[ad_1]

Published on July 8th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned almost 13 million shares of Verisign Inc. (VRSN) for a market value of $2.9 billion. Verisign represents about 0.8% of Berkshire Hathaway’s investment portfolio. This marks it as the 16th largest position in the portfolio, out of 49 stocks.

This article will analyze the internet infrastructure company in greater detail.

Business Overview

VeriSign is a globally diversified provider of domain name registry services and Internet security software. The company operates in a single segment and has a significant international presence.

VeriSign released first quarter results for the period ending March 31st, 2022, on April 28th. Revenue grew 7.2% year-over-year to $347 million. Diluted earnings-per-share of $1.43 compared favorably to $1.33 in the prior year quarter. The company’s operating margin slipped slightly but was still an extremely strong 64.8%.

The company ended the quarter with $1.21 billion of cash, cash equivalents and marketable securities, up $4 million from the fourth quarter of 2021.

VeriSign repurchased 0.9 million shares for $196 million. Under the current share repurchase program, $893 million remains as of March 31st, 2022.

We estimate that VeriSign can generate $6.15 in earnings-per-share for the fiscal 2022 year.

Growth Prospects

Internet usage, which has been increasing at a tremendous rate, should continue to benefit VeriSign and its operations. The company will soon be increasing its registry-level wholesale fee for each .com domain name registration, which will pair well with their massive collection of domain name registrations.

While upcoming price hikes add to VeriSign’s total revenue, the company’s massive operating margin will see that much of this amounts to real bottom line growth. On the downside, we believe that the growth rate going forward will be lower than it has in the past, as much of the transition to the internet has already taken place.

VeriSign has actively repurchased shares in recent periods. In 2021, the company repurchased roughly $723 million worth of shares. This should add, over the long-term, to earnings per share.

We project that the company can continue to grow earnings by 8% annually through 2027.

Competitive Advantages & Recession Performance

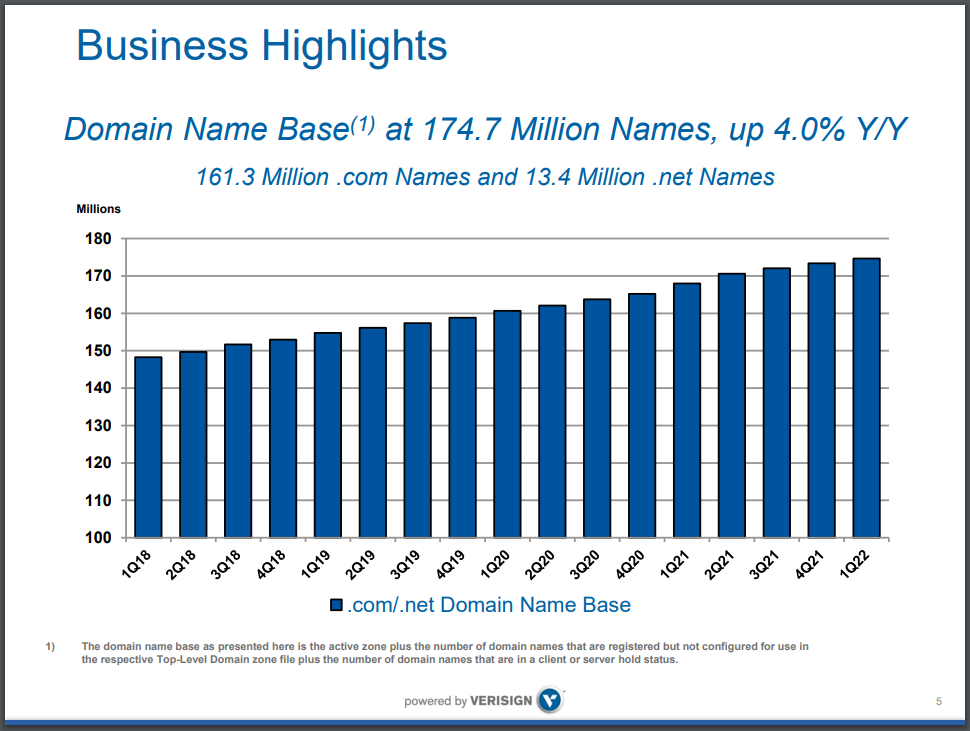

VeriSign’s major competitive advantage is their domain name registration base, which includes almost 175 million .com and .net domain name registrations. These domain name registrations are like subscriptions, which clients must pay for annually.

Source: Investor Presentation

Surprisingly, the company does possess some recession resiliency in that websites are extremely important today. Many businesses could not operate without a website of their own, so they must keep paying for their domain name registration, even in poor economic times. This reliance on the company’s product means that VeriSign benefits from a high renewal rate for domain name registrations.

VeriSign has no dividend for which it may be unable to pay. As a result, the company can continue to spend on reinvesting in the business and repurchase shares.

Valuation & Expected Returns

Shares of VeriSign have traded for a 5- and 10-year average price-to-earnings multiple of 32.0 and 27.3, respectively. Shares are now trading in between both of these averages, which indicates that shares could be near fair value at the current 29.0 times earnings. However, we prefer to remain conservative, and peg fair value at the lower range.

Our fair value estimate for VeriSign stock is 26.0 times earnings. If this proves correct, the stock will correct by a -2.2% annualized loss in its returns through 2027.

Shares of VeriSign currently do not pay a dividend, so investors must rely on earnings growth and valuation expansion for total returns. For exercise sake, if VeriSign did pay a dividend with a 20% target payout ratio in 2022 it would equal about $1.23, which would be good for a 0.7% yield.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 5.6% per year over the next five years. This makes VeriSign a hold.

Final Thoughts

VeriSign holds a strong position in the subscription-style business of domain name registrations. The service it provides is critical to the functioning of the web, and VeriSign is an important internet infrastructure company.

Earnings growth catalysts remain intact, but shares are trading above our estimated fair value at this time.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]

Image and article originally from www.suredividend.com. Read the original article here.