[ad_1]

RAND TALKING POINTS

- Stronger USD and slump in commodities weighs on ZAR.

- Rand indifferent after South African manufacturing PMI beat.

- USD/ZAR bulls now eye 2022 highs.

USD/ZAR FUNDAMENTAL BACKDROP

The South African rand is suffering at the hands of declining global risk sentiment on the back of a hawkish Federal Reserve. Yesterday we saw the Fed’s Loretta Mester render an aggressive message stating that she does not foresee interest rates cuts next year as well as rates above the 4% level. The headwinds for the ZAR are stacking up with the Chinese Caixin manufacturing PMI print back in contractionary territory. COVID-19 woes have also reemerged in China heightening the demand destruction narrative that is plaguing risk sensitive and commodity-linked currencies like the rand. These concerns have filtered through to the broader commodity complex leaving the rand vulnerable to further downside risk.

Continuing on the PMI results, South African manufacturing PMI pushed back into the expansionary region giving the rand a slight boost post-release. Overall, my bias is skewed towards the dollar considering recessionary fears and investors preference for safety. Tomorrow’s Non-Farm Payroll (NFP) data should be a great gauge for the U.S. economy and will carry more weight considering the Fed’s increased dependance on data. Later today, new vehicle sales is scheduled but is likely to have minimal impact on the rand as external global factors take precedence.

USD/ZAR ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

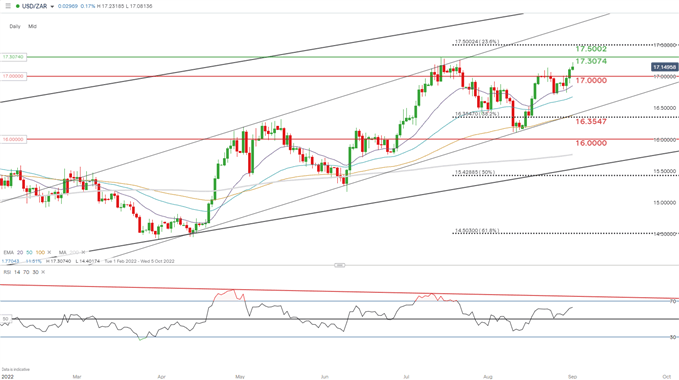

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

On the technical side, price action on the USD/ZAR daily chart shows the recent surge clearing the recent swing highs, now bulls focus on the July swing high at 17.3074. Further upside is supported by trendline resistance shown by the Relative Strength Index (RSI) (red).

Resistance levels:

- 17.5002 (23.6% Fibonacci)

- 17.3074 – July 2022 swing high

Support levels:

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.