[ad_1]

ECB and EUR/USD Price, Chart, and Analysis

- ECB raises interest rates by 50bps, pushing the Euro higher.

- Anti-fragmentation tool details announced.

*** Updates to Follow ***

The European Central Bank hiked interest rates by a larger then expected 50 basis points today, the first rate hike by the ECB for over 11 years. Going into today’s decision, the market had been looking for a 25bp hike with a possibility of 50bps mooted but not expected. The central bank said that further rate normalization would be appropriate at further meetings and that APP reinvestments (bond buying) would run for as long as needed.

The ECB’s new anti-fragmentation tool, the Transmission Protection Instrument (TPI) ‘will be an addition to the Governing Council’s toolkit and can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area. The scale of TPI purchases depends on the severity of the risks facing policy transmission. Purchases are not restricted ex ante. By safeguarding the transmission mechanism, the TPI will allow the Governing Council to more effectively deliver on its price stability mandate. ‘

For all market-moving economic releases and events, see the DailyFX Calendar

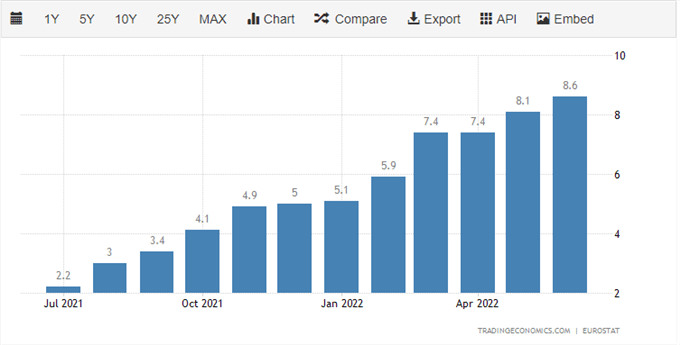

Euro Area inflation hit a record high of 8.6% in June compared to 8.1% in May and 1.9% a year ago. Energy costs continue to soar, while food, alcohol, tobacco, services, and non-energy industrial goods all showed sharp rises in June.

The ECB also announced details of its anti-fragmentation tool (TPI), a new bond-purchase program designed to help member states with higher borrowing costs. This safety net will be used to keep peripheral bond yields and spreads under control. This task has been made more difficult after Italian PM Mario Draghi resigned today after losing the confidence of some members of his coalition government. Italian bond yields jumped by around 20 basis points earlier and the yield spread with the Euro Area benchmark 10-year Bund widened by a further 15 basis points. The ECB’s new anti-frag tool may be in play very quickly.

Italian PM Mario Draghi Resigns – Stocks and Bond Slump

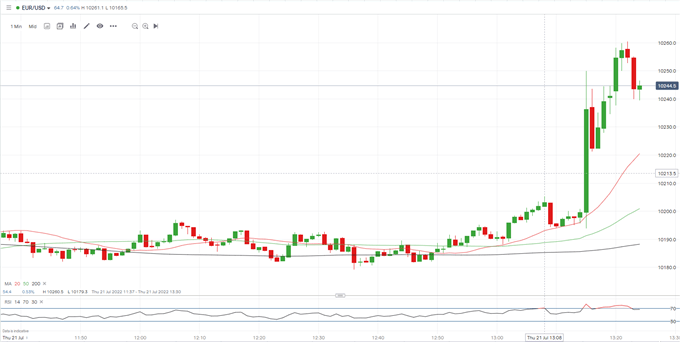

The single currency popped higher on the announcement, hitting 1.0260 from around 1.0200 in short-order.

EUR/USD One Minute Price Chart July 21, 2022

Retail trader data show 63.00% of traders are net-long with the ratio of traders long to short at 1.70 to 1. The number of traders net-long is 2.12% lower than yesterday and 23.44% lower from last week, while the number of traders net-short is 0.86% higher than yesterday and 37.65% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.