[ad_1]

AUSTRALIAN DOLLAR, YEN, CHINA DATA, JAPAN GDP – Talking Points:

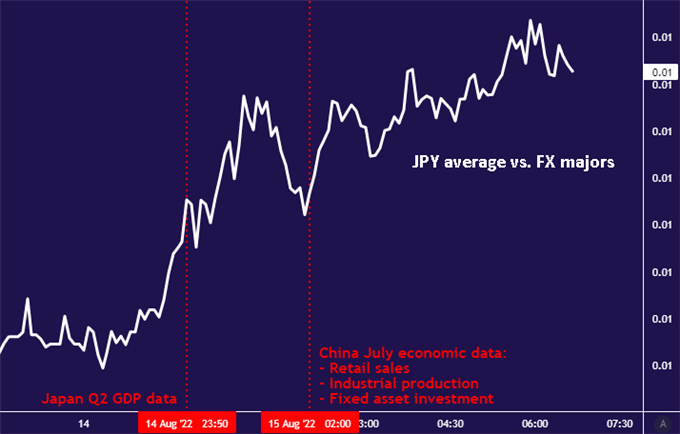

- Chinese economic data inspires a risk-off mood in currency markets

- Japanese Yen higher after Q2 GDP report reveals slower deflation

- S&P 500 futures warn negativity might spread to broader markets

The Australian Dollar sank alongside its New Zealand counterpart as China reported a round of disappointing economic figures. Besides each other, the East Asian giant is the two Oceanic nations’ top export market, and weakness there can echo back along the trade route.

Industrial production grew 3.8 percent on-year in July, undershooting expectations of a 4.6 percent rise. Retail sales added 2.7 percent over the same period, falling short of the 5 percent forecast. Capital investment marked the weakest rise since November 2021 at 5.7 percent. Economists had penciled in a gain of 6.1 percent ahead of the release.

Chart created using TradingView

Earlier in the day, the Japanese Yen rose despite lackluster second-quarter GDP data. Output rose at an annualized rate of 2.2 percent, short of the 2.5 percent baseline forecast. An unexpected rise in the GDP deflator – a measure of inflation – may have inspired the currency.

The index showed prices fell -0.4 percent on-year, marking the slowest deflation since the first quarter of 2021. It was projected to fall -0.8 percent after slipping -0.5 percent in the first quarter. That may have inspired speculation about the possibility of a less-dovish Bank of Japan (BOJ) at some point on the horizon.

Such thinking appeared to be short-lived, however. The priced-in three-year BOJ policy path implied in rates markets has not budget from last week. A return from negative territory on the benchmark lending rate is not expected until at least the second quarter of next year.

The Yen continued to move higher all the same however, finding fresh fuel in China’s downbeat data offering. Weakness in the world’s second-largest economy appeared to inspire a broader risk-off tone, at least in the G10 FX space. The Japanese unit tellingly rose with the safety-minded US Dollar.

Asia-Pacific bourses managed to brush off negativity, tracking up 0.6 percent on average in afternoon trade. European shares are also indicated to open in the green. Futures tracking the bellwether S&P 500 index are pointing lower however, warning resilience in equities may be fleeting.

Chart created using TradingView

FX TRADING RESOURCES

— Written by Ilya Spivak, Head of Greater Asia at DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.