[ad_1]

USD/JPY News and Analysis

- Markets take advantage of FOMC media blackout period – clawing back prior losses

- USD/JPY technical levels to watch ahead of BoJ and Fed meetings

- IG Client Sentiment hints at continued move lower despite significant short positioning

Dollar Declines Enter Third Day

USD/JPY has drifted lower thanks to a softer US dollar. The dollar has declined since peaking after the Bank of Canada (BoC) shock 100 bps rate hike last Thursday. This morning the dollar (via the US Dollar Index, ‘DXY’) has continued the move lower and will mark a third successive day of declines should we close in the red. Look out for a potential MACD bearish crossover.

Looking ahead the economic calendar produces minimal US data as we head into the FOMC decision next Wednesday. Previously, comments from hawkish members of the FOMC tended to accelerate rate hike odds and dollar valuations but seeing that the rate setting committee is in its usual media blackout period, markets have seemingly taken the opportunity to recover lost ground vs the dollar. Markets will look out for the Bank of Japan’s (BoJ) quarterly report as there is no expectation for a move on the interest rate front.

Customize and filter live economic data via our DaliyFX economic calendar

Technical Levels to Watch Ahead of BoJ Meeting

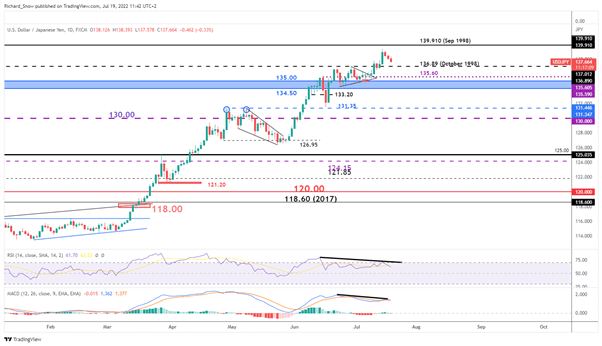

USD/JPY will also mark three successive days of selling if we close in the red. The recent pullback may offer better entry points for USD/JPY bulls, perhaps around the 136.89 level, but the RSI and MACD indicators suggest a bit of caution here. Negative divergence on both the RSI and MACD indicators signal the potential for a reversal at these extended levels in USD/JPY.

While fundamentally, the Japanese Yen offers little drive the currency forward, continued dollar weakness in the lead up to the FOMC rate decision and BoJ rate meeting opens the door to a continued move lower. Support comes in at 126.89 followed by 135.60, 135.00 and 134.50.

Take a look at our MACD module for more on positive and negative divergence.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

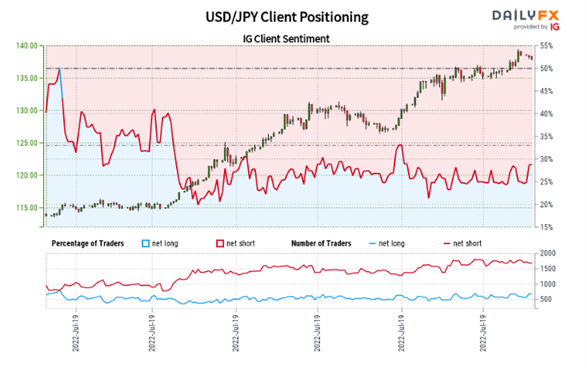

IG Client Sentiment Hints at Continued Move Lower

USD/JPY: Retail trader data shows 29.16% of traders are net-long with the ratio of traders short to long at 2.43 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

The number of traders net-long is 19.66% higher than yesterday and 7.76% higher from last week, while the number of traders net-short is 1.52% lower than yesterday and 3.10% lower from last week.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse lower despite the fact traders remain net-short.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.