[ad_1]

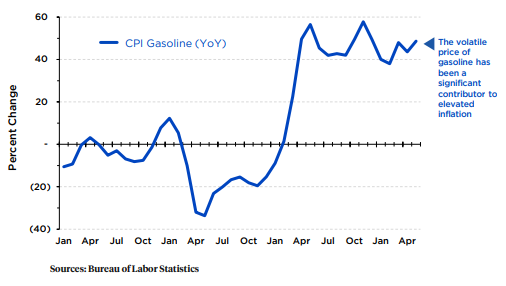

The Consumer Price Index report of 9.1% for June came as a great surprise to many. It was higher than analyst expectations and a reflection of the uphill battle the Fed faces in bringing inflation down to tolerable levels. Despite the soaring inflation, the labor market demonstrated surprising growth according to David Berson, chief economist at Nationwide, all pieces of what the central bank takes into consideration when raising interest rates.

Nonfarm payrolls in June grew 372,000 compared to the expected 250,000, with growth seen in health services, business services, and leisure and hospitality. Even more telling, none of the larger industries reported declines and average earnings have slowed but are still a healthy 5.1% up from June 2021.

Image source: Nationwide’s Weekly Economic Review & Outlook

“When including the downward revisions from the prior two months totaling 74,000, the trend in job gains is lower, but the downward trajectory is modest and job increases remain remarkably strong for a labor market as tight as this one is,” wrote Berson.

Retail sales were also up in June, rising 1%, partially attributed to higher prices driven by the high costs of gasoline and energy and partially attributed to resilient consumers for now. The services sector has slowed but June saw the sector hitting its 25th straight month of expansion, a reflection of a broader shift that is happening from goods to services within the economy.

Image source: Nationwide’s Weekly Economic Review & Outlook

“Bottom line, the consumer continues to spend despite the rise in recession fears,” Berson predicted before the release of June’s retail sales report.

The employment index in June fell for the third time out of the last five months, reflecting the continued difficulties that employers are having in hiring, but hiring is still happening.

“If the labor market data aren’t clear evidence that we are not currently in a recession, they at least suggest that this would be a very unusual recession — one with strong job growth and an extremely tight labor market,” Berson wrote.

The Federal Reserve meets next week, July 26-27, to determine the next round of interest rate hikes. Fed Governor Christopher Waller anticipates a 0.75% but has indicated that he is receptive to a 1.0% increase as well, given retail sales and housing.

For more news, information, and strategy, visit the Retirement Income Channel.

[ad_2]

Image and article originally from www.etftrends.com. Read the original article here.