[ad_1]

Almost everything in your life can be viewed as an event with a probability. What are the chances your local grocery store has the item you’re looking for? What’s the likelihood of running into so-and-so if you go to this bar as opposed to that one? What’re the odds you miss your flight if you leave at X:YZ o’clock?

What do all the probabilities in your life have in common? They’re all dynamic – constantly changing. At the conclusion of the event a binary 0% or 100% is realized, but the journey to that ending can witness wild swings in either direction.

Super Bowl 51 (New England Patriots vs Atlanta Falcons) Win Probability

Super Bowl LI between the New England Patriots and Atlanta Falcons is a prime example of just how much probabilities can change. The Win Probability reached more than 95% for both teams before the Patriots won in overtime.

While probabilities around the market might not shift so extremely, the Fed and their odds of future interest rate hikes are giving even Tom Brady a run for his money.

How to Make Probabilities Out of Futures

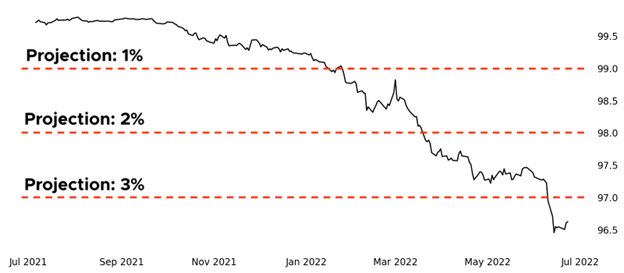

Fed Funds futures (ZQ) are derivatives based on the Fed Fund Rate and their prices generally project what the Fed will do in the future. For example, the December 2022 ZQ futures contract trading at 96.50 means that the market currently thinks interest rates are most likely going to be 3.5% (ZQ futures are priced in a manner that 100-[ZQ Price]=Interest Rate) at the end of the year.*

ZQ Fed Funds Futures (Dec 2022) Historical Prices

In the Summer of 2021, it was projected that rates would still be close to 0% by 2022’s close; and, while the path between 0% and 3.5% has been a volatile one, the journey isn’t over yet!

How Much Will the Fed Rate Hike in 2022?

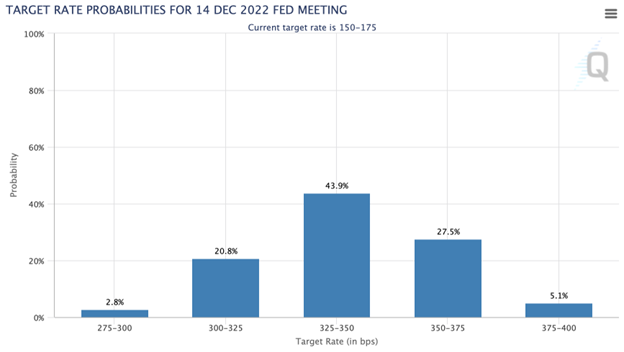

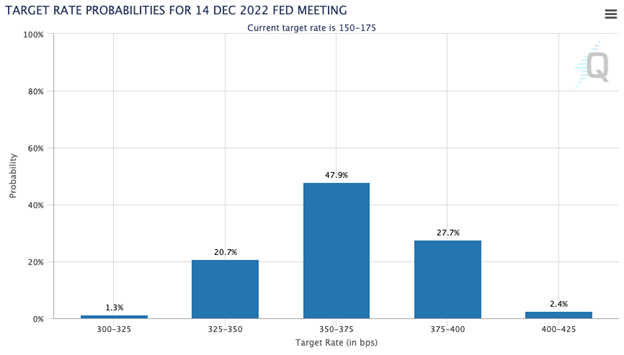

The current projection of a 3.5% interest rate at the end of 2022 is likely to change between now and December. In just the last week of trading, the most probable outcome has gone from leaning over 3.5% to now a shade under it.

Interest Rate Projections for 2022 (as of 6/23/22)

It may not look like much, but a 25 basis point (bps) shift is considered quite volatile for just a week’s worth of trading; extrapolating such volatility over still half a year left to trade, it could be reasonable to expect another 125 bps shift in either direction before the Fed actually speaks in December.

Interest Rate Projections for 2022 (as of 6/17/22)

Assigning odds to life’s events can help in the decision making process, but thinking that the future cannot deviate from the most likely outcome projected today is delusional. Probabilities change, and spotting an inefficiency before the rest of the market can make for some of the best trades.

*Value taken 6/23/22 Source: CME Group (https://cmegroup.com)

—

To learn more about how the Small Exchange is merging the efficiency of futures with the clarity of stocks, make sure to subscribe to their YouTube channel and follow them on Twitter so you never miss an update.

© 2022 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, not intended as a recommendation, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. The information presented here is for illustrative purposes only and is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Trading in derivatives and other financial instruments involves risk.

[ad_2]

Image and article originally from www.danielstrading.com. Read the original article here.