[ad_1]

Chinese regulators are starting to ease policies that once crushed China stocks

Schaeffer’s Investment Research was built from scratch on Bernie Schaeffer’s vision of providing accessible professional-grade trading information to retail traders. This remains our mission today, 41 years later. To access the entirety of the Schaeffer’s 41st Anniversary Stock Picks report, click here.

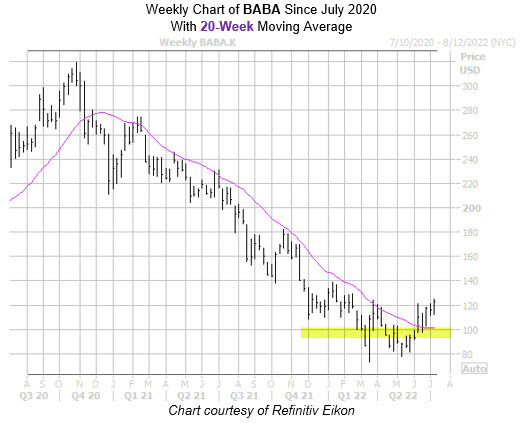

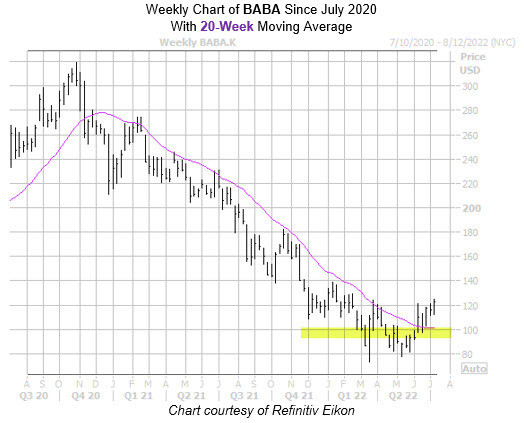

Chinese e-commerce stock Alibaba Group Holding Ltd (NYSE:BABA) is breaking above its year-to-date anchored volume-weighted average price (VWAP). BABA recently reclaimed and held the psychologically-significant $100 area, and is forming a bottom rounding pattern back above the round $300 billion market cap level.

BABA shares have support in place at their newly-toppled 20-week moving average, a trendline that Alibaba stock followed and failed at the whole way down since February 2021. In terms of macro tailwinds, Chinese regulators are starting to ease policies that once crushed China stocks. Meanwhile, there’s potential for ANTIPO’s revival, as the company is still in the process of obtaining a key license for its initial public offering (IPO) to be able to sell shares to the public, and a greenlight on that would be bullish for Alibaba stock.

Despite calls outnumbering puts on an absolute basis, BABA’s 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks one percentage point from an annual high. In other words, this suggests BABA puts are being picked up at a much faster-than-usual rate over the last two months.

For those looking to weigh in, options look like a solid move at the moment. According to BABA’s Schaeffer’s Volatility Scorecard (SVS) tally of 95 out of 100, Alibaba stock has consistently realized bigger returns than options traders have priced in over the last 12 months.

Matthew Timpane, CMT, is a senior market strategist at Schaeffer’s Investment Research. With over a decade of experience in investing, he has a knack for finding unique opportunistic risk vs. reward propositions. His areas of expertise include managing multi-strategy portfolios, trend-following, inter-market analysis, and trade execution efficiency. He has helped tens of thousands of traders navigate the world of options trading through live events such as Benzinga Boot Camps, MoneyShow events, and a number of popular trading podcasts. Mr. Timpane earned his B.S. in business from the University of Wisconsin.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.