[ad_1]

Fundamental Forecast for the US Dollar: Neutral

- Markets are discounting a 75-bps rate hike from the Fed this week. That might not be enough for the US Dollar.

- After the July Fed meeting, there is one 25-bps rate hike priced-in through the end of 2022.

- According to the IG Client Sentiment Index, the US Dollar has a mixed bias heading into the first week of June.

US Dollar Week in Review

The US Dollar (via the DXY Index) fell last week for the first time in a month, posting its worst weekly performance in two months with a loss of -1.33%. The two largest components of the dollar gauge led the way, with EUR/USD rates climbing +1.27% and USD/JPY rates dropping by -1.75%. GBP/USD rates posted a solid gain as well, adding +1.16%. Weakening US economic data has led to a rapid deterioration in rate hike odds for the Federal Reserve, undercutting US Treasury yields and thus a significant source of US Dollar strength in recent months.

A Full US Economic Calendar

The coming week is saturated with important US economic data releases, each of which have the potential to upend FX markets. But no event or data release carries more importance than the July Fed meeting, where it is widely expected another significant rate hike will be levied. While that may be the most important event of the week, the sheer volume of ‘high’ rated events means that volatility in FX markets will likely run higher in the coming days, at least for USD-pairs.

- On Monday, July 25, the June US Chicago Fed national activity index will be released at 12:30 GMT.

- On Tuesday, July 26, the May US house price index is set to be published at 13 GMT, followed by the July US Conference Board consumer confidence index and the June US new home sales report at 14 GMT.

- On Wednesday, July 27, weekly US mortgage applications are due at 11 GMT. June US durable goods orders will come out at 12:30 GMT, as will the June US retail inventories report. June US pending home sales will be released at 14 GMT. The July Fed rate decision will be announced at 18 GMT, followed by Fed Chair Jerome Powell’s press conference at 18:30 GMT.

- On Thursday, July 28, the initial 2Q’22 US GDP report will be published at 12:30 GMT, as will weekly US jobless claims.

- On Friday, July 29, the June US PCE price index is due at 12:30 GMT, as are the June US personal income and personal spending reports. The final July US Michigan consumer sentiment report will be released at 14 GMT.

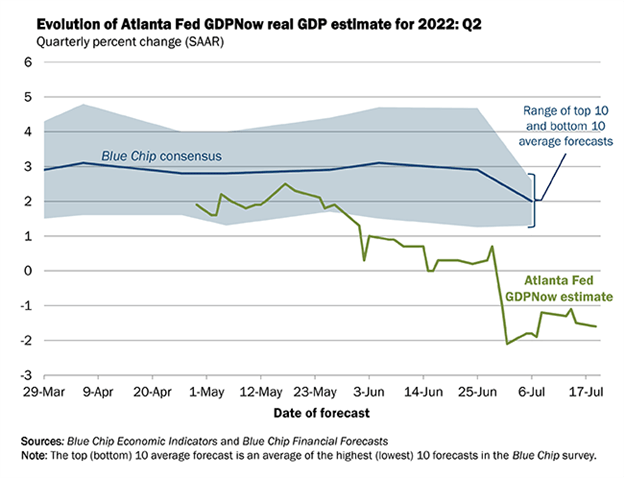

Atlanta Fed GDPNow 2Q’22 Growth Estimate (July 19, 2022) (Chart 1)

Based on the data received thus far about 2Q’22, the Atlanta Fed GDPNow growth forecast is now at -1.6% annualized, down from -1.5% on July 15. The downgrade was due to “second-quarter real residential investment growth [decreasing] from -8.8% to -10.1%.” The next update to the 2Q’22 Atlanta Fed GDPNow growth forecast is due on Wednesday, July 27, ahead of the July Fed meeting.

For full US economic data forecasts, view the DailyFX economic calendar.

Not Many More Rate Hikes Expected

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the front month/August 2022 and December 2022 contracts, in order to gauge where interest rates are headed by the end of this year.

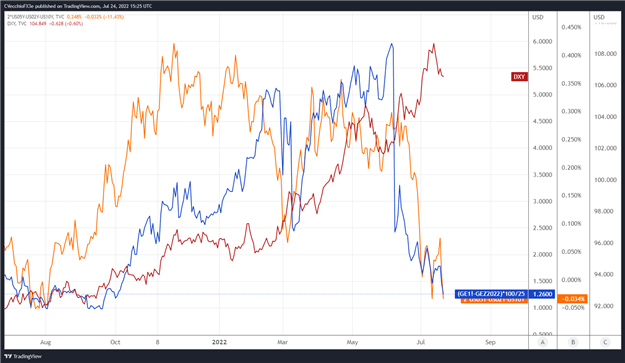

Eurodollar Futures Contract Spread (August 2022-December 2022) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: Daily Timeframe (July 2021 to July 2022) (Chart 1)

By comparing Fed rate hike odds with the US Treasury 2s5s10s butterfly, we can gauge whether or not the bond market is acting in a manner consistent with what occurred in 2013/2014 when the Fed signaled its intention to taper its QE program. The 2s5s10s butterfly measures non-parallel shifts in the US yield curve, and a narrowing of this measure has historically been a negative development for the US Dollar.

After the Fed raises rates by 75-bps this week, there is only one 25-bps rate hike discounted through the end of 2022. Coupled with movement in the 2s5s10s butterfly, the market’s interpretation of the near-term path of Fed rate hikes has become decidedly less hawkish. As markets are ever-forward looking, this week’s rate hike from the Fed may not be a bullish catalyst for the US Dollar if additional rate hikes this year are not signaled.

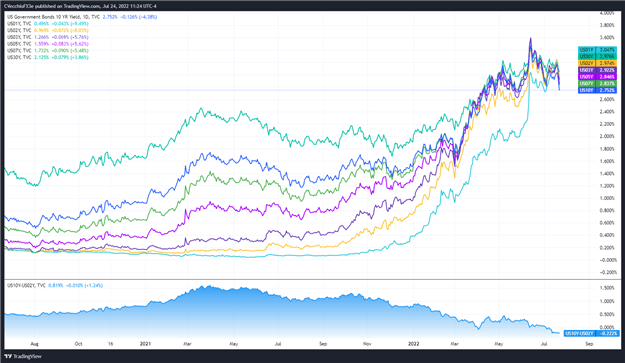

US Treasury Yield Curve (1-year to 30-years) (July 2020 to July 2022) (Chart 3)

The shape of the US Treasury yield curve coupled with declining Fed rate hike odds is acting as a headwind for the US Dollar. US real rates (nominal less inflation expectations) have eased back as well, and now that other major currencies are seeing their own real rates rise thanks to more aggressive central bank action, the monetary policy expectations gap that the US Dollar built up over the past few months has narrowed, eroding the US Dollar’s relative advantage.

CFTC COT US Dollar Futures Positioning (July 2020 to July 2022) (Chart 4)

Finally, looking at positioning, according to the CFTC’s COT for the week ended July 19, speculators increased their net-long US Dollar positions to 39,071 contracts from 38,353 contracts. US Dollar positioning is still stretched by historical standards, even though it is no longer at its most net-long level since March 2017.

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.