[ad_1]

– Reviewed by Nick Cawley, July 29, 2022

The video above focuses on the main aspects of the trading checklist and this article seeks to unpack further aspects of the trading checklist in greater detail.

Why You Should Use a Trading Checklist

Implementing a trading checklist is a vital part of the trading process because it helps traders to stay disciplined, stick to the trading plan, and builds confidence. Maintaining a trading checklist presents traders with a list of questions that traders need to answer before executing trades.

It is important not to confuse a trading plan with the trading checklist. The trading plan deals with the big picture, for example, the market you are trading and the analytical approach you choose to follow. The trading checklist focuses on each individual trade and the conditions that must be met before the trade can be made.

Your Trading Checklist

Before entering a trade, ask yourself the following questions:

- Is the market trending or ranging?

- Is there a significant level of support or resistance nearby?

- Is the trade confirmed by an indicator?

- What is the risk to reward ratio?

- How much capital am I risking?

- Are there any significant economic releases that can impact the trade?

- Am I following the trading plan?

1) Is the Market Trending or Ranging?

Trending markets

Experienced traders know that finding a strong trend and trading in the trend’s direction, has the potential to lead to higher probability trades.

There is a well-known saying that trending markets have the ability to bail traders out of bad entries. As can be seen below, even if a trader entered a short trade after the trend was well established, the trend would continue to provide more pips to the downside than to the upside.

Traders need to ask themselves if the market is exhibiting signs of a strong trend and whether ‘trend trading’ forms part of the trading plan.

Ranging markets

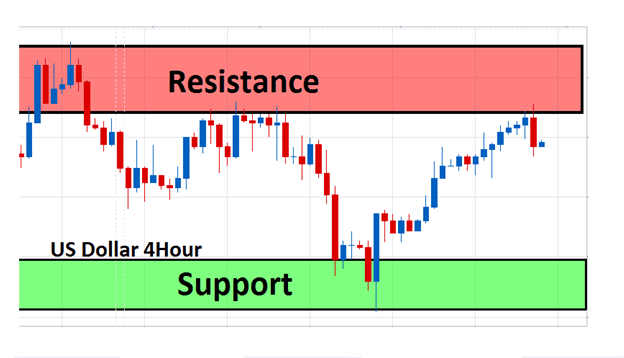

Ranging markets tend to see price bounce between support and resistance to trade within a channel. Certain markets, like the Asian trading session, tend to trade in ranges. Oscillating indicators (RSI, CCI and Stochastic) can be of great use to traders that focus on range trading.

2) Is there a significant level of support or resistance nearby?

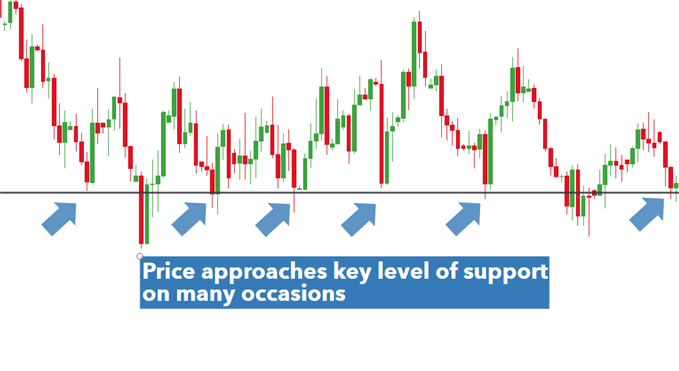

Price action tends to respect certain price levels for a number of reasons and being able to identify these levels is key. Traders do not want to be holding a short position after price has dropped to the key level of support, only to bounce back higher.

The same applies when price approaches a key level of resistance and typically drops lower shortly after. Trend traders typically look for sustained breaks of these levels as an indication that the market may start to trend. Range traders will on the other hand, look for price to bounce between support and resistance for prolonged periods.

3) Is the trade confirmed by an indicator?

Indicators assist traders in confirming high probability trades. Depending on the trading plan and strategy, traders will have one or two indicators that complement the trading strategy. Do not fall into the trap of over-complicating the analysis by adding multiple indicators to a single chart. Keep the analysis clean and simple and easy to view at a glance.

4) What is the risk to reward ratio?

The risk to reward ratio is the ratio of the number of pips that traders will risk in the hopes of reaching the target. According to our Traits of Successful Traders research, which analysed over 30 million live trades, traders with a positive risk to reward ratio were nearly three times more likely to be profitable than those who do not. For example, a 1:2 ratio means that a trader risks half of what he/she stands to gain if the trade works out. The image below further depicts this principle.

5) How much capital am I risking?

It is essential for traders to ask this question. Often traders blow up their accounts by leveraging the account to the maximum when chasing “sure things”. One way to avoid this is to limit the leverage used on all trades to ten to one, or less. Another helpful tip is to set stops on all trades and ensure that the aggregate amount risked is no more then 5% of the account balance.

Before placing a trade, ask yourself, “how much capital should I use?”

6) Are there any significant economic releases that can impact the trade?

Sudden market news has the potential to invalidate the “perfect” trade. While it is almost impossible to anticipate things like, acts of terror, natural disasters or systemic failures in the financial markets, traders can plan for economic releases like NFP, CPI, PMI and GDP releases.

Plan ahead by viewing our economic calendar which highlights major economic releases from the top trading nations

7) Am I following the trading plan?

All of the above is of very little use if it does not tie in with the trading plan. Deviating from the trading plan will result in mixed results and only frustrate the trading process. Keep to the trading plan and do not place trades unless the trading checklist has been completed and confirms the trade may be executed.

Trading Checklists: A Summary

- Having a trading checklist does not automatically mean all trades will become winning trades. It will however help traders to stick to the trading plan, trade with more consistency, and avoid impulsive or reckless trades.

- At DailyFX we have dedicated a podcast to the trading plan and how to create one.

- Document your trades and stay accountable with the help of a trading journal.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.