[ad_1]

EUR/USD ANALYSIS & TALKING POINTS

- EZ Manufacturing PMI Flash (JULY) – ACT: 49.6; EST: 51

- EZ Services PMI Flash (JULY) – ACT: 50.6; EST: 52

EURO ON THE BACKFOOT AFTER DISSAPOINTING PMI’S

The euro began its descent today beginning with French PMI’s missing estimates followed by German data which often services as a barometer for the entire EU region. Unsurprisingly, EZ PMI’s followed suite (see economic calendar below), augmenting the weaker euro. Manufacturing and services fell across the board, hinting at the negative impact of inflation on these respective sectors. Consumer spending looks to be on the decline as recessionary fears take hold across the globe while the worlds major importing nation China grapples with stifled economic activity leading to a systemic adverse effect on European exports.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

Later today, the spotlight will be on the U.S. with their PMI data under scrutiny. Expectations are lower but still within the expansionary zone. A print in line or above forecasts could see EUR/USD move lower while a miss will be interesting in terms of market reaction against the current EU PMI reaction.

EURO FUNDAMENTAL BACKDROP

Yesterday’s ECB interest rate decision was welcomed by global markets however, the limiting factor on euro upside sourced from its newly dubbed Transmission Protection Instrument (TPI) aimed at easing inflationary pressures (via higher borrowing costs) in the region. While the tool sounds promising at a surface level, the lack of details provided weighed on the euro and distressed nations within the region. In particular, Italy took the brunt of the ambiguity due its political situation and soaring 10Y BTP-Bund spreads. One positive relates to the unrestricted nature of the TPI as stated by the ECB but until markets get greater clarity, the euro will likely remain under pressure.

Now that the ECB outlined a more data centric outlook (scrapping forward guidance), today’s market response to PMI’s sets up next week’s EU inflation and GDP releases with added interest.

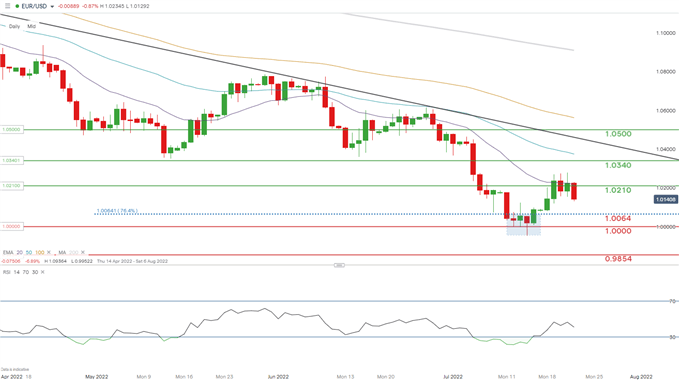

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Resistance levels:

Support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 65% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we settle on a short-term cautious bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.