[ad_1]

Author: Mr and Mrs DDU.

Perhaps the most important factor for how quickly we can reach financial independence and retire early is how much we save. The difference between saving $30,000 and $40,000 a year can snowball significantly over a decade.

We aren’t trying to save every last cent we can. We want to enjoy our lives and experiences now, not just when we reach FIRE. However, at the same time we recognise that living a simpler life means we save more, it also means we don’t need to accumulate as much wealth to afford the lifestyle we want of living off only our investment income.

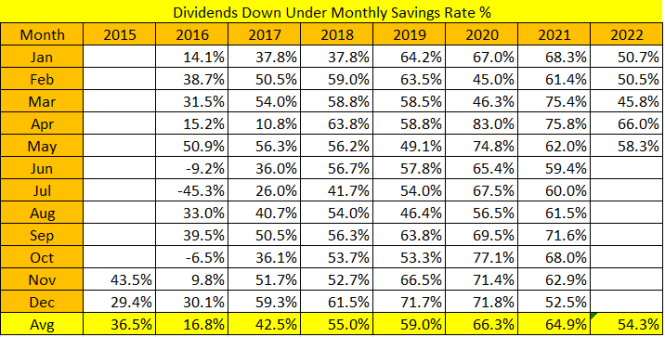

We are currently aiming to save around 50% to 60% of our net income.

Most of the money we are saving is being split between our house fund and investments. We post any articles about our money savings choices or habits here.

May 2022 Savings Update

Dividend Income: $638.66

Regular Income: $8,162.91

Adsense Income: $0.00

Total Income: $8,792

Expenses: $3,668

Savings Rate: $5,124

Savings Percentage: 58.3%

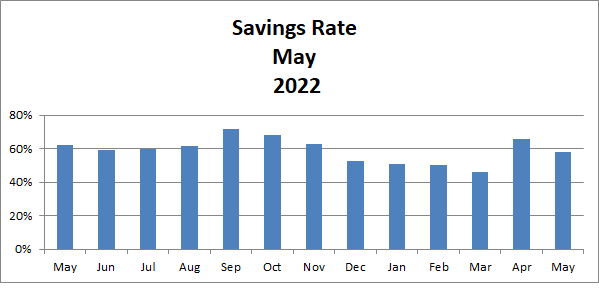

Here is the graph:

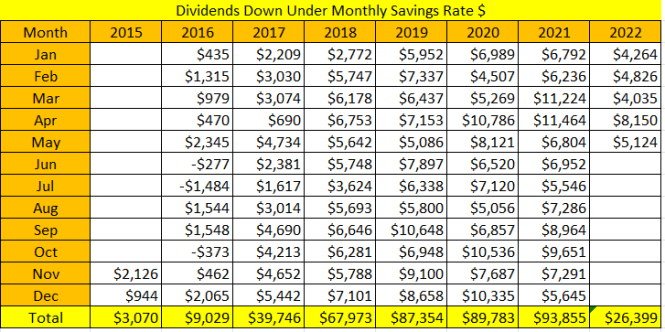

We invested a total of $5,000 of our savings into shares (not including any Dividend Re-Investment Plans). We added $0 of this month’s savings to our house deposit.

Here are the changes compared to last year:

May 2021 rate: 62%

May 2022 rate: 58.3%

Un-Improvement: 3.7%

May 2021 savings: $6,804

May 2022 savings: $5,124

Un-Improvement: $1,680

Income

Dividend Income – In May, we received $638.66. Our dividends covered 17.4% of our expenses.

Regular Income – This is the after-tax figure if you’re wondering. It is the combined figure of both our incomes plus any bank interest we have received. This amount also includes any government payment(s) we receive now that we have Little DDU in our life. Our superannuation (payments made for our personal retirement – sort of like 401k in the US or NEST in the UK) contributions are not included in our income or savings rate, but do help our long-term wealth.

Google Adsense – As the name suggests, it’s when Google makes a payment for advertising on the blog. We received a payment in November. Thanks for reading the blog and keeping the ‘lights’ on!

Expenses

Here we go, non-regular expenses that happened this month:

Op shops – We went looking through a bunch of op shops during May and got various things for around $50 including a toy microphone for Little DDU (she likes singing) and a hula hoop.

New TV – We bought a TV second hand for around $100, which would have cost several hundred dollars more if we had bought it brand new. Our old TV was 15+ years old and stopped working (unsure on exact age because it was also second hand). We are loving our new TV for movie nights!

Savings Tables

Here are our two savings tables since we started blogging showing the savings rate % and the savings rate in $ terms:

Final thoughts

While not quite as good as last year, it was still a solid savings month. We’re happy with anything over 50%. We’re putting lots of savings to work into shares at the moment.

The 3 key factors for us to become wealthy are:

- How much we earn

- How much of our earnings we save

- How hard we can make our savings/investments work

These monthly savings posts will track how good we’re doing with the first 2 factors.

How did your savings go in May?

Thanks for reading this article about our financial journey Down Under. Onwards and upwards!

[ad_2]

Image and article originally from dividendsdownunder.com. Read the original article here.