[ad_1]

I have held Algonquin Power & Utilitties Corp for almost 2 years now. As it was going down, I was adding but I stopped adding to it after a few times.

Today, the market landscape is different. It’s not about what I think of AQN anymore but how it compares to all the other stocks impacted by the economic situation we are in.

I ran some numbers, and across all 262 dividend stocks tracked with the Canadian Dividend Snapshot Screener, 58% of them are near the 52-week lows.

That’s why my portfolio is down and why most investors have a lower portfolio than last year. However, being down is not a reason to take action.

I have money invested, I need to ask if there is a better option. It’s just that simple. AQN is not the only stock I review but for today, it’s about assessing if I can have a better holding than AQN.

Why BNS over AQN?

I have resisted adding more banks for a long time but I can’t ignore the current situation. It is reminescent of 2009.

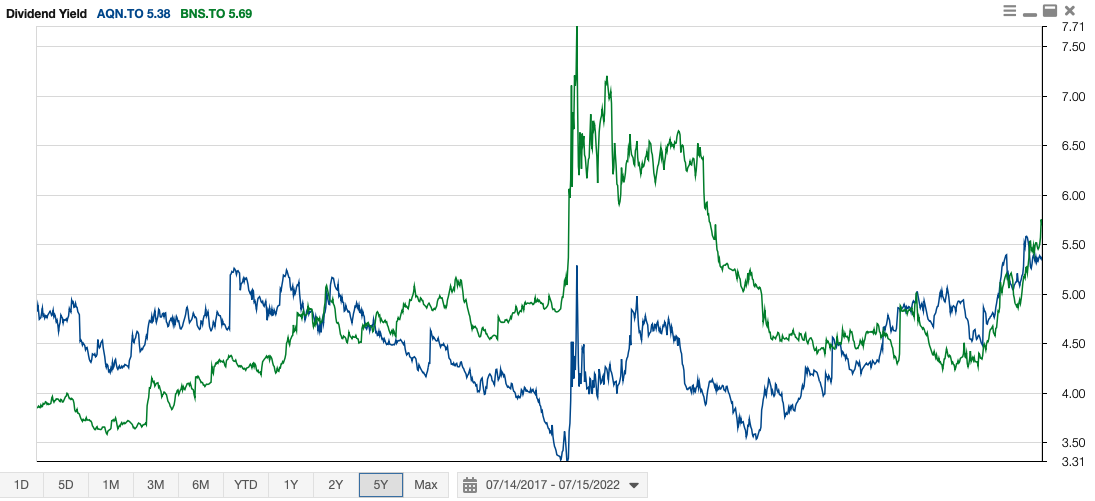

The current Scotia Bank yield and low PE is what makes BNS more attractive than AQN. Both have a similar dividend yield as of today. In my book, BNS is a less risky holding today than AQN overall and I increase my income by a little.

| AQN | BNS | |

|---|---|---|

| Dividend Yield | 5.42% | 5.69% |

| 10 -Year Dividend Growth | 8.99% | 5.79% |

| Dividend Payout Ratio | 133.38% | 45.72% |

| PE | 26.26 | 8.77 |

| 52-Week Ratio | 17.44% | 5.09% |

Should I Add More Banks?

Do I not have enough Canadian bank stocks? I have 14% in the Canadian banks and I am going to add another 2.8% for a total of 16.8% in the banks.

Am I CRAZY?

Depending on how you approach your portfolio, you may have a limit of 10% in a sector or 2% in a stock, but I don’t. I don’t follow hard lines anymore.

Having hard line usually protects you downward but limits you upward. Been there, and unfortunately left money on the table with my winners like Apple and Microsoft.

What about DIVERSIFICATION?

Is Warren Buffett diversified? How do you establish what diversification is? What is good enough? and what isn’t enough?

It’s all about your confidence. Your confidence in keeping your emotions in check, and in knowing the companies you hold in your portfolio (knowing the businesses and their revenue streams, not the financials).

As you know, I do track my diversification as you can see below but there aren’t any religious numbers. Let’s be honest, Canada doesn’t offer much to diversify a portfolio …

Sector diversification; while often used in diversification topics, the simplification of using serctor is flawed. So many tech companies are now part of the Communication Services sector for example. The reclassification did not change what the companies did … it just made the indexes work better.

Is VISA a technology company? or a financial company? VISA doesn’t take a single risk with lending, it just provides a technology service to financial institutions and takes a cut out of every transactions.

True technical diversification can only be accomplished through index ETFs. Aside from that, diversification is how you perceive it.

Do you have cash? bonds? or just stocks? Is that diversified if you don’t have cash or bonds? Don’t answer that.

You see, diversification is what you make of it in order to feel confident about your strategy.

In fact, 90% of my portfolio is in 17 stocks.

Why Not Add To An Existing Bank?

I don’t have a problem adding to my existing holdings but in this case, the account in question is a non-registered account and I want to increase the yield by selecting BNS instead of lowering my yield from AQN to RY for example.

This begs the question about selling my other banks and buying more BNS? Why not?

I do believe Royal Bank, TD Bank and National Bank are better banks. I believe they are the top 3 Canadian banks from a business perspective.

It doesn’t mean the other ones are bad, it just means that for a total return, I see the ones I hold as having more potential. I also see Canadian banks as the bedrock of my portfolio and would rather not change those.

Final Decision

While I have a lot of banks, today’s economic situation is slightly different, and I have to take advantage of the opportunity to optimize my holdings.

My non-registered account is not a dividend growth account. I want a yield above 5% if I can with a dividend growth over 5% to keep up with inflation.

Does the trading cost matter? No. The dividend will cover that very quickly.

[ad_2]

Image and article originally from dividendearner.com. Read the original article here.