[ad_1]

EUR/USD Price, Chart, and Analysis

- Italian political instability is back in full view.

- Stock market and Italian government bonds fall sharply.

Italian Prime Minister Mario Draghi has resigned today after one-and-a-half years in office after his coalition government fell apart. Mr. Draghi tendered his resignation to President Sergio Mattarella earlier this week but was asked to go back to Parliament and try and form a new government. PM Draghi however was unable to gain the support of all of his coalition partners and tendered his resignation this morning. It looks likely that President Mattarella will dissolve Parliament shortly and call for an early election.

Mr. Draghi’s resignation and the uncertainty around the upcoming election hit Italian financial markets further with the FTSE MIB index of the top 40 Italian companies slumping by around 2%…

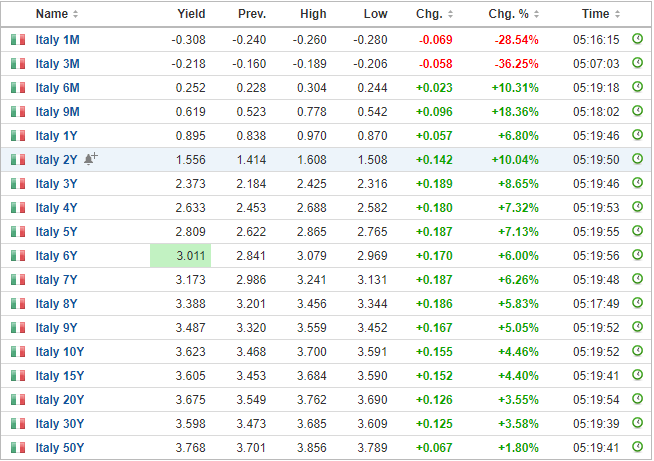

while Italian government bond yields soared. The 10-year Italian/German yield spread widened by a further 15 basis points to around 235 basis points. The rise in Italian borrowing costs will cause ECB President Christine Lagarde further problems ahead of today’s ECB policy meeting where the central bank is expected to hike interest rates for the first time since Q2 2011.

ECB Preview: How Will the Euro React?

For all market-moving economic releases and events, see the DailyFX Calendar

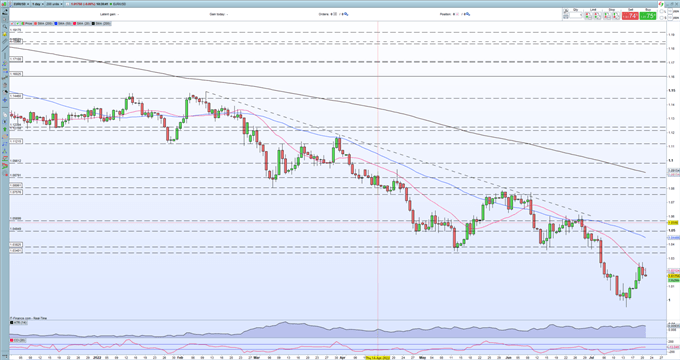

The single currency weakened against the US dollar but the move is muted ahead of the ECB rate decision. The Euro has rallied against the greenback over the last few days after trading below parity, but the pair now look under further pressure.

EUR/USD Daily Price Chart July 21, 2022

Retail trader data show 63.00% of traders are net-long with the ratio of traders long to short at 1.70 to 1. The number of traders net-long is 2.12% lower than yesterday and 23.44% lower from last week, while the number of traders net-short is 0.86% higher than yesterday and 37.65% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.