[ad_1]

Bitcoin (BTC), Ethereum (ETH) Charts and Analysis:

Tough times in the cryptocurrency of late with a lack of volatility leaving active traders on the sidelines as Bitcoin meanders sideways. Range traders with a mildly bullish bias will have been successful of late as Bitcoin is currently showing a wave pattern with slightly higher highs and higher lows being printed over the last 6-8 weeks. The Average True Range (ATR) – a measure of volatility – is at a multi-month low, while BTC is using the 50-day sma as support. To push further higher, Bitcoin needs to post a fresh swing-high above $24,668.

Bitcoin Daily Price Chart – August 5, 2022

Chart via TradingView

With the Goerli/Prater merge expected next week, the third public testnet merge before the main Ethereum PoW to PoS changeover occurs in mid-September, Ethereum may well push higher ahead of the ‘Merge’ event. The Goerli/Prater merge is expected to occur between August 6-12. For more details on the Ethereum switch to PoS from Pow see The Ethereum Foundation.

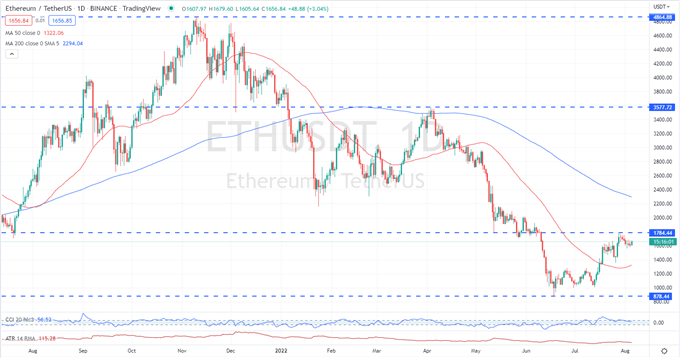

The daily Ethereum chart is slightly different from the Bitcoin daily as ETH has outperformed BTC since mid-July. To keep this short-term move higher going, ETH needs to trade back above $1,784 and produce a new short-term higher high. The 50-day sma remains supportive.

Ethereum Daily Price Chart – August 5, 2022

Chart via TradingView

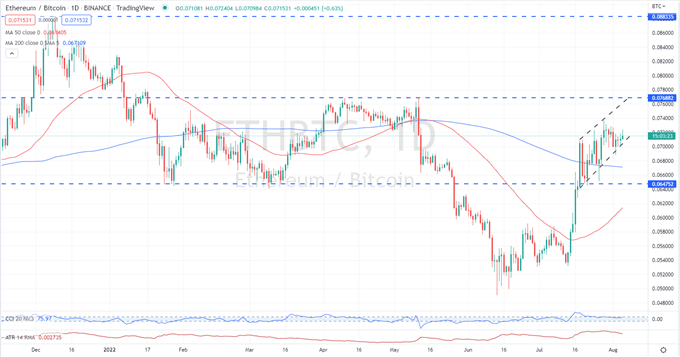

The Ethereum/Bitcoin spread highlights ETH’s outperformance over the last month. A bullish channel formation is currently playing out and while this remains in place, the pair will likely move back to the May 11 high at 0.07688. This formation is fairly aggressive however with a sharp support slope. The pair has tested this support in the past week and are likely to do so again, so traders need to be alert to a possible break lower. The 50- and 200-day smas remain supportive.

Ethereum/Bitcoin Daily Price Chart – August 5, 2022

Chart via TradingView

What is your view on Bitcoin and Ethereum – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.