[ad_1]

- German Industrial Production Eked Out a Surprise Gain in June.

- Deutsche Lufthansa AGSeals Ground Crew Wage Deal to Avert Further Walkouts.

- US Jobs Report Looms.

DAX 40: Stalls Near Key Levels as Investors Seek Guidance from US Jobs Report

The DAXhad a mixed European session with gains being surrendered as investors digest more quarterly corporate earnings ahead of the latest widely watched U.S. jobs report. The index is heading toward its third consecutive week of gains as largely positive corporate earnings have overshadowed fears that the region is heading for an economic slowdown later this year. Helping the tone Friday was the news that German industrial production eked out a surprise gain in June, as output in Europe’s manufacturing powerhouse rose 0.4% from May. Deutsche Lufthansa AG and labor union Verdi sealed an agreement on a wage deal for the company’s 20,000 ground crew after a one-day strike led to a wave of cancellations. The deal includes monthly pay hikes in three stages through the end of next year with check-in staff to get between 13.6% and 18.4% more pay, helping workers cope with higher energy bills. The carrier on Thursday said the walkouts cost it around 35 million euros.

In corporate news, Allianz (ALVG) stock fell 2.7% after the German insurer posted a hefty 23% fall in second quarter net profit, dampened by volatile markets. On the flip side, Deutsche Post (DPWGn) stock rose 5.9% after it reported double-digit growth in revenue and earnings, boosted by its thriving freight and express business.

All focus now shifts to the July U.S. employment report as investors look for clues on how the Federal Reserve will view the strength of the world’s largest economy. Nonfarm payrolls are seen increasing by 250,000 jobs last month, a slowing in growth from 372,000 in June, which could ease pressure on the Fed to deliver a third straight interest rate increase of 75 basis points at its next meeting in September.

For all market-moving economic releases and events, see the DailyFX Calendar

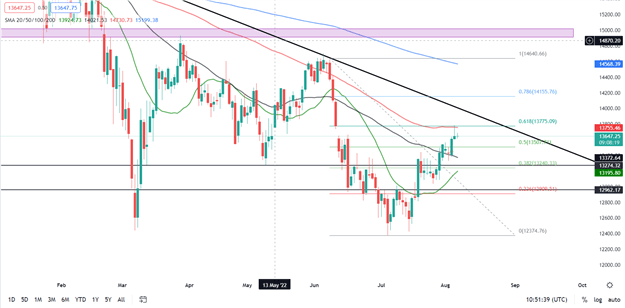

DAX 40 Daily Chart – August 5, 2022

Source: TradingView

From a technical perspective, last week Friday saw a monthly candle close as a bullish candle of a level of support. We closed above the 50-SMA while at the same time maintaining a bullish structure (higher highs and higher lows) on the monthly timeframe. The daily timeframe saw an inverted hammer candle close at the top of an uptrend. With selling pressure returning here we could see a pullback to the 50-SMA before moving higher.

DAX 40 1H Chart – August 5, 2022

Source: TradingView

The 1H chart has seen a price drop since reaching its weekly high of 13787 on Wednesday and tapping into the 100-SMA on the daily chart. We have seen mixed price action in European trade today which could be down to the much-anticipated US jobs report. Price is currently compressed between the 20 and 50-SMA while strong confluences for would be sellers lie just above the weekly high.

Key intraday levels that are worth watching:

Support Areas

•13525

•13380

•13274

Resistance Areas

•13787

•14000

•14156

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter:@zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.