[ad_1]

- BOJ Unlikely to Intervene any Further in FX Markets Unless Yen Volatility Returns.

- 145.00 Resistance Remains the Key.

- A Host of Fed Policymakers Scheduled to Speak Today.

Recommended by Zain Vawda

How to Trade USD/JPY

USD/JPY Fundamental Backdrop

USD/JPY continued its rally higher on what proved to be an interesting Monday for markets as a whole. The US dollar was firmer across the board as the dollar index printed fresh highs around the 114.50 area. The Yen has thus surrendered around 75% of the gains achieved on the back of the Bank of Japan’s (BoJ) FX intervention last week, with the pair reaching a high of 144.810.

US Dollar Index D Chart- September 27, 2022

Source: TradingView

As we enter Q4 we have seen the Bank of Japan (BoJ) remain an outlier in the global tightening race while the US Federal Reserve has continued to stick by its hawkish rhetoric. The Fed expects to continue raising rates with a year-end target of 4.5-4.75% as per the forward guidance from last weeks meeting. Yesterday brought comments from Fed policymaker Loretta Mester who reiterated the need for higher rates to keep inflation in check, while fellow policymaker Charles Evans confirmed earlier today that inflation is job number one for the Fed with a tougher rate environment to persist for a while. Later in the day we have Fed Chair Jerome Powell speaking followed by policymakers James Bullard and Neil Kashkari with rhetoric expected to remain unchanged.

For all market-moving economic releases and events, see the DailyFX Calendar

Bank of Japan and Potential for Further Intervention

Bank of Japan (BoJ) Governor Haruhiko Kuroda in his forward guidance following last week’s meeting stated that there will be no change in forward guidance for two to three years. This saw a spike in volatility in the Yen which resulted in the Finance Minister’s decision to intervene in the FX markets for the first time in 24 years. Despite this both Governor Kuroda and Finance Minister Shunichi Suzuki have reiterated that they are not looking to defend price levels but deal with heightened volatility and excessive moves. As long as the Yen weakens at a gradual pace without spikes in volatility the chance of further intervention remains slim.

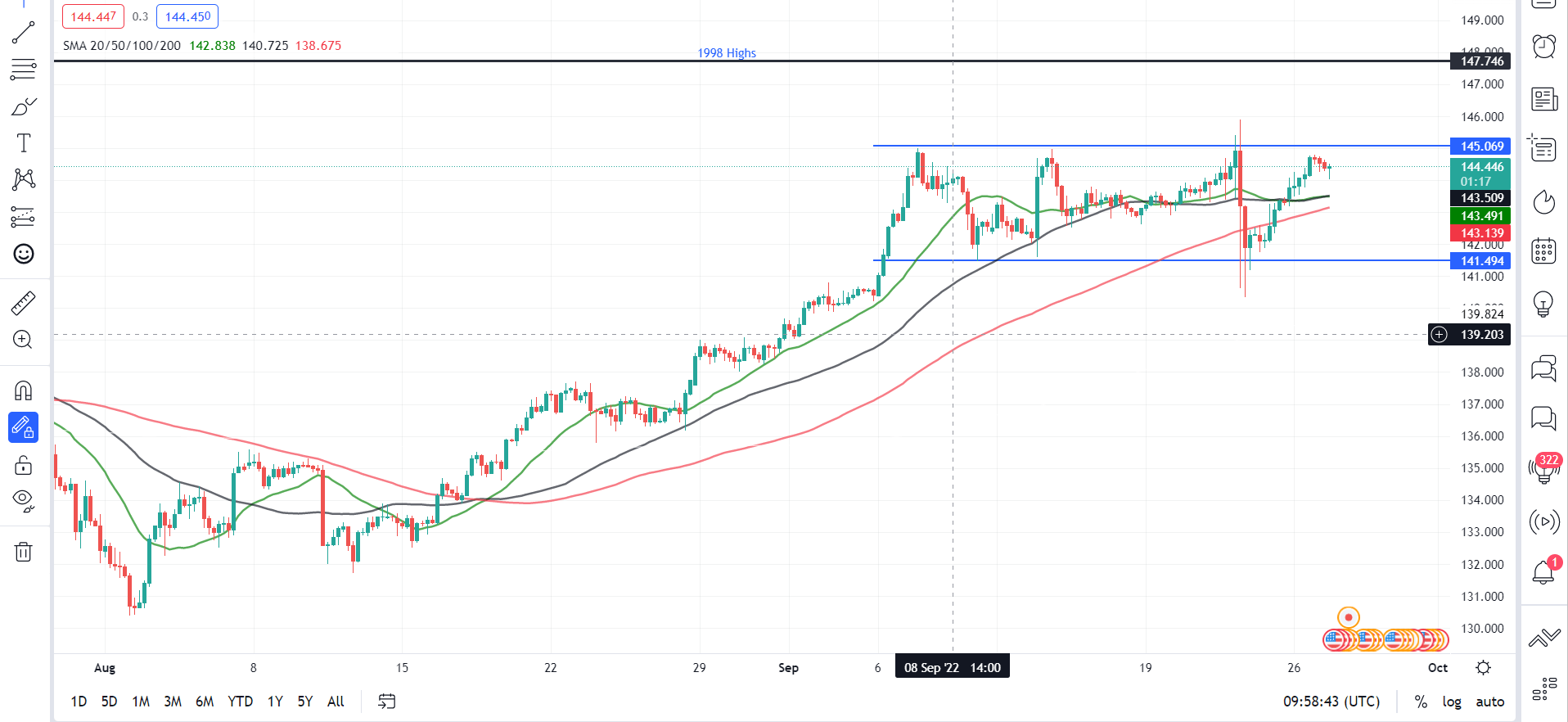

USD/JPY Four-Hour Chart – September 27, 2022

Source: TradingView

From a technical perspective, we have had two days of bullish price action with yesterday’s daily candle closing as a marubozu candlestick, an indication that further upside may be ahead. We continue to trade within the range from 141.50 to the 145.00 area, with a four-hour candle close above 145.00 needed if we are to push on. We currently trade above the 20, 50 and 100-SMA which should provide support should we see a slight pullback in price. A bullish move above the 145.00 level should see us test 1998 highs at 147.75 or push toward the key psychological 150.00 level.

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

Key intraday levels that are worth watching:

Support Areas

•143.50

•142.60

•141.50

Resistance Areas

•145.00

•147.75

| Change in | Longs | Shorts | OI |

| Daily | -6% | 9% | 5% |

| Weekly | -26% | -1% | -8% |

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.