[ad_1]

Andrii Dodonov

We have covered iShares 1-3 Year Treasury Bond ETF (SHY) a few times now. SHY’s objective is to track the performance of an index composed of 1-3-year U.S. Treasury Bonds.

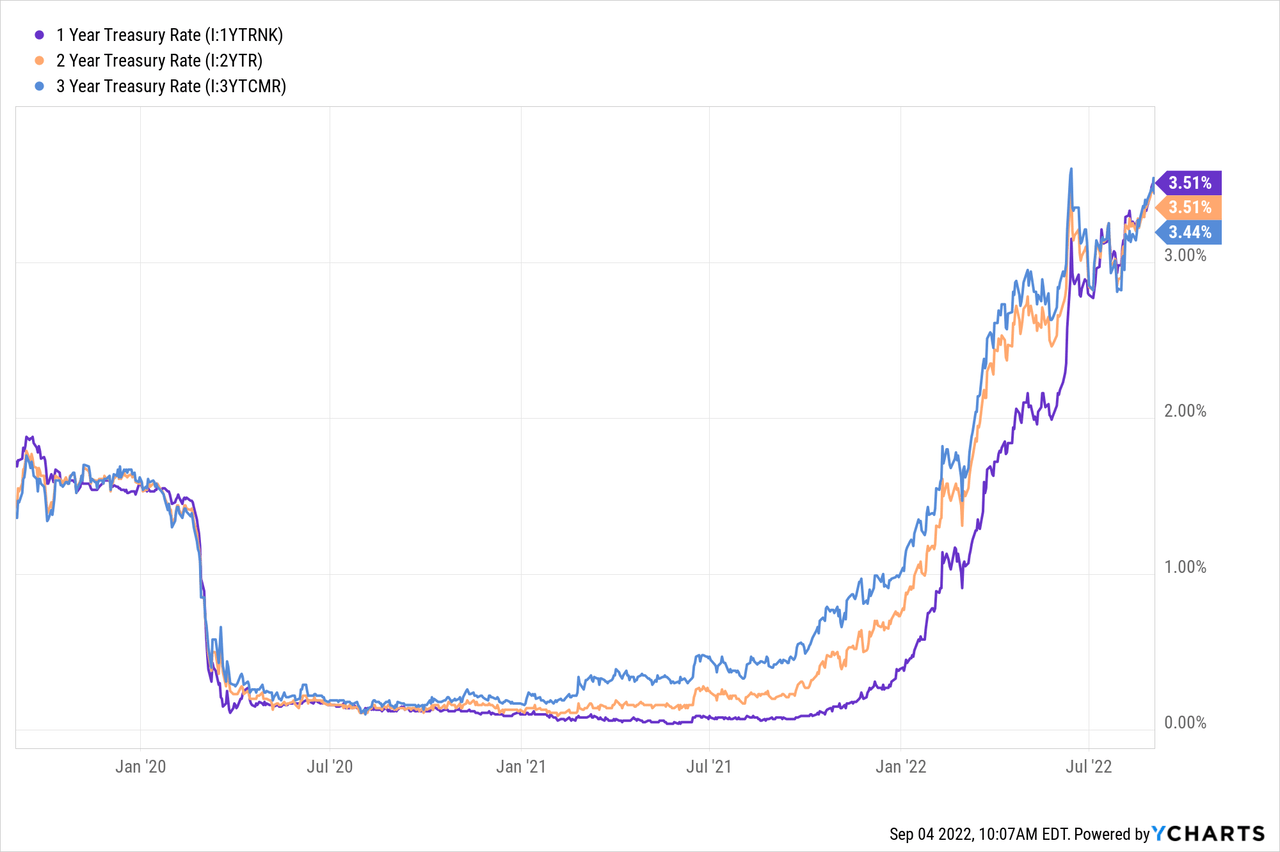

We started covering SHY in October 2020 and our sentiments during the course of our articles mirrored the yield of the underlyings of its benchmark index.

While we were never buyers of this fund, we saw light at the end of the tunnel with SHY getting attractive for parkers of cash. The conclusion from our most recent piece stated this:

SHY now pays you to park cash and fixed income in general is becoming more attractive. After having an extremely bearish stance on bonds for 2021, we are starting to see some better opportunities and recently bumped up fixed income to 2.5% of our portfolio. Keep in mind though, that we expect the Fed to unleash the most aggressive tightening if the S&P 500 stays elevated. SHY offers too little for parking cash but we still think it outperforms the broader equity indices from here. So it is now a legitimate investment, albeit with little reward.

Source: SHY: Cash Parking Becomes More Attractive

Seeking Alpha

When you are right, you are right, right?

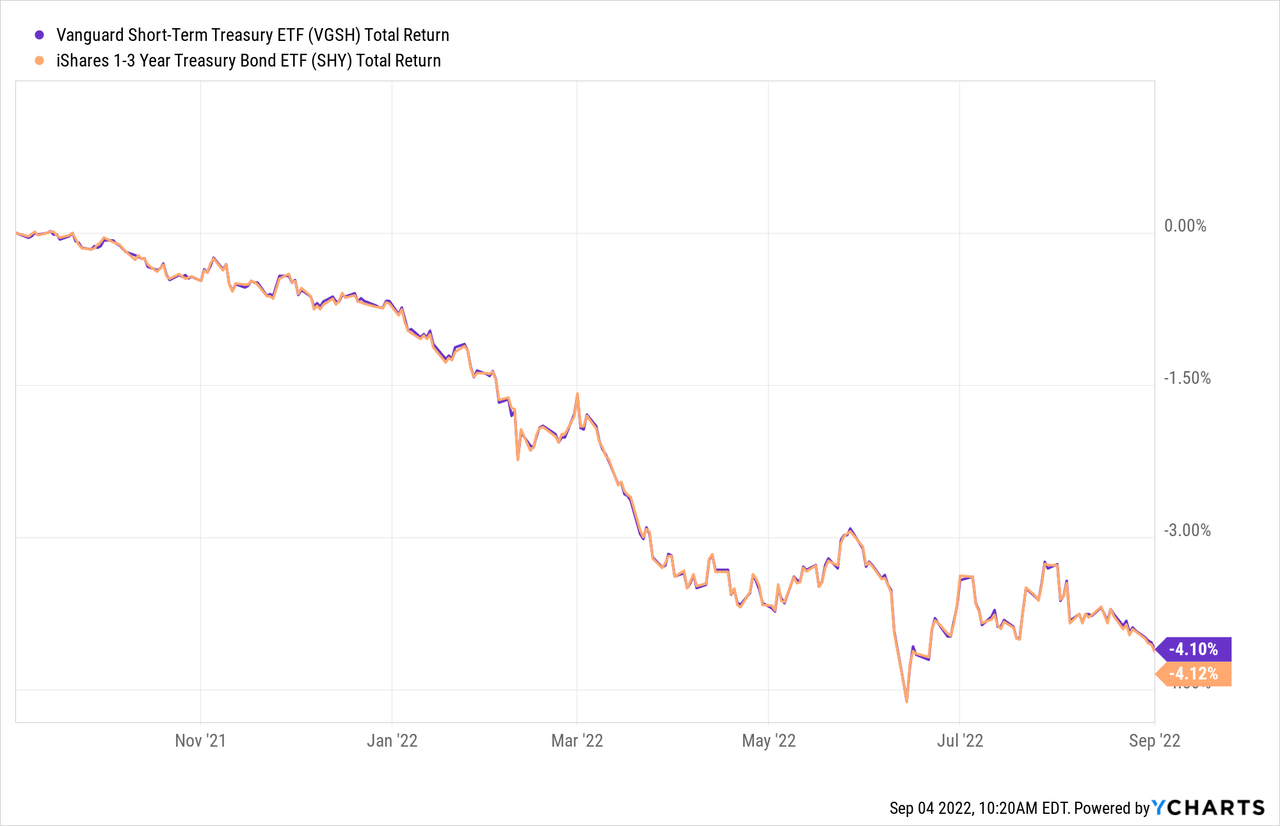

Today, instead of revisiting SHY the sixth time, we talk about Vanguard Short-Term Treasury ETF (NASDAQ:VGSH) that also invests in 1-3-year U.S. Treasury Bonds. Their prices move almost in lockstep as can be seen in the seemingly single legend chart below.

Current Allocations & Characteristics

VGSH, as per the Vanguard website, invests “primarily in high-quality (investment grade) U.S. Treasury Bonds”. We can only guess that the redundancy in the statement is used to drive home the high quality of the securities held in the ETF.

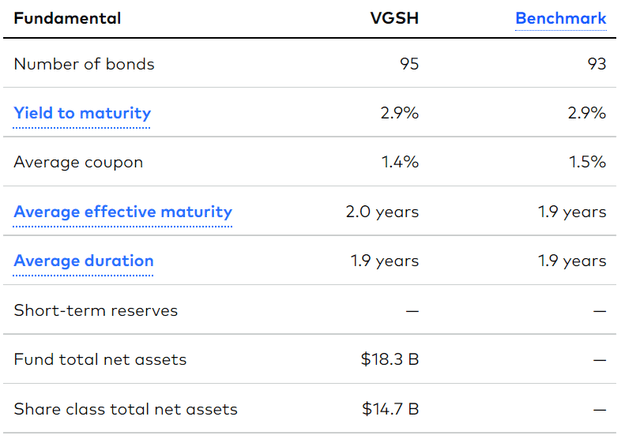

The ETF tracks its benchmark by investing at least 80% of its assets in bonds included in the index. The selection of the bonds is done via sampling and in aggregate the bonds chosen represent the whole index in terms of risk factors and characteristics. While majority of its holdings comply with the 1-3 year objective, about 2% of the portfolio is held 3-4 year bonds.

Vanguard – VGSH

As per the most current information on the fund website, it holds 95 bonds with a weighted average maturity of 2 years.

Vanguard – VGSH

The effective duration was almost the same at 1.9 years. With the yield to maturity (YTM) singing the hit song from Evanescence, the distributions to the investors have also been steadily increasing.

Vanguard – VGSH

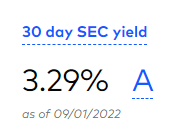

The current distribution based on the last payout is 1.24% ($0.7236 annual distribution x $58.57 current price). With the 1-3 year treasury bonds yielding over 3% (see first chart presented in this article), we expect the YTM to rise to meet that rate and with that so will the distributions to the ETF’s unitholders. Now, there is an underlying assumption regarding the yield to maturity coming to fruition, that is, that the bonds will be held to maturity. However, in this rising rate environment, it high turnover could only mean a higher resultant yield to maturity. Also, giving more credence to our rising YTM and distribution assertion is the 30 day SEC yield, which is already 3.29%.

Vanguard – VGSH

Finally, with a 0.04% expense ratio, we don’t see a material discrepancy between what the fund earns and what it will distribute.

Performance

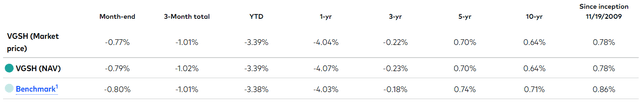

Although 0.04% is a negligible amount, it does impact the performance against the benchmark ETF. We can see that VGSH has more or less kept up with its benchmark, S&P Bloomberg US Treasury 1-3 Yr Index, with the lack of fees for the latter attributable to the ETF’s minor underperformance.

Vanguard – VGSH

Verdict

Funds like SHY and our protagonist are becoming more attractive today versus a year back because parking cash is actually beginning to pay thanks to Powell waking up from the 2 year long hibernation.

He has a fever and the only cure is more interest rate hikes.

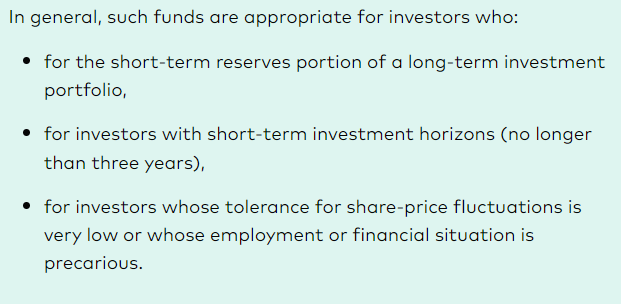

Our outlook for the next decade is that buy and hold will not work and those sticking to that method will be scratching their heads as to where they went wrong when this period is over. We continue to be nimble in this market and feed our income needs by selling lower risk cash secured puts and covered call options. However, these ETFs can work for some purposes. VGSH, very helpfully provides a profile for the type of investor suited for a conservative fund.

Vanguard – VGSH

We like to add a fourth criteria – investors that cannot see the value in our two favorite income strategies, cash secured puts and covered calls.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.