[ad_1]

Bitcoin, Ethereum Talking Points

Bitcoin (BTC/USD) Technical Analysis

The return of risk-on sentiment supported last week’s crypto rally that allowed Bitcoin to retest $25,000. After rising to a two-month high, failure to gain traction above psychological resistance resulted in an increase in selling pressure, muting the upward move.

Discover 3 Key Tips for Trading Cryptocurrency

With momentum stalling at key technical levels, another big week of high-impact economic data may assist in the catalyzation of price action throughout the crypto sphere.

DailyFX Economic Calendar

Learn How to Read a Forex Economic Calendar

To further illustrate the importance of the current zone, short-bodied candles on the daily chart highlight Fibonacci levels providing additional levels of support and resistance. With the 76.4% retracement of the March – June move holding bulls at bay at $424,790, the 20-day MA (moving average) has formed support at $23,549 with a break below reopening the door for $20,000.

Bitcoin (BTC/USD) Daily Chart

Source: TradingView, Chart by Tammy Da Costa

On the eight-hour chart, the rising trendline currently remains intact with the long wick candle forming a potential hanging man (a bearish reversal pattern).

Bitcoin (BTC/USD) 8 Hour Chart

Source: TradingView, Chart by Tammy Da Costa

Bitcoin Key Levels:

|

Support |

Resistance |

|

$23,822 |

R1: $24,790 |

|

$22,892 |

R2: 25,000 |

|

$21,52 |

R3: 26,171 |

Ethereum (ETH/USD) Technical Analysis

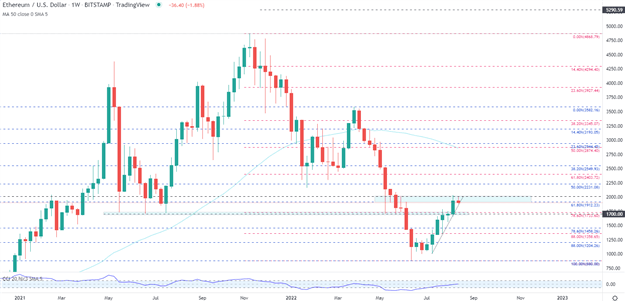

Meanwhile, for the second largest cryptocurrency, Ethereum gained approximately 13.8% before hitting a barrier of resistance at $2,000. With ETH 2.0 expected to debut next month, the transition to a more energy efficient Proof of Stake (PoS) added to optimism, fueling the upward move.

On the weekly timeframe, the narrow range between $1,912 and $2,000 is indication of a battle between bulls and bears that are fighting for dominance.

Ethereum (ETH/USD) Weekly Chart

Source: TradingView, Chart by Tammy Da Costa

After six consecutive weeks of gains, the CCI (commodity channel index) remains in overbought territory with a move lower suggesting that bullish momentum may be losing steam.

Ethereum (ETH/USD) Daily Chart

Source: TradingView, Chart by Tammy Da Costa

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.