[ad_1]

USD/CAD Analysis and Talking Points

Aside from the Non-Farm Payrolls report, CAD traders will be closely watching the latest Canadian jobs data, in which expectations are for a modest employment gain of 20k. As it stands, option market pricing suggests an implied move of 58pips for USD/CAD.

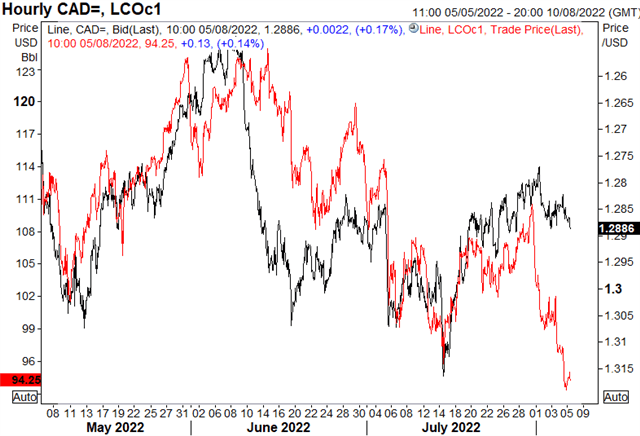

That being said, as shown in the chart below, oil prices have been a key factor behind the Canadian Dollar’s performance throughout the week. With oil on course for its largest weekly drop of the year, USD/CAD remains supported on dips. However, major pairs are likely to trade in ranges until today’s jobs report and next week’s US CPI report provides some clarity. Meanwhile, on the technical side, topside resistance is situated at 1.2930-50, while support sits at 1.2790.

A Helpful Guide to Support and Resistance Trading

USD/CAD inverted vs Brent Crude Oil

Source: Refinitiv

IG Client Sentiment Shifts Mixed USD/CAD Bias

Data shows 57.40% of traders are net-long with the ratio of traders long to short at 1.35 to 1. The number of traders net-long is 2.61% lower than yesterday and 1.02% lower from last week, while the number of traders net-short is 8.86% lower than yesterday and 2.86% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.