[ad_1]

By Frank Corva

When you purchase digital assets through a centralized exchange — a CEX — like Binance or Coinbase, you’re only purchasing an IOU for these assets.

And what many of us are learning the hard way in the wake of FTX’s implosion is that the quality of these IOUs is only as good as the solvency of the exchange that issues them.

Because many crypto exchanges are located offshore, they don’t fall under the purview of US regulators or any other major authorities.

For this reason, you aren’t well-protected when you use these platforms.

So, in effort to stay safe, you may be best off only using centralized exchanges to buy and sell crypto as opposed to trusting these exchanges to custody your assets for you.

This means that once you’ve purchased some crypto via a centralized exchange, it’s best to then transfer it to a non-custodial wallet of your choosing.

Learning to trust yourself

Bitcoin was designed to eliminate trust in counterparties.

It was created in response to the 2007-2008 financial crisis and was designed to take power out of the hands of “too-big-to-fail” counterparties — the type of counterparty that FTX was well on its way to becoming.

But the self-custody of digital assets concept can be a challenging one to grasp at first.

Most of us look at the balances in our bank or brokerage accounts on a computer screen and don’t think twice about whether our money or assets are safe in the hands of the institutions that custody them for us.

Few of us — if any — would think to call our broker at Charles Schwab and say, “Hey, Mike — So, instead of you guys holding all of those claims to my stocks on your database, how about you send me some physical copies of them, and I’ll just store them in my safe at home.”

Call me crazy, but I get the feeling Mike doesn’t often get that call.

But this is essentially what you’re doing when you transfer your assets from the custody of a CEX to a non-custodial wallet.

Obviously, the Bitcoin or other digital assets that you transfer don’t become physical when you make such a transfer, but your ability to access them becomes, in part, only as good as the 12-to-24-word recovery seed phrase that you have to write down on paper when you set up your non-custodial wallet.

And this seed phrase should probably go into your safe at home — right where you’d otherwise put all of those stock certificates that Mike sent you.

I say this less to scare you and more to prepare you.

To invest in crypto, you have to make a decision as to who you trust more: yourself or a centralized custodian that might not be subject to proper regulatory oversight.

When you do choose yourself and self-custody your digital assets, this benefits the assets you hold in specific ways, as well.

Following the golden rule

Crypto purists — especially Bitcoiners — religiously abide by the following rule: Not your keys, not your coins.

They believe that you don’t truly own your digital assets until you manage them in a non-custodial wallet — more specifically, a hardware wallet — to which you hold the private keys.

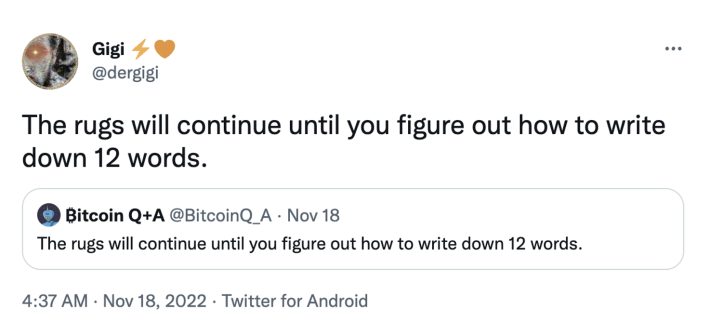

They also believe that you are leaving yourself open to crypto “rug pulls” — or “rugs” for short — which is when all liquidity for a crypto project or exchange suddenly disappears.

For this reason, they urge Bitcoin and crypto investors to learn how to use a non-custodial wallet to protect themselves.

No CEX is safe in the eyes of the Bitcoin and crypto religious.

To truly invest in an asset like Bitcoin, you must start by accepting the responsibility of using a non-custodial wallet.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.