[ad_1]

Big Pharma will close out this week’s earnings reports, with Gilead Sciences GILD set to give its Q3 results on October 27. The biopharmaceutical giant has held up well this year compared to the broader market with GILD only 5% from its highs.

With Gilead Sciences edging towards its 52-week highs, investors will want to see if earnings can support a continued rally in its stock.

Image Source: Zacks Investment Research

GILD Overview

Gilead Sciences’ revenue is derived from its treatments in human immunodeficiency virus (HIV), liver diseases, hematology/oncology diseases, and inflammation/respiratory diseases. GILD’s portfolio also includes drugs for Hepatitis C.

Last quarter, revenue increased 1% from Q2 2021 to $6.3 billion. This was highlighted by a 71% year over year increase in oncology sales at $527 million. The company also saw strong demand in its HIV portfolio with its Biktarvy sales up 28% year over year to $2.6 billion.

Investors will hope that Gilead Sciences HIV expansion can continue to grow along with its oncology and liver disease treatments. While current inflationary environments could scale back volume, consumers will usually spare no expense on essential medicines even during a market downturn.

Q3 Outlook

The Zacks Consensus Estimate for GILD’s Q3 earnings is $1.44 per share, which would represent a decline of – 45% from Q3 2021. Sales for Q3 are expected to be down -17% at $6.12 billion. Estimates for the period have gone down from $1.54 per share at the beginning of the quarter.

Year over year, GILD earnings are expected to decline -10% in 2022 and virtually be flat in FY23 at $6.51 per share. Top line growth is expected to decline, with sales down -7% this year and another -3% in FY23 to $24.52 billion.

However, GILD shares have rallied nicely going into the quarterly release as Q4 and FY23 earnings estimate revisions are starting to rise.

Performance & Valuation

Year to date GILD is only down -3% to outperform the S&P 500’s -20%. This has also outperformed its peer group’s -41% and the Medical-Biomedical/Genetic Market’s -24%. Even better, GILD’s total return is +1% YTD when adding in its strong dividend.

Image Source: Zacks Investment Research

Gilead Sciences has been a pioneer and industry leader. Over the last decade GILD’s total return is +171%. While this underperformed the benchmark, it has blasted its peer group’s +93% and its Zacks Subindustry’s +37%.

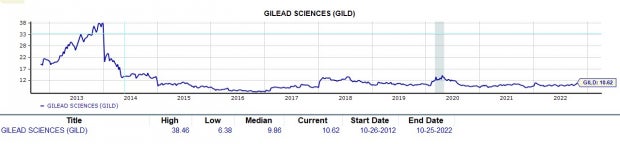

Trading around $70 per share, GILD has a P/E of 10.6X. This is lower than the industry average of 20.1X, which includes some noteworthy companies such as Amgen AMGN and Moderna MRNA. Plus, GILD still trades at a discount to its decade-high of 38.4X and is close to the median of 9.8X.

Image Source: Zacks Investment Research

Bottom Line

Going into Q3 earnings GILD lands a Zacks Rank #3 (Hold) and its Medical-Biomedical and Genetics Industry is in the top 23% of over 250 Zacks Industries. GILD also offers longer-term investors a solid 4.20% annual dividend yield at $2.92 per share. And the Average Zacks Price Target still suggests 4% upside from current levels.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Moderna, Inc. (MRNA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.