[ad_1]

Khaosai Wongnatthakan

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-Listed ETFs

Total traded volume

Throughout June, trading activity on the Tradeweb European ETF marketplace reached EUR 55.1 billion, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 82.8%.

Adam Gould, head of equities at Tradeweb, said: “June was another extremely turbulent month for equities. Elevated oil prices, lack of clarity from the Fed and some key earnings misses were a few of the many factors that contributed to the broad-based sell off. During turbulent periods, we continue to see clients use ETFs as a valuable tool to transfer risk and tactically position portfolios.”

Volume breakdown

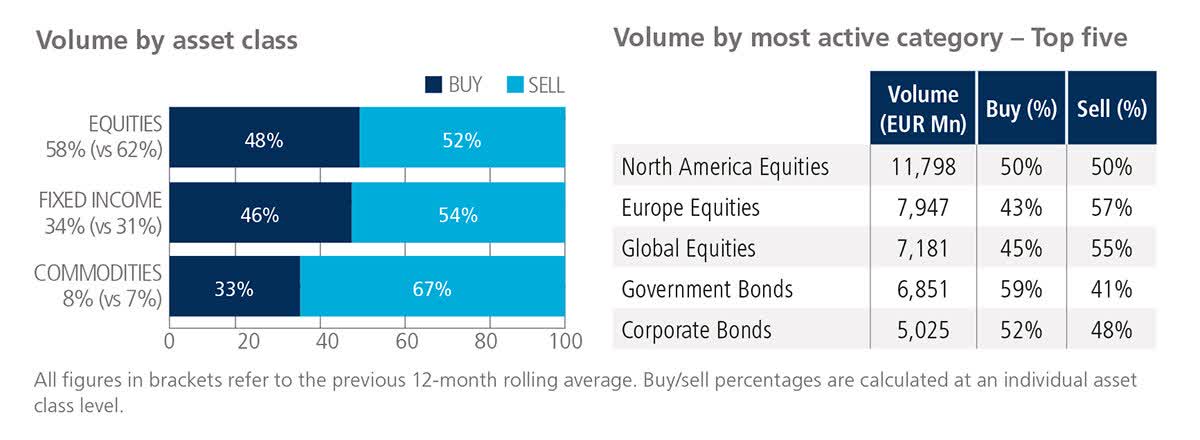

All asset classes saw net selling for the second consecutive month. Activity in commodity ETFs, where ‘sells’ outstripped ‘buys’ by 34 percentage points, increased to 8% of the total platform flow in June. North America Equities was the most actively-traded category, with nearly EUR 11.8 billion in total notional volume.

Top ten by traded notional volume

The iShares Core S&P 500 UCITS ETF (CSTNL) held on to the top spot for another month. In second place, the Lyxor Commodities Refinitiv/CoreCommodity CRB TR UCITS ETF is benchmarked against an index tracking the changes in the prices of the futures contracts on energy, metals and agricultural products.

U.S.-Listed ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in June 2022 was USD 58.7 billion, the platform’s third best monthly performance on record.

Volume breakdown

As a percentage of total notional value, equities accounted for 49% and fixed income for 45%, with the remainder comprising commodity and specialty ETFs. Adam Gould, head of equities at Tradeweb, said: “As ETFs increasingly become a staple in the toolkits of investors, we’ve seen many continue to embrace electronic RFQ as their preferred execution method. Year over year, monthly U.S. ETF activity on Tradeweb was up 135% and for the first half of 2022, volumes rose 125%.”

Adam Gould, head of equities at Tradeweb, said: “As ETFs increasingly become a staple in the toolkits of investors, we’ve seen many continue to embrace electronic RFQ as their preferred execution method. Year over year, monthly U.S. ETF activity on Tradeweb was up 135% and for the first half of 2022, volumes rose 125%.”

Top ten by traded notional volume

During the month, 2,027 unique tickers traded on the Tradeweb U.S. ETF marketplace. Fixed income products dominated June’s top ten list by traded notional volume, with the Vanguard Short-Term Bond Index Fund ETF moving up five places from May to be ranked first.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.