[ad_1]

PepsiCo will invest $550 million in Celsius Holdings for an 8.5% stake in the company

PepsiCo, Inc. (NASDAQ:PEP) is in the spotlight today, after agreeing to invest $550 million in Celsius Holdings (CELH) for an 8.5% stake. The deal also has also enabled PepsiCo to take over the company’s U.S. energy drink distribution, and to nominate a director to serve Celcius’ board. At last check, PEP is up 1% to trade at $176.78.

Options bulls are taking notice, with 21,000 calls across the tape so far — double the intraday average — as opposed to just 4,047 puts. Most popular by far is the 8/5 180-strike call, where positions are currently being opened, followed distantly by the September 180 call.

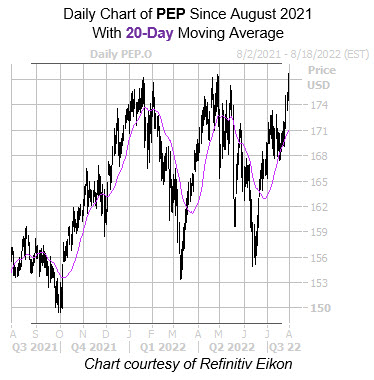

The equity has fared extremely well since its last earnings report, which culminated in a beat-and-raise. In fact, the shares earlier today hit a fresh all-time high of $177.69, and are now eyeing their third-straight win. The 20-day moving average has been supporting the security since late June, and longer term PEP sports a 12.6% year-over-year lead.

Options look like an attractive route at the moment. This is per the security’s Schaeffer’s Volatility Index (SVI) of 16%, which sits in the relatively low 23rd percentile of readings from the last 12 months, meaning options traders are currently pricing in low volatility expectations for the equity.

[ad_2]

Image and article originally from www.schaeffersresearch.com. Read the original article here.