[ad_1]

Quite a few financial services companies are appearing to trade at discounts. These stocks are looking like ideal candidates for a potential end-of-year Santa Clause rally.

Two stocks that come to mind are American Express AXP and Capital One Financial COF, with both still well off their 52-week highs. Let’s see if it’s time to buy these two lending and banking giants’ stocks going into 2023.

American Express (AXP)

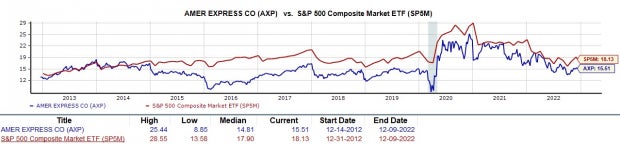

Starting with financial services giant American Express, AXP is only down -4% YTD Vs. The S&P 500’s -19%. This has outperformed the Financial-Miscellaneous Services -22% drop. Even better, over the last five years, AXP’s total return is +72% to beat the benchmark and crush its Zacks Subindustry’s -19%.

Image Source: Zacks Investment Research

American Express is focused on credit payment card products along with travel-related services with sales projected to climb 25% in 2022 at $52.92 billion. Fiscal 2023 sales are expected to jump another 12%.

On the bottom line, earnings are expected to decline -1% in Fiscal 2022 at $9.91 per share. This is a clear indication that operating costs have been challenging for American Express this year. However, earnings estimate revisions are slightly up from $9.87 a share 90 days ago. FY23 earnings are forecasted to jump 10% but earnings estimates have trended down over the last quarter.

AXP is still 21% off its 52-week highs trading around $157 a share. At current levels, American Express stock trades at 15.5X forward earnings. This is higher than the industry average of 10.2X but American Express has been a clear industry leader. Plus, AXP trades nicely below its decade high of 25.4X and closer to the median of 14.8X.

Image Source: Zacks Investment Research

AXP currently lands a Zacks Rank #3 (Hold) and offers a modest 1.35% dividend yield at $2.08 per share. The average Zacks Price Target also suggests 7% upside from current levels.

Capital One Financial (COF)

Also landing a Zacks Rank #3 (Hold) is Capital One Financial (COF). Capital One has evolved into a consumer and commercial lending giant along with deposit origination and banking services.

Sales are forecasted to jump 12% in 2022 and rise another 7% in FY23 to $36.49 billion. However, on the bottom line earnings are expected to drop -30% this year at $18.78 per share. FY23 earnings are projected to decline another -15% to $16.01 a share. It is important to note that earnings estimates have also trended down for FY22 and FY23.

Still, Capital One’s valuation is starting to make its stock look poised for an extended rally. Trading 40% off its 52-week highs at around $97 a share COF trades at just 5X forward earnings. This is slightly below the industry average of 6.6X and 85% below its decade-high of 34.7X. Even better, COF trades at a 47% discount to its decade median of 9.5X.

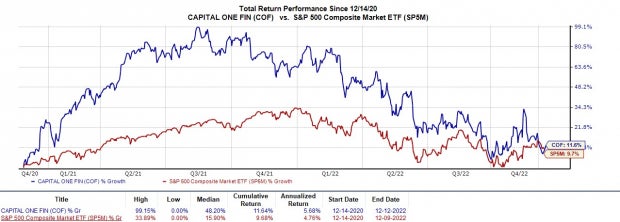

Image Source: Zacks Investment Research

Challenges in Capital One’s bottom line are starting to look priced into the stock at current levels.

Capital One stock is down -33% year to date to underperform the S&P 500. COF’s YTD decline has been on par with its peer group which includes notable companies such as Discover Financial Services DFS and Ally Financial ALLY. However, Over the last two years, Capital One’s total return is +11% to outperform the benchmark and its peers -20%.

Image Source: Zacks Investment Research

Capital One’s top-line growth is more impressive than Discover Financial and Ally Financial in addition to its low valuation making the stock stand out among these equities.

With COF trading very reasonably relative to its past, the stock certainly looks like a candidate for an end-of-year rally after this year’s large drop. Capital One offers investors a generous 2.54% annual dividend yield at $2.40 a share. Even better, the average Zacks Price target suggests 35% upside from current levels.

Bottom Line

American Express and Capital One stocks are starting to look intriguing heading into 2023. Both stocks could be poised for a rebound at some point and their valuations seem to support this from a price-to-earnings perspective.

Although there may be more short-term weakness ahead and possibly better buying opportunities it may be worth holding these stocks in the portfolio. Both AXP and COF offer solid dividends to support patient investors and have promising top-line growth despite the tougher operating environment weighing on their bottom lines at the moment.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Capital One Financial Corporation (COF) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.