[ad_1]

EUR/USD Rate Talking Points

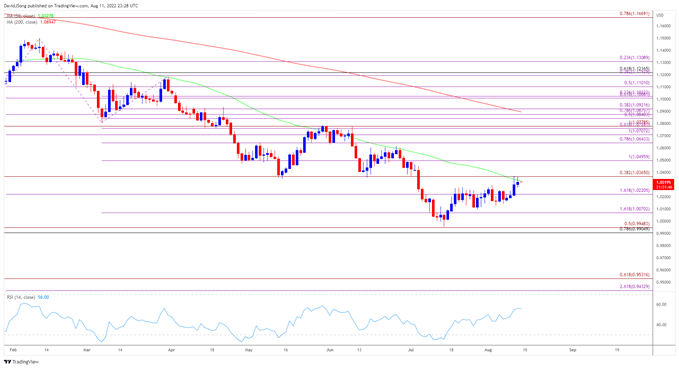

EUR/USD stages a four-day rally for the first time since March on the back of US Dollar weakness, but the exchange rate appears to be responding to the former support zone around the May low (1.0349) as it struggles to hold above the 50-Day SMA (1.0328).

EUR/USD Rate Rally Responds to Former Support Zone

EUR/USD holds near the monthly high (1.0369) as the slowdown in the US Consumer Price Index (CPI) casts doubts for another 75bp Federal Reserve rate hike, and the exchange rate may continue to retrace the decline from the July high (1.0485) after clearing the opening range for August.

However, recent price action raises the scope for a short-term pullback in EUR/USD as it fails to extend the series of higher highs and lows from earlier this week, and it remains to be seen if the Federal Open Market Committee (FOMC) will adjust its approach at the next interest rate decision on September 21 as the central bank is slated to update the Summary of Economic Projections (SEP).

Until then, EUR/USD may trade within a defined range as the former support zone around the May low (1.0349) appears to be acting as resistance, and the exchange rate may mirror the price action from June if it fails to hold above the 50-Day SMA (1.0328).

In turn, the advance from the yearly low (0.9952) may turn out to be a correction in the broader trend as the moving average continues to reflect a negative slope, but a further advance in EUR/USD may fuel the recent flip in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment report shows 49.15% of traders are currently net-long EUR/USD, with the ratio of traders short to long standing at 1.03 to 1.

The number of traders net-long is 3.96% higher than yesterday and 10.46% lower from last week, while the number of traders net-short is 3.22% higher than yesterday and 17.42% higher from last week. The decline in net-long position comes as EUR/USD holds near the monthly high (1.0369), while the rise in net-short interest has fueled the flip in retail sentiment as 51.34% of traders were net-long the pair earlier this week.

With that said, waning expectations for another 75bp rate hike may keep EUR/USD afloat over the coming days, but the exchange rate may continue to respond to the former support zone around the May low (1.0349) as it fails to extend the series of higher highs and lows from earlier this week.

EUR/USD Rate Daily Chart

Source: Trading View

- EUR/USD clears the opening range for August to test the 50-Day SMA (1.0328) for the first time since June, with a break/close above the 1.0370 (38.2% expansion) area raising the scope for a run at the July high (1.0485).

- A break/close above the 1.0500 (100% expansion) handle opens up the 1.0640 (78.6% expansion) region, but the exchange rate may continue to track the negative slope in the moving average as it appears to be responding to the former support zone around the May low (1.0349).

- Failure to close above the 1.0370 (38.2% expansion) area may push EUR/USD back towards 1.0220 (161.8% expansion), with a break of the monthly low (1.1054) bringing the 1.0070 (161.8% expansion) region on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.