[ad_1]

Gold, Brent Oil, WTI, China, Iran, Prompt Spread, Technical Outlook – Talking Points

- Gold prices muted above 1,700 despite a US Dollar pullback

- Crude oil prices advance as sentiment improves across APAC region

- Strength in crude oil’s prompt spread suggests a tightening market

- WTI prices approach 20-day SMA and 38.2% Fib after overnight gain

A pullback in the US Dollar hasn’t encouraged confidence in gold prices, with XAU doing very little just above the 1,700 level. This follows last week’s drop below September 2021 low as prices fell for a fifth consecutive week. The price behavior suggests that gold bulls may have completely abandoned the case that prices would benefit from extremely high global inflation. XAU remains muted as stock indexes across the Asia-Pacific region fall in Tuesday trading.

The latest Commitments of Traders (COT) report from the CFTC for the week ending July 12 showed that the total short position on gold among non-commercial traders (speculators) rose to its highest level since 2018. A drop below the psychologically important 1,700 level may send XAU prices sharply lower, with sentiment appearing bearish even after weeks of selling.

Brent crude oil is trading around the 106 handle after prices rallied overnight against a broadly weaker US Dollar. A rebound in market sentiment across the Asia-Pacific region, particularly in China, supported prices. Chinese regulators are considering a proposal to allow homebuyers to suspend mortgage payments on unfinished homes. Beijing is also pushing local governments to lend more in special bonds for infrastructure projects as the country attempts to reach its growth target amid sporadic Covid lockdowns.

Iran raised its official selling price (OSP) for Asian customers for August from $6.10 to $8.90 above the Oman/Dubai benchmark. That oil benchmark serves as crude oil’s price reference for products from the Middle East Gulf, Russia, and Mexico. The move suggests that Iran sees increased demand from China, being one of its few customers due to US sanctions. Iran has increased oil production by around 32,000 barrels per day in the second quarter.

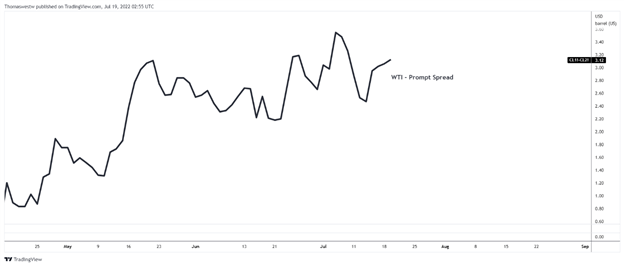

Meanwhile, the prompt spread (difference between the current and next month’s contract price) in WTI crude oil has increased over the last four sessions. That suggests the market is tightening. A reduction in tonight’s US crude oil inventory data from the American Petroleum Institute (API) may support that view. However, the US Energy Information Administration’s weekly report, due out tomorrow night, is expected to show a slight build.

Chart created with TradingView

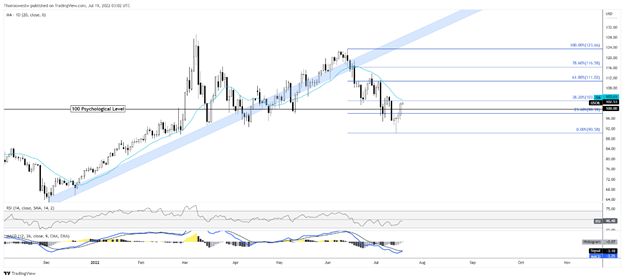

Crude Oil Technical Outlook

Crude oil prices are up more than 10% from the July lows set last week. Prices cleared the psychologically important 100 level overnight before moderating this morning just short of the 38.2% Fibonacci retracement. The 20-day Simple Moving Average (SMA) sits just above that Fib level. If bulls clear those levels, it may induce further strength.

Crude Oil Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.