[ad_1]

The second quarter of the year has been a tricky three months for the Bank of England (BoE) as inflation continued to soar – and is expected to rise further – while growth slowed to a crawl, sparking fears that the UK may enter a recession (two consecutive quarters of negative growth). While the BoE may argue that it has been dealt a bad hand of cards, their reaction to runaway inflation now looks like it is has been too little, too late. UK headline inflation is now over 9% and, if the BoE’s forecasts are correct, it is set to hit double-digits in the coming months, with the soaring price of fuel and food continuing to hit the UK consumer hard. The inflation genie is well and truly out of the bottle and the UK central bank may need to double down on rate hikes to try and get price pressures under control.

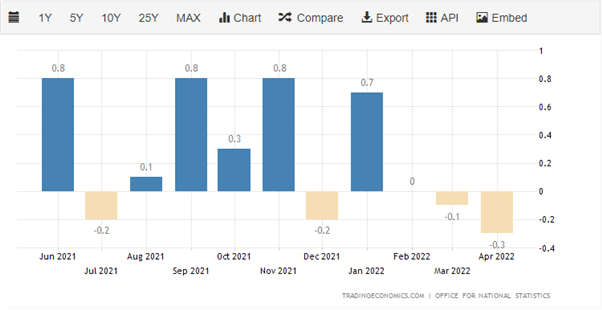

Bank of England Growth Chart

Source: TradingEconomic.com

In the Q2 forecast we looked at the inflation/growth puzzle that the BoE needs to solve and recent data show this situation worsening. Inflation continues to soar while the latest, monthly, UK GDP data shows the economy not just slowing down but going into reverse. While April’s figure was hit by a slowdown in the coronavirus test and trace program to the tune of 0.4% GDP, data showed contraction across all sectors in the UK economy. With UK Q2 and Q3 growth expected to be flat, there is a real chance that a further economic downturn will send the UK into a recession. This in turn leaves the UK central bank facing the tricky problem of quelling inflation while leaving the UK economy with enough room to grow.

UK Economy Chart

Source: TradingEconomic.com

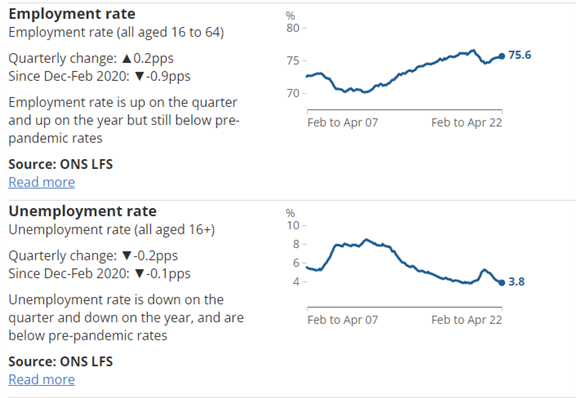

The UK labor market remains in robust health, and while this is good for the UK population as a whole, it also presents another challenge for the BoE, wage inflation. Companies are finding it difficult to hire and those that can are having to pay higher wages due to a combination of inflation and a tight labor market.

Unemployment Rate Graph

Source: ONS LFS

The British Pound Outlook for Q3

The UK is not alone in facing testing times ahead with developed markets across the globe battling inflation and slowing growth. The U.S. after a slow start has been hiking interest rates at a record pace, while the ECB will soon take its Bank Rate out of negative territory and start its own quantitative tightening program.

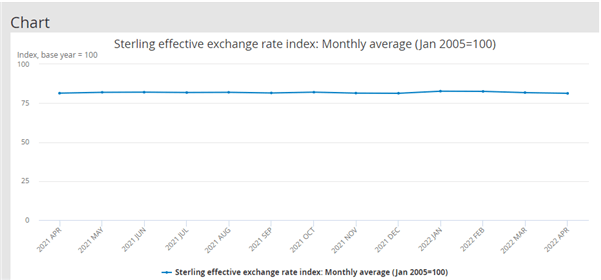

The British Pound if looked at in isolation against the US dollar has performed poorly, with cable down around 10 big figures since the start of Q2. However, Sterling’s effective exchange rate index is flat over the last year, highlighting the strength of the US dollar. This US dollar strength is starting to weaken as markets begin to price in a recession in the United States. US Treasury yields are falling from their recent highs as these recession fears grow, leaving the US dollar struggling to make further upside.

Sterling Effective Exchange Rate Index

Source: ons.gov.uk

Away from the economic backdrop, the British Pound is under pressure from the UK political arena. PM Boris Johnson continues to lose the support of the British public and those within the Conservative party, as one faux pas follows another. The Prime Minister still retains enough support within his party to continue, but it will not take too many ministerial resignations before this changes. Politics is weighing on Sterling.

The outlook for the British Pound may not be as negative as the economic and political backdrop suggests. Financial markets are very efficient and price in expectations and perceived problems ahead of time. The heavy sell-off in cable may be nearing its end, due mainly to a weakening US dollar, while EURGBP looks rangebound and likely to stay that way. GBPJPY made a six-year high in Q2, due to the weakness in the Japanese Yen, and any drift lower in this pair may open fresh opportunities for GBPJPY as the Bank of Japan continues with its ultra-loose monetary policy.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.