[ad_1]

FTSE 100, Dow Jones Talking Points

- FTSE 100 – price action supported by positive earnings

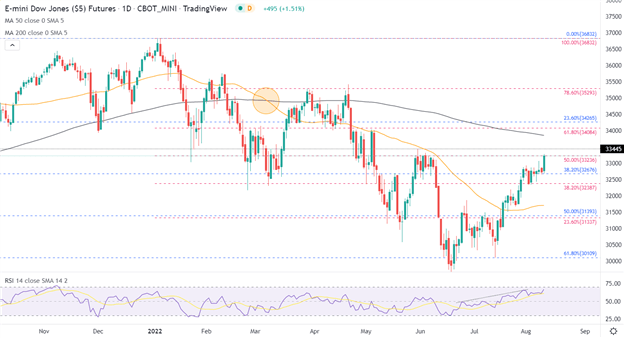

- Dow Jones bounces off support – softer US CPI print drives stocks higher

- Wall Street faces challenging resistance after recovering June losses

Stock Indices Rise – Optimistic US CPI Boosts Sentiment

Global stock indices are trading higher with Nasdaq, S&P 500 and Dow leading gains.

After Friday’s NFP (non-farm payroll) number doubled estimates (528k vs 250k est), a softer inflation print has provided optimism for stock indices. With the core inflation rate (YoY) remaining at 5.9% in July, the annual inflation rate (incl food and energy) has fallen to 8.5% showing potential signs of easing.

Visit DailyFX Education to learn about the role of central banks in global markets

DailyFX Economic Calendar

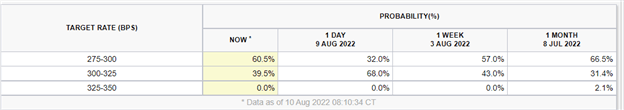

Expectations of Another Aggressive Rate Hike Ease

Over the past month, lower gas and energy prices have provided a temporary relief for price pressures that have been on a consistent rise since late last year.

Upon release of the data, expectations for a third consecutive 75-basis point rate hike to be announced at the September FOMC fell sharply (from 68 – 39.5%), supporting risk assets.

Source: CME Fed Watch Tool

Upon release of the data, Dow futures broke out of its recent range. With price action threatening the 50% Fibonacci of the 2022 move at 33,236, support continues to hold at 32,676 while the RSI (relative strength index) heads towards overbought territory.

Dow Jones Daily Chart

Source: TradingView, Chart by Tammy Da Costa

After recovering all of June’s losses, prices remain well above the 50-day MA (moving average), providing additional support at 31,706.

If bulls manage to gain traction above 33,236, the 33,500 psychological level could hold firm with a break above opening the door for 34,000.

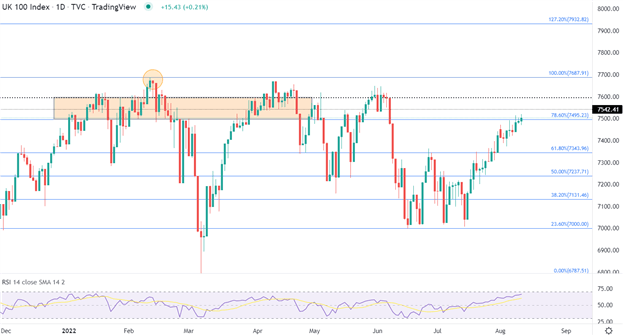

FTSE 100 Technical Analysis

Similarly, the FTSE has managed to trade higher after positive earnings from Aviva (AV), Admiral Group (ADM) and Flutter Entertainment contributed to the bullish move.

Despite a challenging time for the UK who is struggling with extreme heat and low water levels, FTSE is on path to reclaim 7,500 with the next level of resistance holding at 7,600.

FTSE 100 Daily Chart

Source: TradingView, Chart by Tammy Da Costa

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.