[ad_1]

Thanks to Powell’s comments, the most important number from the UMich sentiment survey now is inflation expectations. As a reminder, the Fed Chair freaked out at last month’s preliminary print of 3.3% (before it was revised lower for the final print). The ‘good’ news for Powell is that Inflation Expectations tumbled in preliminary July data (with medium-term expectations tumbling to just 2.8%)…

Source: Bloomberg

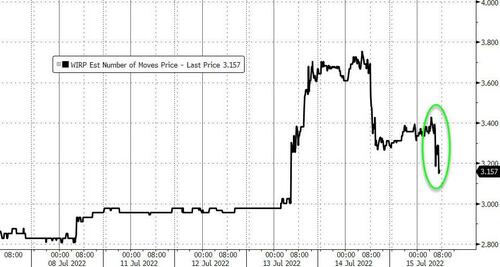

That is the lowest 5-10Y Inflation Expectation in 12 months, and was just what the market wanted to back The Fed off a little (100bps rate-hike odds have tumbled to just 15% from over 75%)…

And send stocks higher…

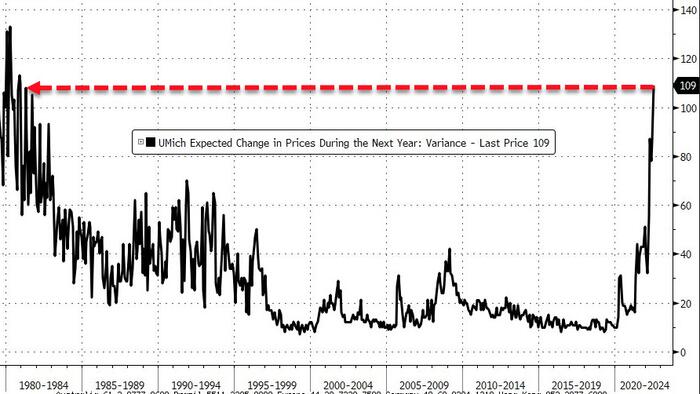

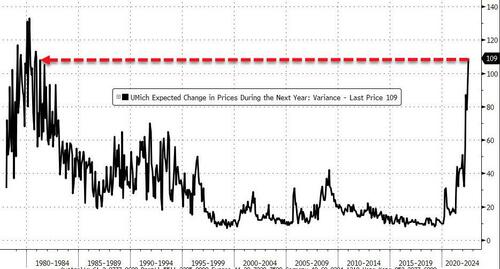

But – and it’s a big but, we do note that Inflation uncertainty continued to grow, with 26% of consumers expecting prices to stay the same or fall over the next 5 to 10 years, up from 11% a year ago.

Aggregate variance in respondents answers is its most uncertain since 1980…

Which fits perfectly with Fed Chair Powell’s recent admission that The Fed knows nothing about inflation.

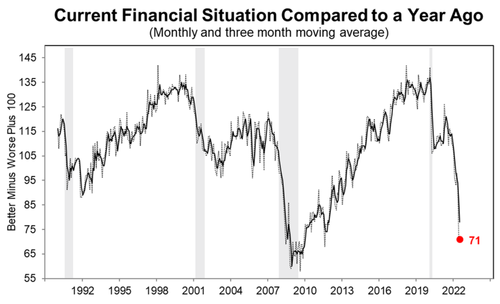

Current assessments of personal finances continued to deteriorate, reaching its lowest point since 2011, according to the university’s report.

The headline sentiment indicator was expected to remain flat at 50 – a record low – but rose very modestly to 51.1 driven by a rise in ‘current conditions’ (biggest jump since April 2021) while ‘expectations’ slipped lower…

Source: Bloomberg

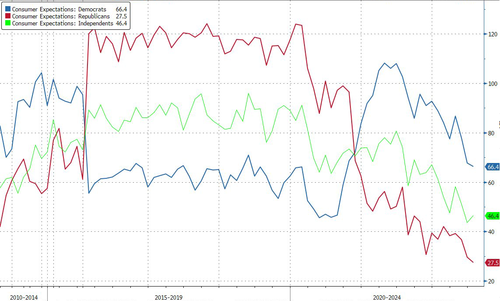

Expectations tumbled for both Republicans and Democrats (weakest since Biden admin began) but Independents saw sentiment expectations improve modestly (perhaps as gas prices dropped)…

Roughly half of respondents blame inflation for lowering their living standards, the worst since the 2008 financial crisis..

“Consumers remained in agreement over the deleterious effect of prices on their personal finances,” Joanne Hsu, director of the survey, said in a statement.

Will this print back The Fed off 100bps?

Finally, one important thing to consider…

One month ago Powell and the market overreacted to a survey of 441 Americans.

Today the market is again overrreacting to a survey of 441 Americans.

— zerohedge (@zerohedge) July 15, 2022

[ad_2]

Image and article originally from www.zerohedge.com. Read the original article here.