[ad_1]

GBP/USD – Prices, Charts, and Analysis

- UK politics back in the spotlight.

- GBP/USD traders should be wary of heavyweight US data releases.

The two candidates looking to be the next UK Prime Minister, Liz Truss and Rishi Sunak, will take part in a series of head-to-head televised debates, starting tonight, that will go a long way to deciding who gets the keys to No.10 Downing Street. Current polling shows Foreign Secretary Truss leading the former Chancellor among Conservative voters and party members.

For all market-moving economic data and events, refer to the DailyFX calendar

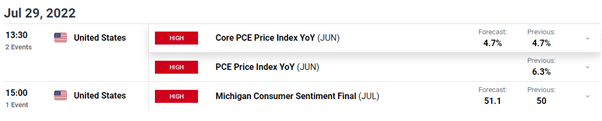

While UK politics may make headlines this week and affect Sterling, a range of heavyweight US data and events this week will likely be the driver of any moves in GBP/USD. The standout event is the FOMC meeting on Wednesday where the Fed is expected to hike interest rates by another 75 basis points. The latest market pricing shows a 76.3% probability of a 75 basis point hike and a 23.7% of a 100 basis point move. In addition, the first look at US Q2 GDP on Thursday – likely negative – and Core PCE on Friday will give traders a much better take on the state of the US economy.

Weekly Fundamental US Dollar Forecast – July Fed Meeting in Focus

Cable is trading either side of 1.2000 as the week kicks off in a fairly subdued fashion. A break above 1.2064 would see the pair trading at their best level in nearly three weeks, while there is little in the way of support, aside from the 20-day simple moving average at 1.1968, to prevent the pair from breaking back below 1.1900. Cable looks indecisive at the moment and better trading opportunities lie elsewhere.

GBP/USD Daily Price Chart – July 25, 2022

Retail trader data show 75.75% of traders are net-long with the ratio of traders long to short at 3.12 to 1. The number of traders net-long is 1.39% higher than yesterday and 7.87% lower from last week, while the number of traders net-short is 3.52% lower than yesterday and 2.27% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.