[ad_1]

CreativaImages

The Vanguard FTSE All-World ex-US Small-Cap ETF (NYSEARCA:VSS) shows what happens when you exclude US indices from your ETF – you get a really low multiple. Some of the portfolio is solidly allocated, but a fair bit is in cyclical exposures where the cycle is long in the tooth. Questions about foreign earnings remain, and the play becomes a speculation of how bad or long a recession might be. There isn’t too much emerging market risk at least, which removes a potential wildcard. Overall, this isn’t a convincing buy.

Breakdown of VSS

Let’s start with the positive elements, which is that the multiple really is very low. A 6x PE implies a great earnings yield of close to 20% which will easily outpace whatever reference rates become.

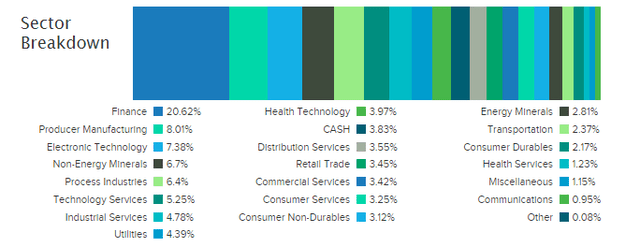

On top of this low multiple there are some sectoral exposures that are more likely to produce earnings growth than others that occupy allocations.

Financial companies often include, in the case of this small and mid cap ETF, insurance or regional banking companies that will both benefit from higher interest rates. This 20% allocation does some work in anchoring the average portfolio earnings.

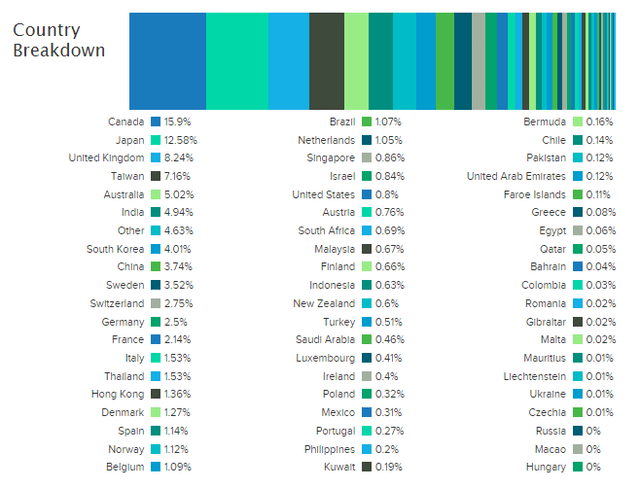

Moreover, the country exposures are not worrying. While being a global ETF, it is clear that allocation are concentrated towards developed markets.

That isn’t to say that emerging markets are trash. Plenty have commodity exposures that have supported their FX better than anyone would expect, even relative to the dollar. However, they are less predictable and we prefer avoiding them when possible.

The Problems

This is more or less where the positives end. Even among the developed market exposures, there are some prominent irritations. In the 13% Japan exposure you have the collapse of the Yen to contend with, which has eroded USD denominated earnings from these companies. Then there’s Taiwan, where you have some political risks associated with China and their plans for the island. Taiwan is 7% of the portfolio. China is also there at 4% and we don’t like that at all.

The bigger issue though are the sectoral exposures outside finance. Some of the top holdings include companies like West Fraser Timber (WFG), and other very cyclical industries whose PEs are extremely low, around 3-5x. This is because everyone sees the writing is on the wall: a recession is coming. How bad or long it will be would determine whether these companies are interesting to you or not. These cyclical exposures are the majority of the portfolio. They could be good investments if they’re averaging out at less than a 6x PE. We’ve spoken favorably in the past about the Canadian lumber exposures.

The yield is also not high on the portfolio at about 2%. Overall, we think this is a speculative portfolio due to the sectoral exposures. The mid-cap/small-cap or foreign exposures aren’t the problem with it, it’s just the cyclicality.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.