[ad_1]

Australian Dollar Talking Points

AUD/USD carves a series of higher highs and lows as it extends the rebound from the yearly low (0.6681), and the exchange rate appears to be on track to test the 50-Day SMA (0.6971) as it clears the opening range for July.

AUD/USD Poised to Test 50-Day SMA After Clearing Opening Range for July

AUD/USD appears to have reversed course after failing to test the June 2020 low (0.6648), and the commodity bloc currencies may stage a larger recovery ahead of the Federal Reserve interest rate decision on July 27 amid waning expectations for a 100bp rate hike.

Source: CME

The CME FedWatch Tool suggests the Federal Open Market Committee (FOMC) will retain its current approach in normalizing monetary policy a the gauge now reflects a greater than 60% probability for a 75bp rate hike later this month, and it remains to be seen if Chairman Jerome Powell and Co. will adjust the forward guidance for monetary policy as a growing number of Fed officials show a greater willingness to implement a restrictive policy.

Until then, AUD/USD may attempt to test the 50-Day SMA (0.6971) as it carves a series of higher highs and lows, but the advance from the yearly low (0.6681) may turn out to be a correction in the broader trend as the moving average continues to reflect a negative slope.

In turn, AUD/USD may mirror the price action seen during the previous month as it failed to hold above the moving average, and a larger rebound in the exchange rate may lead to a flip in retail sentiment like the behavior seen earlier this year.

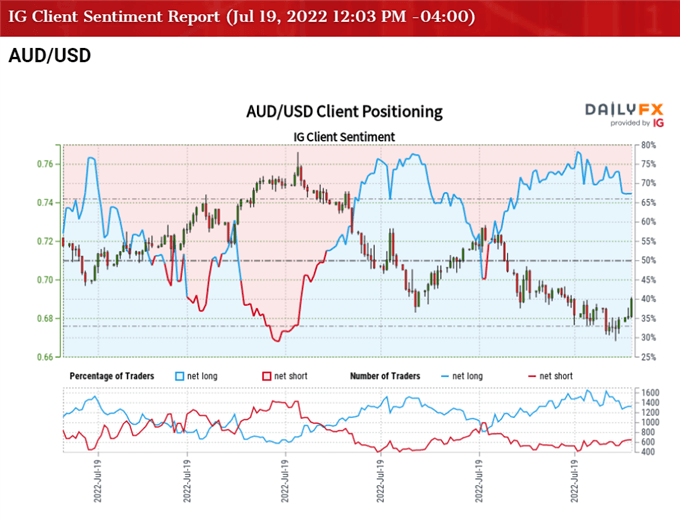

The IG Client Sentiment report shows 59.11% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 1.45 to 1.

The number of traders net-long is 9.84% lower than yesterday and 25.98% lower from last week, while the number of traders net-short is 28.15% higher than yesterday and 41.34% higher from last week. The drop in net-long position comes as AUD/USD trades to a fresh monthly high (0.6912), while the jump in net-short interest has alleviated the crowding behavior as 74.81% of traders were net-long the pair last week.

With that said, recent price action raises the scope for a larger rebound in AUD/USD as it extends the series of higher highs and lows from the yearly low (0.6681), and the exchange rate may attempt to test the 50-Day SMA (0.6971) as it clears the opening range for July.

{{GUIDE|SENTIMENT_GUIDE| Learn More About the IG Client Sentiment Report}

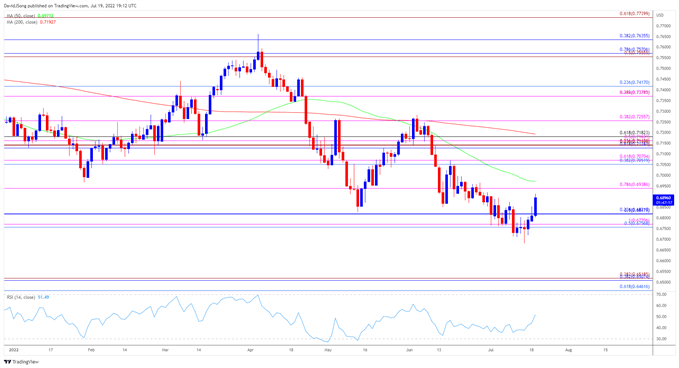

AUD/USD Rate Daily Chart

Source: Trading View

- AUD/USD appears to have reversed course ahead of the June 2020 low (0.6648) as it extends the series of higher highs and lows from the yearly low (0.6681), with the move back above the 0.6820 (23.6% retracement) region bringing the 0.6940 (78.6% expansion) area on the radar.

- A move above the 50-Day SMA (0.6971) opens up the 0.7050 (38.2% retracement) to 0.7070 (61.8% expansion), with the next area of interest coming in around 0.7130 (61.8% retracement) to 0.7180 (61.8% retracement).

- However, the moving average may largely cap the near-term rebound in AUD/USD like the price action seen during the previous month, and lack of momentum to push above the 0.6940 (78.6% expansion) area may bring the 0.6760 (50% retracement) to 0.6770 (100% expansion) region back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.