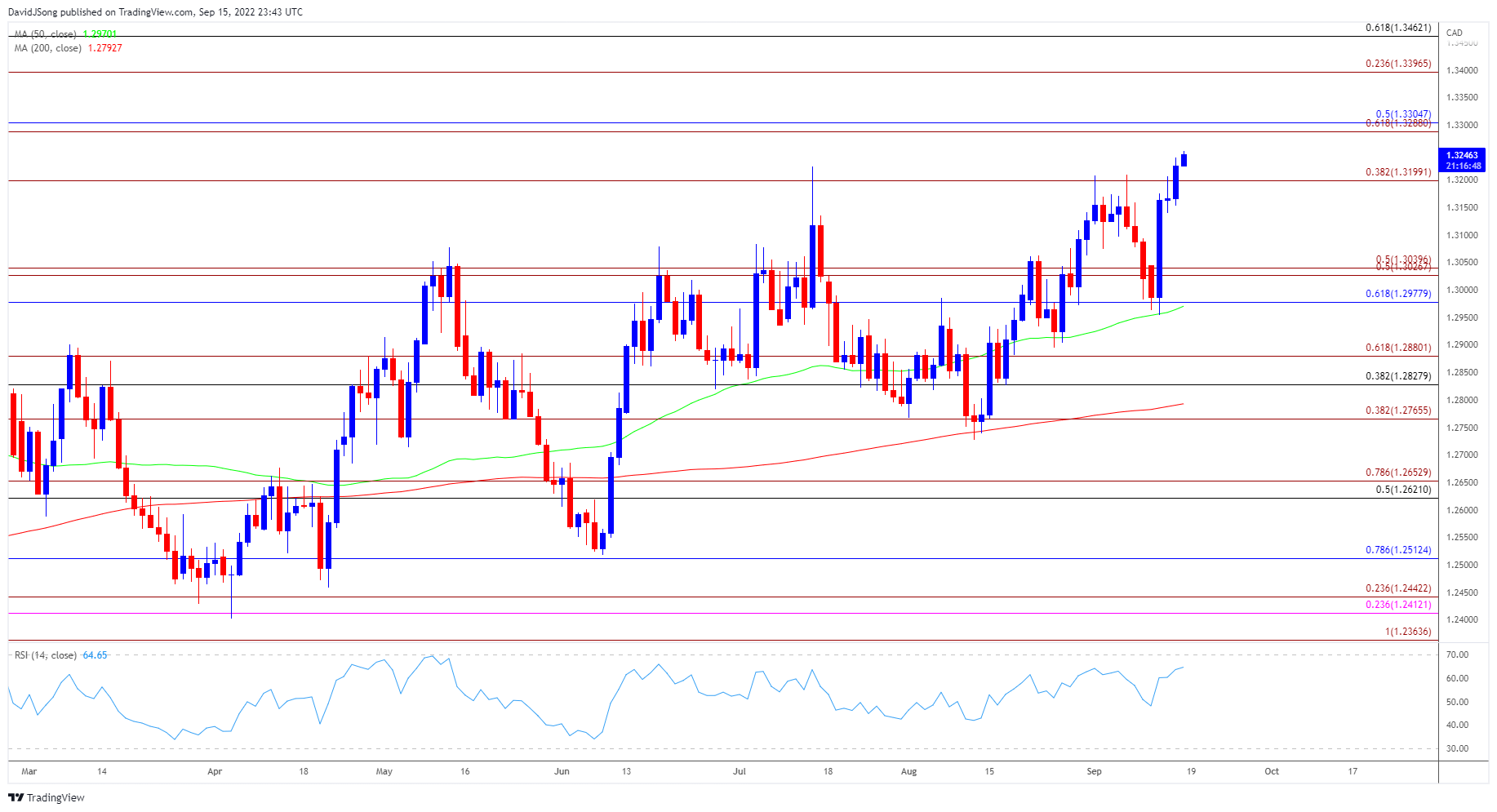

USD/CAD bounces back from the 50-Day SMA (1.2970) to clear the July high (1.3224), and the exchange rate may push towards the November 2020 high (1.3371) as it clears the opening range for September.

USD/CAD Rebound from 50-Day SMA to Clear September Opening Range

USD/CAD trades to a fresh yearly high (1.3252) as it extends the advance following the stronger-than-expected US Consumer Price Index (CPI), and the exchange rate may continue to appreciate ahead of the Federal Reserve interest rate decision on September 21 as it extends the series of higher highs and lows from earlier this week.

Looking ahead, the Federal Open Market Committee (FOMC) rate decision may influence the near-term outlook for USD/CAD as the CME FedWatch Tool reflects a 100% probability for a 75bp rate hike, and the exchange rate may continue to trade to fresh yearly highs over the remainder of the month should the central bank retain its current approach in combating inflation.

At the same time, the FOMC may continue to endorse a hawkish forward guidance as the committee plans to carry out a restrictive policy, and the update to the Summary of Economic Projections (SEP) may fuel the recent rally in USD/CAD if Chairman Jerome Powell and Co. project a steeper path for US interest rates.

In turn, USD/CAD may track the positive slope in the 50-Day SMA (1.2970) as it bounces back from the moving average, but a further advance in the exchange rate may fuel the tilt in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment report shows only 29.83% of traders are currently net-long USD/CAD, with the ratio of traders short to long standing at 2.35 to 1.

The number of traders net-long is 0.39% higher than yesterday and 29.70% lower from last week, while the number of traders net-short is 3.94% higher than yesterday and 45.22% higher from last week. The decline in net-long position comes as USD/CAD climbs to a fresh yearly high (1.3252), while the surge in net-short interest has fueled the crowding behavior as 47.72.% of traders were net-long the pair earlier this week.

With that said, speculation for another 75bp rate hike may keep USD/CAD afloat ahead of the FOMC meeting, and the exchange rate may push towards the November 2020 high (1.3371) as it clears the opening range for September.

Introduction to Technical Analysis

Market Sentiment

Recommended by David Song

USD/CAD Rate Daily Chart

Source: Trading View

- USD/CAD clears the opening range for September as it extends the series of higher highs and lows from earlier this week, with the close above the 1.3200 (38.2% expansion) handle bringing the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region on the radar.

- A break above the November 2020 high (1.3371) opens up the 1.3400 (23.6% expansion) handle, with the next area of interest coming in around 1.3460 (61.8% retracement).

- However, failure to test the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region may curb the bullish price action in USD/CAD, with a move below the 1.3200 (38.2% expansion) handle bringing the 1.3030 (50% expansion) to 1.3040 (50% expansion) area back on the radar.

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.