[ad_1]

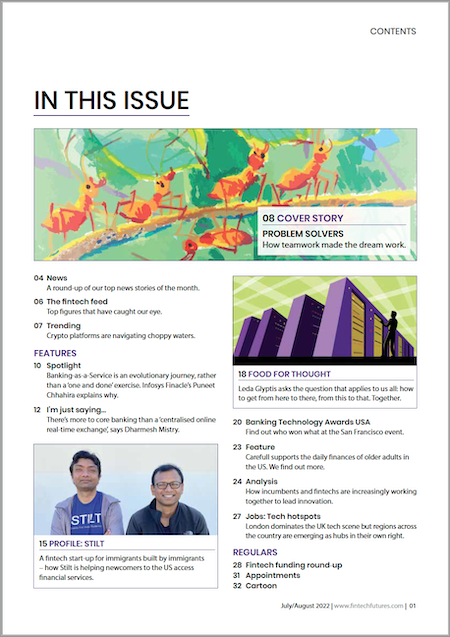

Cover story: MAKING THE DREAM WORK – Helping Ukraine in a planet-friendly way.

Welcome to the combined July/August edition of the magazine! As we reach the 2022 halfway point, here is a quick round-up of some of the winners and losers so far.

The crypto market is on rocky grounds – Vauld in Singapore, Voyager Digital and Celsius in the US have halted operations; while tech giant Meta is pivoting away from digital currency and sunsetting its Novi venture.

Meanwhile, the EU regulators have reached a provisional agreement on a new landmark regulatory framework for cryptocurrencies. The MiCA (Markets in Crypto-assets) proposal aims to protect investors and preserve financial stability.

In the blockchain space, three year-old we.trade is shutting shop. The Hyperledger-based venture – “the world’s first enterprise-grade blockchain-enabled trade finance platform” – owned by 12 banks and IBM, offered to connect SMEs to banks, and provided traders with access to insurance, credit rating, financing and logistics services.

HSBC-backed Serai has closed after three years in operation. Serai’s mission was “to simplify global trade” for SMEs by providing supply chain solutions to brands and manufacturers. However, it couldn’t build a commercially viable business. (HSBC is also among the founding banks and shareholders of we.trade.)

Australian challenger bank Volt is shuttering after failing to raise sufficient funds. It’s returning its banking licence to the regulator and the deposits to account holders.

But new challengers are emerging. Australia-based “social banking app” Chippit has raised $136,000 in pre-seed funding and launched in closed beta.

New Zealand is getting its first digital home loan platform, Tella; the UAE regulator has granted banking licence to digital bank Zand; and Ecuador’s Daxsen Group is set to launch a new digital bank, Daxsen Bank, to “revolutionise” the country’s banking sector.

In the UK, Kroo has secured a full banking licence and £26 million in a Series B funding round. The bank offers a current account with overdraft, along with socially conscious initiatives that help in “creating change in communities, tackling environmental issues and simplifying banking”.

Another UK start-up, Ashman, has received a restricted banking licence and hopes for the full regulatory approval later this year. Ashman intends to transform the banking experience for property SMEs – which it claims is a £90 billion market opportunity – by providing real-estate lending for conscientious businesses and savings for consumers.

CLICK HERE TO READ THE FULL EDITION OF THE BANKING TECHNOLOGY MAGAZINE JULY/AUGUST 2022

[ad_2]

Image and article originally from www.fintechfutures.com. Read the original article here.