[ad_1]

The total supply of stablecoins decreased globally by 18.8% at the end of the second quarter of 2022 as the equities markets and risky assets experience volatile times due to rising inflation and other macro reasons.

Stabelcoins Supply Falls In The Second Quarter

Digital tokens called stablecoins are anchored to fiat money like the dollar. These currencies are supported by a combination of cash reserves, commercial holdings, and other physical assets and make use of blockchain technology.

This week, Arcane Research released a paper that detailed the supply pattern. In their analysis, Arcane looked at supply information for popular tokens like USDT, USDC, BUSD, DAI, MIM, and USTC.

Data indicated that the overall supply was above $180 billion in May 2022. By the end of the second quarter, that amount had dropped to $151.3 billion, indicating an 18.8% decline in worldwide supply.

The report claims that the significant reduction, which is estimated to be worth $35.1 billion, is the greatest quarterly supply drop in stablecoins history. This occurs at a time when the cryptocurrency market is struggling and the prices of market leaders like Bitcoin have fallen dramatically.

The crypto ecosystem entered the seven seas in 2022, and stablecoins were not left unphased.

To understand how stablecoins navigated the stormy market conditions and whether Arcane’s stablecoin predictions for 2022 stand the test of time, click below:https://t.co/uL5tTWFQlT

— Arcane Research (@ArcaneResearch) July 26, 2022

Suggested Reading | TRON Bulls Are Back To Pump Some Energy Into TRX Coin

USDC To The Top

In particular, Arcane’s report anticipates a rise of USDC to the top. In fact, the analysis predicted that somewhere in October 2022, the market value of USDC will increase by around USDT.

According to Arcane, Tether (USDT) has been the market’s largest stablecoin, fully utilizing the first mover advantage. However, in November 2021, it decreased by 50%. As the market capitalization of USDT fell from $78 billion to $66.3 billion in 2022, the fall continued.

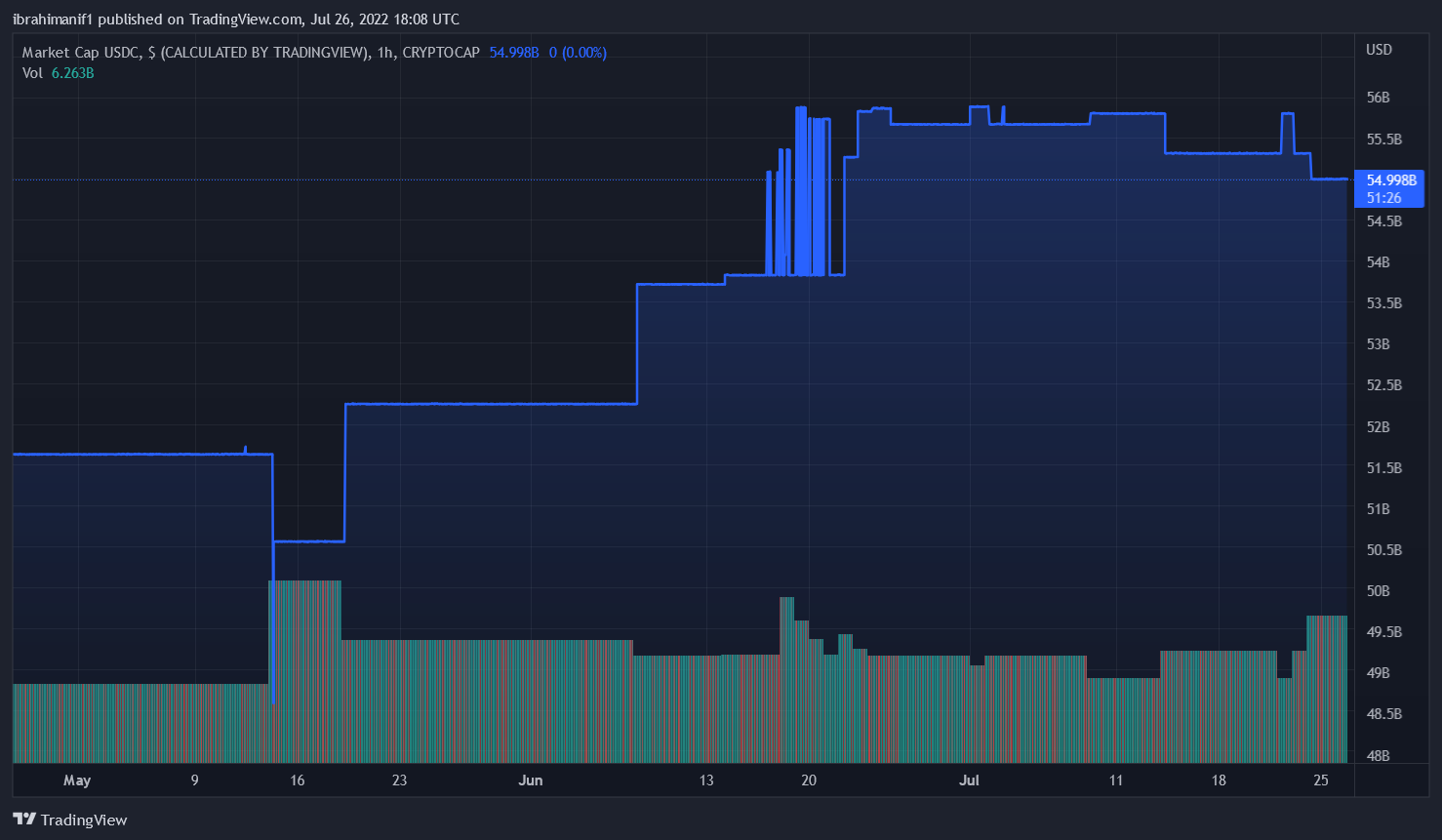

USDC market cap at $54 Billion. Source: TradingView

The top two stablecoins in cryptocurrency at the time of publication are USDT and USDC. The market capitalization of both tokens is over $50 billion. Binance USD (BUSD), the nearest rival, comes in third with a market worth of roughly $17.83 billion.

Related Reading | Ethereum Merge: How ETHBTC Could Hint At A Return Of Risk Appetite

Featured image from iStock Photo, charts from TradingView.com, Arane research

[ad_2]

Image and article originally from www.newsbtc.com. Read the original article here.