[ad_1]

EUR/USD News and Analysis

- Gazprom blames gas turbine technical delays on “anti-Russian sanctions”

- EUR/USD technical levels ahead of NFP – Trading range remains intact but anticipated increased volatility poses a challenge

In yesterday’s report, I highlighted the developing range in EUR/USD as the euro fails to capitalize on periods of dollar weakness. From a fundamental perspective, this is understandable as the risk to the euro and euro zone in general have moved up a notch. The main risk factors include: uncertain gas flows from Russia to Germany as the war in Ukraine continues, hiking rates during a growth slowdown and the potential flare up in periphery bond yields – although the ECB has plenty of fire power to mitigate against this.

Gazprom announced yesterday that “anti-Russian sanctions are hindering the successful resolution of the transportation and repair of Siemens gas turbine engines”. Such rhetoric doesn’t bode well for Germany. Europe’s largest industrial economy. The effects of soaring gas prices have already taken a toll on German industry as BASF, one of the world’s largest fertilizer producers announced planned cuts to its ammonia production and warned that higher gas prices would be passed down to consumers and farmers next year.

EUR/USD Technical Levels Ahead of NFP

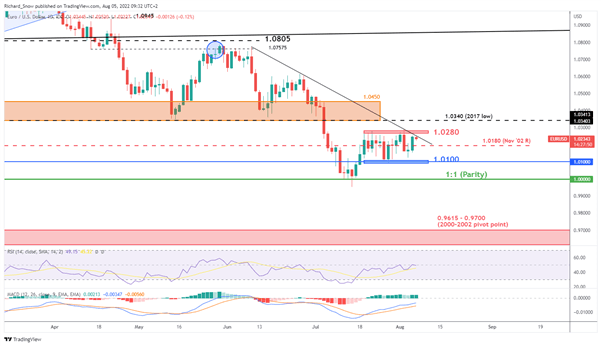

In yesterday’s price action we saw EUR/USD move higher, towards the upper bound of the developing range (1.0100 – 1.0280). The pair failed to reach the upper bound but did appear to find resistance at the descending trendline which has capped a series of lower highs.

EUR/USD bears will surely be watching this level ahead of the NFP data later today. A strong jobs report provides more room for the Fed to continue hiking interest rates and could see a temporary rise in the dollar, coinciding with a possible move lower in EUR/USD. However, NFP tends to bring a lot of volatility to the market which could even threaten to swing above the upper bound of the range only to then continue trading back within it.

Range trading can be tricky and it’s important to implement sound risk management techniques in the event of a breakout. Find out more about range trading by via the banner below:

EUR/USD 4-Hour Chart

Source: TradingView, prepared by Richard Snow

The daily chart highlights the longer-term downtrend.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Risk Events Ahead

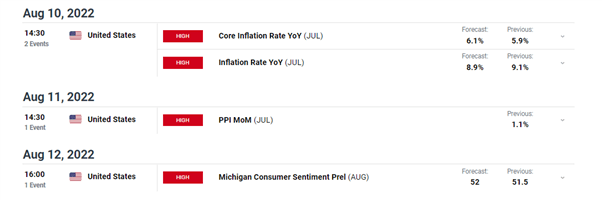

Risk events for the week ahead includes the NFP report later today, US inflation on Wednesday, PPI on Thursday and preliminary Uni of Michigan consumer sentiment data on Friday.

Customize and filter live economic data via our DaliyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.