[ad_1]

Advisors are expecting more from the wholesalers they work with. Their time is as valuable as ever—rattling off facts about their best funds, dropping off a fact sheet, and then hitting the golf course isn’t cutting it anymore. They’re looking for an expert who’s knowledgeable about their firm’s products as well as the market environment to better inform their investment strategy and decision-making.

To better understand the evolving dynamic between advisors and wholesalers, YCharts surveyed both groups to identify: How can wholesalers make the biggest impact on an advisor’s day-to-day? Do wholesalers actually provide value the way advisors expect? And what does the ideal wholesaler-advisor relationship look like?

How Important is Today’s Wholesaler?

It should come as no surprise that wholesalers believe they play a significant role in an advisor’s success. In stark contrast, over 50% of advisors surveyed do NOT think wholesalers play an important role in their success.

Download: What Do Advisors Look For In Their Wholesalers?

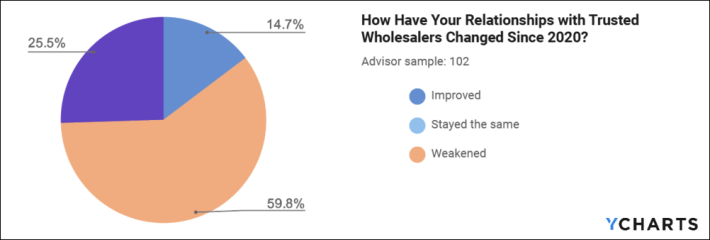

Additionally, 1 in 4 advisors believe the relationship with their trusted wholesalers has actually weakened since 2020. While the impact of the COVID-19 pandemic most likely played a factor in this, wholesalers have some ground to make up for in proving their worth.

Download: What Do Advisors Look For In Their Wholesalers?

What’s Important to Them is Important to You

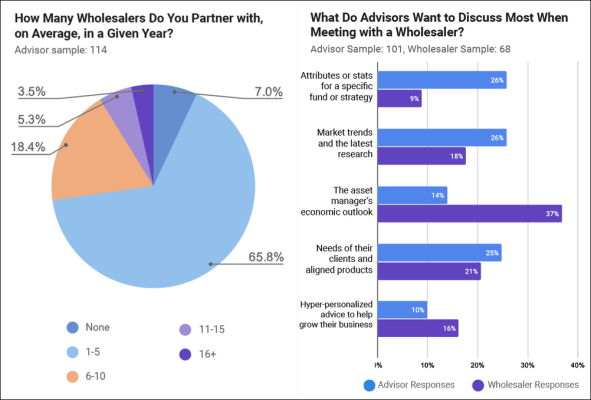

Every wholesaler understands the struggle of scheduling time to meet with busy advisors. And with so many wholesalers in the arena vying for limited time, competition is fierce. To make matters worse, over 65% of advisors surveyed noted that they only meet with 1-5 wholesalers each year. “Time is money” as they say, and advisors have expressed a strong preference for quality over quantity. So how do you make that time count?

Download: What Do Advisors Look For In Their Wholesalers?

For starters, make sure to understand the advisor’s expectations from the meeting. Of the advisors surveyed, the 3 topics they are most interested in are:

- Learning about the latest market trends and industry research

- An asset manager’s family of funds and associated attributes

- Working with a wholesaler that will help address the needs of their clients.

With that in mind, take some time to understand the needs of your advisor’s clients and tailor the conversation accordingly.

By knowing which fund categories are well-suited to prevailing conditions and an advisor and their clients’ needs, advisor meetings can be productive and rich with value—not sales pitches.

This article was originally published on YCharts.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.