[ad_1]

Japanese Yen Talking Points

USD/JPY trades to a fresh weekly low (131.73) following the slowdown in the US Consumer Price Index (CPI), and the exchange rate appears to be on track to test the monthly low (130.39) after struggling to push back above the 50-Day SMA (135.24).

USD/JPY Eyes Monthly Low After Failing to Push Back Above 50-Day SMA

USD/JPY initiates a series of lower highs and lows despite the rebound in US Treasury yields and the exchange rate may continue to depreciate over the coming days if it fails to defend the opening range for August.

It seems as though the slowdown in the US CPI is fueling speculation for an adjustment in Federal Reserve’s forward guidance for monetary policy as Chairman Jerome Powellacknowledges that “it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.”

Source: CME

As a result, speculation for a shift in Fed policy may keep USD/JPY under pressure as the CME FedWatch Tool now reflects a greater than 60% probability for a 50bp rate hike next month, and it remains to be seen if the Federal Open Market Committee (FOMC) will adjust its approach at the next interest rate decision on September 21 as Governor Michelle Bowman argues that “similarly-sized increases should be on the table until we see inflation declining in a consistent, meaningful, and lasting way.”

Until then, USD/JPY may continue to give back the advance from the June low (128.60) amid waning expectations for a 75bp Fed rate hike, but the tilt in retail sentiment looks poised to persist as traders have been net-short the pair for most of the year.

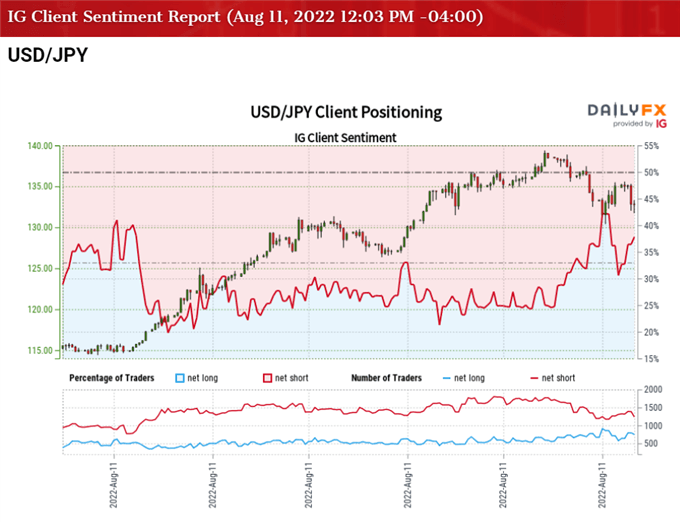

The IG Client Sentiment report shows 37.61% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 1.66 to 1.

The number of traders net-long is 4.54% higher than yesterday and 13.15% higher from last week, while the number of traders net-short is 9.53% higher than yesterday and 1.72% higher from last week. The rise in net-long interest has helped to alleviate the tilt in retail sentiment as 32.87% of traders were net-long USD/JPY earlier this week, while the rise in net-short position comes as the exchange rate initiates a series of lower highs and lows.

With that said, USD/JPY may attempt to test the monthly low (130.39) as it struggles to push back above the 50-Day SMA (135.24), and speculation for smaller Fed rate hikes may keep the exchange rate under pressure as the advance from the June low (128.60) unravels.

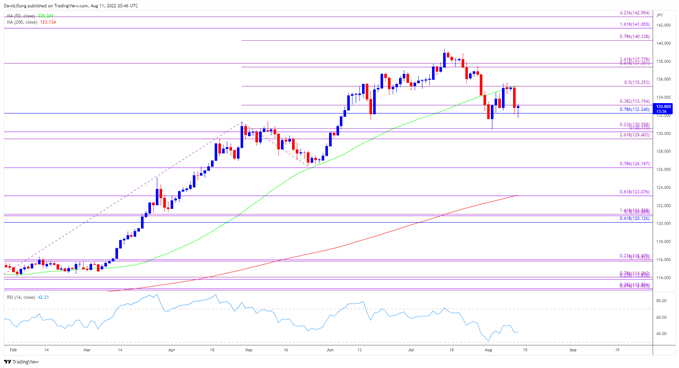

USD/JPY Rate Daily Chart

Source: Trading View

- USD/JPY may threaten the opening range August as it struggles to push back above the 50-Day SMA (135.24), with the failed attempts to close above 135.30 (50% expansion) pushing the exchange rate back towards the Fibonacci overlap around 132.20 (78.6% retracement) to 133.20 (38.2% expansion).

- The recent series of lower highs and lows may lead to a test of the 130.20 (100% expansion) to 130.60 (23.6% expansion) region, with a break of the monthly low (130.39) opening up the 129.40 (261.8% expansion) area.

- Nevertheless, failure to close below the overlap around 132.20 (78.6% retracement) to 133.20 (38.2% expansion) may keep USD/JPY within the monthly range, but need a close above 135.30 (50% expansion) to bring the topside levels back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.