[ad_1]

RAND TALKING POINTS

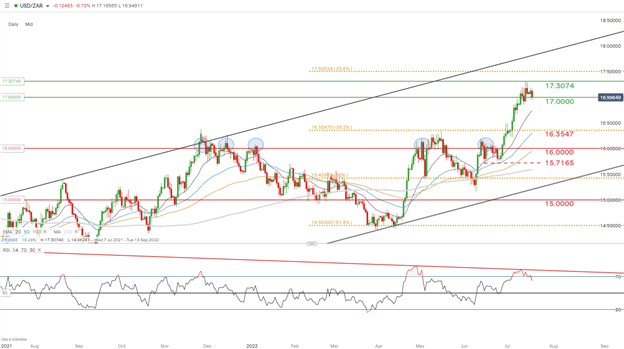

- Possible short-term pullback on the cards for ZAR bulls.

- SARB rate decision in focus this week.

- Will R17/$ hold as support?

USD/ZAR FUNDAMENTAL BACKDROP

The South African rand has found some respite this morning on the back of a weaker U.S. dollar as money markets revise Fed rate hike expectations lower from 100bps. The week ahead holds several key economic data points for South Africa including inflation and the SARB’s interest rate announcement (see economic calendar below). Inflation has already exceeded the reserve bank’s upper target limit of 6% in May and is expected to climb to 7.2% tomorrow adding to hawkish pressure on SARB to hike 50bps on Thursday. Should inflation data miss expectations I don’t see the SARB being swayed to reduce this 50bps projection alongside an aggressive Federal Reserve. Since the 16.00 upside breakout in late June, inflationary pressures have hurt South African consumers and although hiking rates are not idea, controlling a weakening rand is essential in limiting further inflation downside on the consumer.

USD/ZAR ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

The recent bleak commodity outlook seems to have stalled for now ahead of China’s Loan Prime Rate (LPR) decision tomorrow with the 1-year expected to stay at 3.7% while the 5-year rate which was unexpectedly cut in May to 4.45% from 4.6% may see another cut to stimulate the property sector as mortgage repayments come under threat. Coupling the SARB rate hike expectation with a potential cut by the PBOC could see the rand strengthen against the greenback this week. Locally, loadshedding has somewhat eased giving businesses a slight break from the Stage 6 blackouts earlier this month and should add to rand support.

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/ZAR price action has bears testing the 17.0000 psychological support zone with a confirmation close below possibly leading to further downside for the pair. My short-term bias is skewed to rand strength this week under the current fundamental backdrop while future price movement for the ZAR will be dependent on the U.S. and China respectively.

Current overbought conditions on the Relative Strength Index (RSI)shows slowing bullish upside momentum while corresponding price action moves higher. This phenomenon is known as bearish divergence and traditionally points to move lower. This could be the start of a pullback towards subsequent support zones.

Resistance levels:

Support levels:

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.