[ad_1]

Marathon stock is flashing a historically bullish signal

This commentary first appeared on Forbes Great Speculations, where Schaeffer’s Investment Research is a regular contributor.

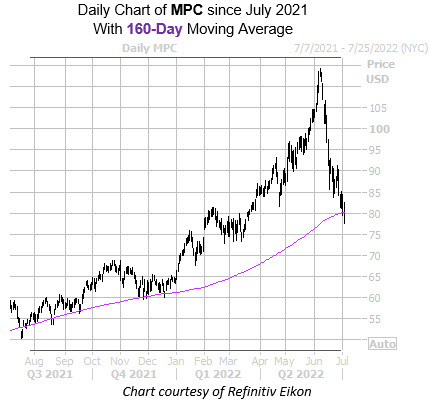

Marathon Petroleum Corp (NYSE:MPC) stock has been succumbing to the recent government pressure on big oil companies, last seen down 3.6% to trade at $78.81, after earlier slipping to its lowest level since March. However, MPC could soon add to its 23.4% year-to-date lead, given its latest pullback has the equity nearing a historically bullish trendline.

According to Schaeffer’s Senior Quantitative Analyst Rocky White’s latest study, MPC is within one standard deviation of its 160-day moving average. The security has seen three similar signals over the past three years, and was higher one month later every time, averaging a 6.4% gain for that period. A similar move would place Marathon Petroleum stock back above the $83 level.

Plus, MPC’s relative strength index (RSI) of 24.1 sits firmly in “oversold” territory. This means the stock is overdue for a short-term bounce.

Options look like a decent way to weigh in on the oil stock. The security’s Schaeffer’s Volatility Scorecard (SVS) sits at a 91 out of 100, meaning MPC has exceeded option traders’ volatility expectations during the past year.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.