[ad_1]

USD/JPY Price and Chart Analysis

- The Bank of Japan (BoJ) keeps buying bonds.

- USD/JPY faces a volatile week ahead.

The Bank of Japan bought in excess of USD115 billion of Japanese government bonds (JGBs) in June, a new record amount, as the central bank continues to hold borrowing costs at pre-determined lows. While central banks around the globe hike interest rates at a robust pace, the BoJ refuses to budge from its ultra-accommodative stance. The Japanese central bank recently said that the uncertainty surrounding Japan’s economy ‘is very high’ and that they remain vigilant to ‘financial and currency market moves’. This ongoing loose monetary policy has left the Japanese Yen adrift with a range of JPY pairs making record multi-year lows.

Japanese Yen Gyrates Against USD as BoJ Holds Steady on Ultra-Loose Policy

Next week is expected to be volatile for a range of USD pairs with a raft of high-importance data and events on tap. A combination of consumer confidence, the latest FOMC rate decision, the first look at Q2 growth, and the Fed’s favored inflation reading, Core PCE, will provide a range of trading opportunities in the week ahead.

For all market moving data releases and economic events see the real-time DailyFX Calendar.

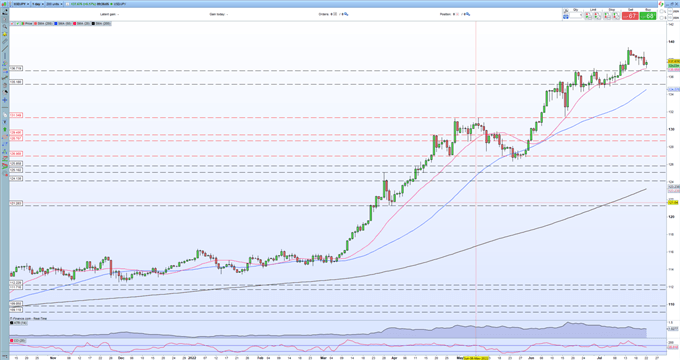

The technical outlook for USD/JPY remains mixed as the short-term sell-off nears a zone of support. USD/JPY slipped back to 137.00 earlier in the session, just above the 20-day simple moving average at 136.96, and currently sits mid-range at 137.65. Below the short-term moving average is a cluster of prior lows and highs all the way down to sub-135.00 and this cluster of trading activity will likely hold any attempt to push the pair lower. Any further rally in USD/JPY will find firm resistance at 140.00.

USD/JPY Daily Price Chart – July 22, 2022

Retail trader data show 30.30% of traders are net-long with the ratio of traders short to long at 2.30 to 1. The number of traders net-long is 12.14% lower than yesterday and 13.56% higher from last week, while the number of traders net-short is 1.72% lower than yesterday and 10.97% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.

What is your view on USD/JPY – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.