[ad_1]

EUR/USD Price, Chart, and Analysis

- DailyFX data and events calendar needs to be closely monitored.

- EUR/USD – 1.0340 or 1.000, both levels may trade next week.

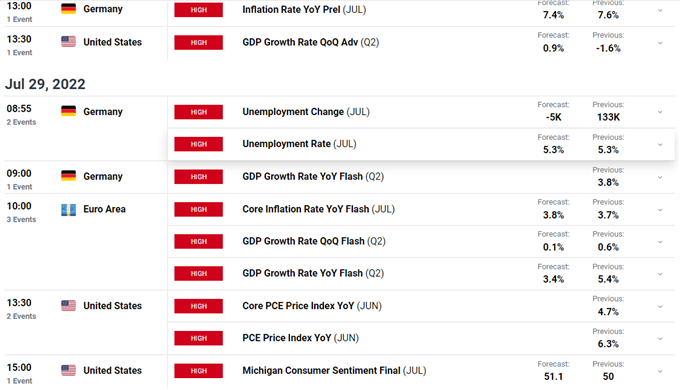

The next week is packed full of high-importance data releases and events with Wednesday and Friday of particular note. On Wednesday we have the latest FOMC rate decision, where the Fed is fully expected by another 75 basis points, while on Friday we have Euro Area inflation and the latest look at US Core PCE. All of the events shown below have the ability to move EUR/USD, leaving traders at risk if they are not following these releases. The economic calendar is your best friend next week.

For all market-moving economic releases and events, see the DailyFX Calendar

This week’s 50 basis point rate hike by the European Central Bank (ECB) did little to prop up the ailing Euro, while the somewhat sketchy details of the central bank’s anti-fragmentation program – the Transmission Protection Instrument (TPI) – left traders guessing as to how and when it may be used to quell peripheral bond spreads. Financial markets have already priced in another 50bp rate hike at the next ECB policy meeting on September 8 and it is hoped that more details about TPI will be known well ahead of this meeting if bond yields start to rise further.

With the sheer volume of risk events in the week ahead, EUR/USD could easily trade back up to strong resistance at 1.0340, test support around parity again, or test both in the same week. The 14-day ATR is currently around 100bps and climbing, while EUR/USD currently changes hands at 1.0120. Minor levels of support and resistance at 1.0080 and 1.0280 may slow any move.

EUR/USD Daily Price Chart July 22, 2022

Retail trader data show64.83% of traders are net-long with the ratio of traders long to short at 1.84 to 1. The number of traders net-long is 2.01% higher than yesterday and 16.58% lower from last week, while the number of traders net-short is 5.79% lower than yesterday and 13.28% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.