[ad_1]

Fundamental Forecast for the US Dollar: Neutral

- The July Federal Reserve meeting changed the trajectory for the US Dollar for the rest of 2022.

- US jobs data due at the end of the week are expected to remain strong, though the US unemployment rate may have stopped falling amid the Fed’s rate hikes.

- According to the IG Client Sentiment Index, the US Dollar has a bearish bias heading into the first week of August.

US Dollar Week in Review

The US Dollar (via the DXY Index) dropped last week for the second consecutive week, losing -0.67%, the first back-to-back weekly pullbacks since the middle of May. The catalyst was of little surprise, a July Federal Reserve meeting that suggested policymakers are shifting into a less aggressive stance moving forward. The two largest components of the dollar gauge were the leaders, with EUR/USD rates adding +0.11% and USD/JPY rates falling by -2.11%. GBP/USD rates did well too, adding +1.39%. It’s likely that we’re going to see a relatively more dovish Fed moving forward, whereby even if there are more rate hikes, they’re unlikely to be at the same 75-bps pace we’ve seen over the past two meetings – which is not good news for the US Dollar.

A Lighter (but Still Important) US Economic Calendar

Last week was a veritable ‘Superbowl’ of US economic data, with growth data, inflation rates, consumer spending figures, and a Fed meeting. Comparatively, the coming week will be more relaxed. Nevertheless, there are still several important US economic data releases and events that will stoke volatility in USD-pairs.

- On Monday, August 1, the July US ISM manufacturing PMI will be released at 14 GMT.

- On Tuesday, August 2, the June US JOLTs report is due at 14 GMT, at which time Chicago Fed President Evans will give remarks.

- On Wednesday, August 3, weekly US mortgage application figures will be published at 11 GMT. The July US ISM non-manufacturing (services) PMI will come out at 14 GMT, as will June US factory orders. Weekly US energy inventories data will be released at 14:30 GMT.

- On Thursday, August 4, weekly US jobless claims are due at 12:30 GMT. Cleveland Fed President Mester will give a speech at 16 GMT.

- On Friday, August 5, the July US nonfarm payrolls report and unemployment rate will be published at 12:30 GMT. The June US consumer credit report will be published at 19 GMT.

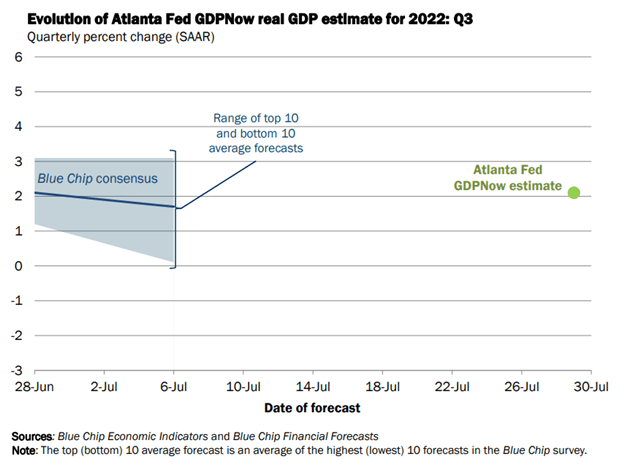

Atlanta Fed GDPNow 3Q’22 Growth Estimate (July 29, 2022) (Chart 1)

Based on the data received thus far about 3Q’22, the Atlanta Fed GDPNow growth forecast is now at +2.1% annualized in its initial reading from July 29. This would be a significant improvement after the 1Q’22 US GDP report showed a contraction of -1.6% annualized and the 2Q’22 US GDP report showed a contraction of -0.9% annualized.

For full US economic data forecasts, view the DailyFX economic calendar.

Rate Hikes Disappearing

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the front month/August 2022 and December 2022 contracts, in order to gauge where interest rates are headed by the end of this year.

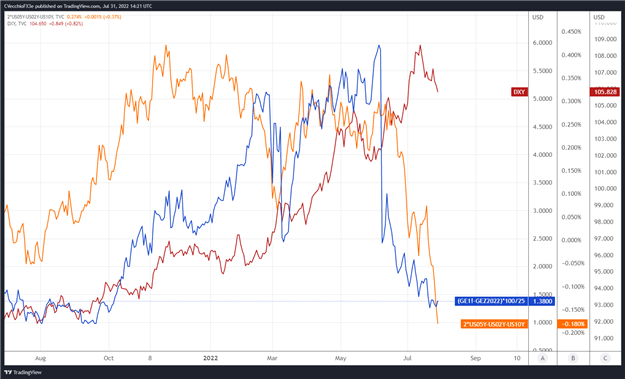

Eurodollar Futures Contract Spread (August 2022-December 2022) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: Daily Timeframe (July 2021 to July 2022) (Chart 1)

After the Fed raised rates by 75-bps last week, Eurodollar spreads are only discounting one 25-bps rate hike discounted through the end of 2022. Fed funds futures tell a slightly different story, seeing a 50-bps hike in September and one more 25-bps hike in either November or December. Regardless, these measures of rate hike expectations have eroded. And with the 2s5s10s butterfly turning negative, the market clearly sees the Fed as less hawkish. A less hawkish Fed against the backdrop of a weaker US economy could be trouble for the US Dollar for the rest of 2022.

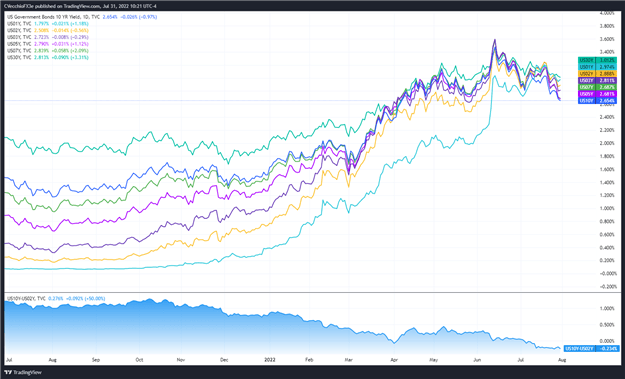

US Treasury Yield Curve (1-year to 30-years) (July 2020 to July 2022) (Chart 3)

The shape of the US Treasury yield curve – inversion – alongside declining Fed rate hike odds continues to act as an obstacle for the US Dollar. US real rates (nominal less inflation expectations) have started to pull back serving as another headwind. With other major central banks expected to be relatively more aggressive than the Fed over the next few months, the monetary policy expectations gap that has aided the US Dollar in recent months is disappearing.

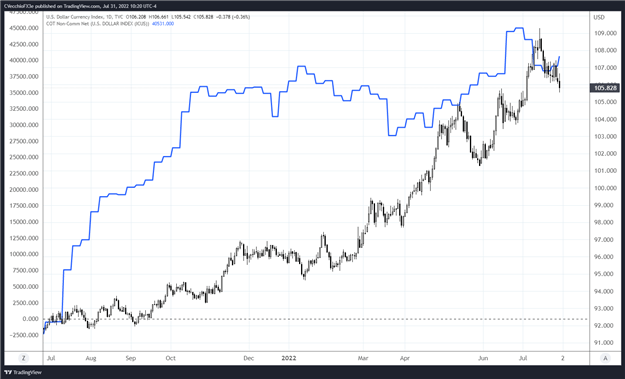

CFTC COT US Dollar Futures Positioning (July 2020 to July 2022) (Chart 4)

Finally, looking at positioning, according to the CFTC’s COT for the week ended July 26, speculators increased their net-long US Dollar positions to 40,531 contracts from 39,071 contracts. Despite moderation in recent weeks, US Dollar positioning is still oversaturated, holding near its most net-long level since March 2017.

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.