[ad_1]

Weekly Fundamental Gold Price Forecast: Neutral

- Gold prices had a relatively tame week despite sharp losses on Friday. More concerning is the renewed push higher by real yields in developed economies.

- The economic calendar is quiet at the start of the week, busiest on Wednesday, then tapers off again into the August US jobs report on Friday.

- The IG Client Sentiment Indexsuggests that gold prices in USD-terms (XAU/USD) have a bearish trading bias.

{{GUIDE|GOLD }}

Gold Prices Week in Review

Despite the Federal Reserve’s Economic Policy Symposium that sparked volatility across asset classes, gold prices had a relatively tame week overall. Gold in USD-terms (XAU/USD) fell by -0.74%, the worst performing gold-cross among the majors. Among the losers, gold in JPY-terms (XAU/JPY) dropped by -0.09%, while the worst performer was gold in AUD-terms (XAU/AUD), which sank by -0.75%. On the upside, gold in EUR-terms (XAU/EUR) led the way higher, notching a modest gain of +0.24%, followed by gold in GBP-terms (XAU/GBP), up by +0.17%.

But gold prices’ gains were curtailed on Friday after Fed Chair Jerome Powell made clear that rate hikes will continue to take place over the coming months – as did other central bankers at Jackson Hole. The immediate effect on Friday was a rise in sovereign bond yields (not limited to US Treasury yields) and a decline in inflation expectations across developed economies, curating a push higher in real yields globally. If real yields continue to climb, then gold prices will face more difficult trading conditions in the immediate future.

Economic Calendar Week Ahead

The final days of August and early days of September will feature a smattering of growth, inflation, and jobs data from Europe and North America. The calendar is relatively quiet at the beginning of the weak, most dense on Wednesday, and then tapers off again into the end of the week.

- On Tuesday, gold in EUR-terms (XAU/EUR) will be in focus when the preliminary August German inflation report (HICP) is released at 12 GMT. Gold in USD-terms (XAU/USD) will be in the spotlight at 14 GMT, when the August US Conference Board consumer confidence reading is due.

- On Wednesday, gold in CNH-terms (XAU/CNH) should prove volatile when the August China NBA manufacturing PMI is published at 1:30 GMT. Gold in EUR-terms is back in focus when the preliminary August French inflation report (HICP) comes out at 6:45 GMT, followed by the August German unemployment change and unemployment rate at 7:55 GMT, then preliminary August Italian inflation report (HICP) and the flash August Eurozone inflation report (HICP) at 9 GMT. Gold in CAD-terms (XAU/CAD) will garner attention at 12:30 GMT, when the 2Q’22 Canada GDP report is released.

- On Thursday, September 1, gold in EUR-terms is back in focus when the final 2Q’22 Italian GDP report is due at 9 GMT. Gold in USD-terms is back in the spotlight at 14 GMT with the release of the August US ISM manufacturing PMI report.

- On Friday, September 2, gold in USD-terms is back in focus for the final time, with the release of the August US nonfarm payrolls report and unemployment rate scheduled for release at 12:30 GMT.

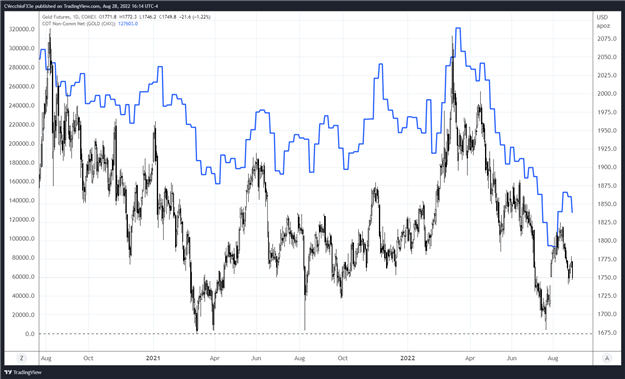

GOLD PRICE VERSUS COT NET NON-COMMERCIAL POSITIONING: DAILY TIMEFRAME (August 2020 to August 2022) (CHART 1)

Next, a look at positioning in the futures market. According to the CFTC’s COT data, for the week ended August 30, speculators decreased their net-long gold futures positions to 127,603 contracts, down from the 144,036 net-long contracts held in the week prior. The futures market is now the least net-long over the past month.

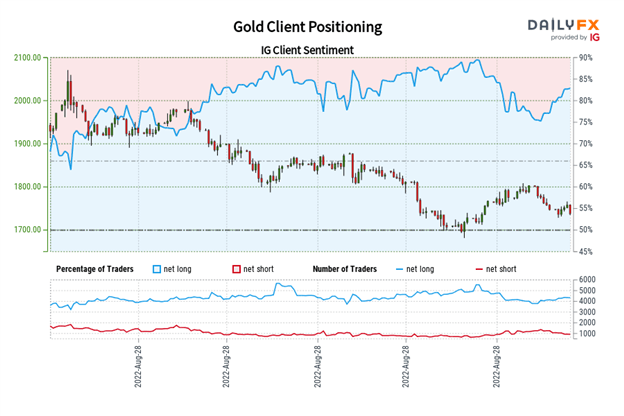

IG CLIENT SENTIMENT INDEX: GOLD PRICE FORECAST (August 26, 2022) (CHART 2)

Gold: Retail trader data shows 84.82% of traders are net-long with the ratio of traders long to short at 5.59 to 1. The number of traders net-long is 0.60% lower than yesterday and 4.84% higher from last week, while the number of traders net-short is 17.45% lower than yesterday and 32.90% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.