[ad_1]

Esports events have been attracting a huge viewing audience recently. Advertisers are already adapting and optimising their marketing strategies to the specifics of this rapidly-growing industry.

In today’s article, we’ll take a closer look at Mobile Global eSports Inc., the company that is involved in running esports events and tournaments at universities. It is planning to go public on the NASDAQ on 29 July under the “MGAM” ticker symbol.

What we know about Mobile Global eSports

The company is a subsidiary of Sports Industry of India, which develops different types of sports in the country. Mobile Global eSports’ business is running esports events and tournaments at universities.

In total, there are over 900 universities and 40,000 colleges in India with approximately 37 million students. The total number of students in all educational facilities exceeds 300 million people. However, we’ll provide more details about the company’s target market a bit later.

Last year, Mobile Global eSports held 27 esports tournaments in India between 125 university teams. The company’s management is focused on engaging all educational organisations in running sports events. In addition, the company is planning tournaments for high-school children in test mode.

Mobile Global eSports’s business model offers the following sources of revenue:

- selling branded merchandise

- team membership and participation fees

- licence sales

- mobile app monetisation

- streaming sales

Mobile Global eSports is a young company; its operational activities started in March 2021. Since the moment it was established, the company has raised $6 million in investment. The anchor investors were Razor Legacy Investors, Jita Ventures, and Greeny Legacy.

The prospects of Mobile Global eSports’ target market

eSports is a rapidly-growing entertainment area that already has a lot of prospective teams and popular associations, as well as a huge fan base.

According to market research by Ernst & Young, the global eSports audience gained 18% in 2021 if compared to 2020. The number of viewers all over the world is expected to reach 725 million by 2025. The most popular games are Dota 2, Heroes of the Storm, Counter Strike: Global Offensive, and Call of Duty.

eSports in India has been actively developing since 2010 with a mass distribution of smartphones and 4G networks. Experts from Ernst & Young say that in the two years from 2018 to 2020, the number of active users rose from 4 to 17 million.

By 2025, it is expected to be 85 million, while the number of professional cyberathletes might reach 1.5 million. As a result, India’s share in the global eSports market might amount to 10%.

The total amount of revenue of all online gaming events in the country last year was $40 million. At Ernst & Young, they believe this indicator might rise to $147 million by 2025. An average annual growth will be 38%, while the total economic impact might reach $1.3 billion.

How Mobile Global eSports performs financially

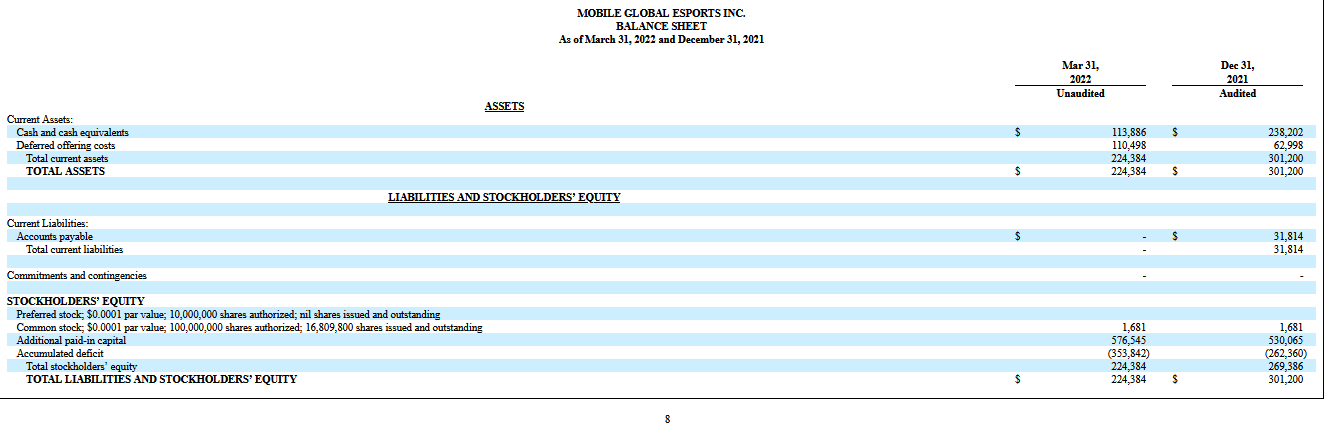

The company currently has neither revenue nor net profits, that’s why let’s take a look at its expenses. As of 31 March 2022, the issuer’s net loss was $262,000. The main expenditure area was market research.

As of the same date, Mobile Global eSports’ total liabilities were $224,000, while the cash equivalents on its balance sheet were $114,000.

Strengths and weaknesses of Mobile Global eSports

The company’s strengths are:

- By 2025, the numbers of active users and professional cyberathletes in India are expected to reach 85 million and 1.5 million, respectively

- Compound Annual Growth Rate (CAGR) of the company’s target market might be 38%

- India’s share of the global eSports market might reach 10% by 2025

- Proprietary online games

- No strong competitors

The list of weaknesses is much shorter: no revenue or net profits.

What we know about the Mobile Global eSports IPO

The underwriter of the IPO is WestPark Capital Inc. The issuer is planning to sell 1.5 million common shares at the price of $4-5 per share. Gross revenue is expected to be about $6.75 million, not including conventional options sold by the underwriter.

Assuming the IPO is successful at the proposed price range, the issuer’s value at the IPO excluding underwriter options might be approximately $76.59 million. Since the company doesn’t generate revenue or net profit, we can’t use any multipliers to assess its prospects.

Money raised during the IPO will be spent on:

- Brand expansion in India and Asia

- Acquisition of new software licences and patents

- eSports development in the country

Buying Mobile Global eSports shares might be considered a classic venture investment, which is not suitable for all investors.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

[ad_2]

Image and article originally from blog.roboforex.com. Read the original article here.