[ad_1]

As Americans are painfully aware, inflation is the highest in 40 years prompting The Federal Reserve to remove the massive punch bowl. In fact, Federal Reserve Governor Christopher “Fats” Waller backed raising rates by 75 basis points this month.

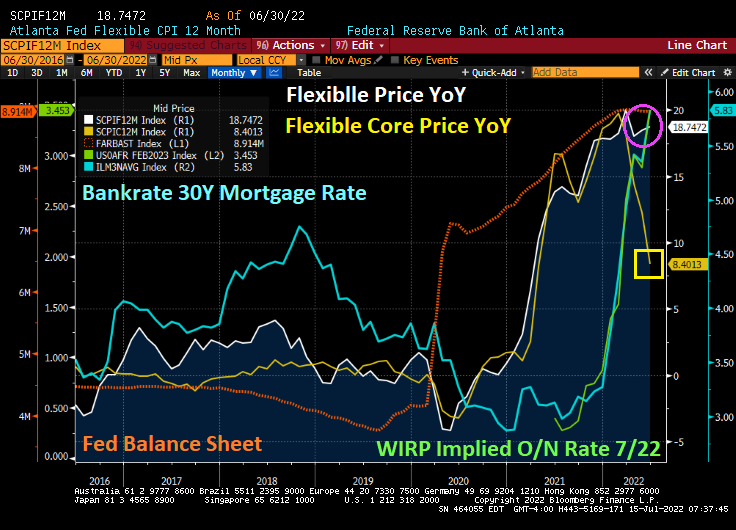

How hot was the recent inflation report? The Atlanta Fed’s flexible price index rose to 18.74% YoY. On the other hand, the CORE flexible price index (less energy and food) plunged to 8.46% YoY. The 30-year mortgage rate from Bankrate rose slightly to 5.83% as the implied overnight rate for the July FOMC meeting rose to 3.45%.

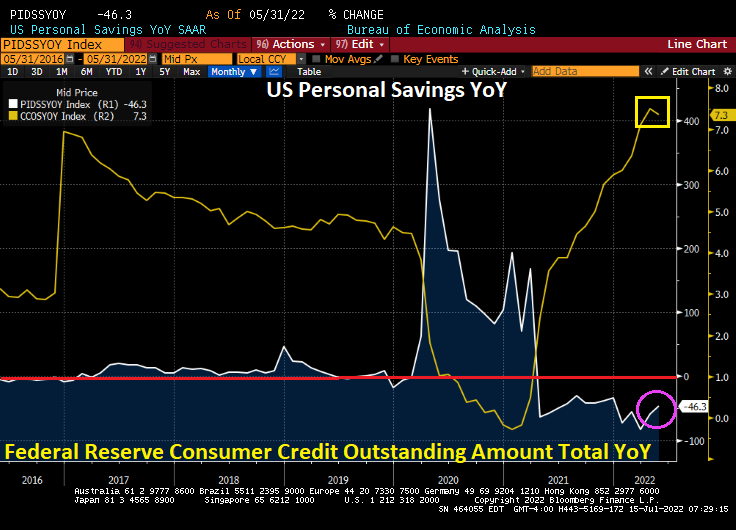

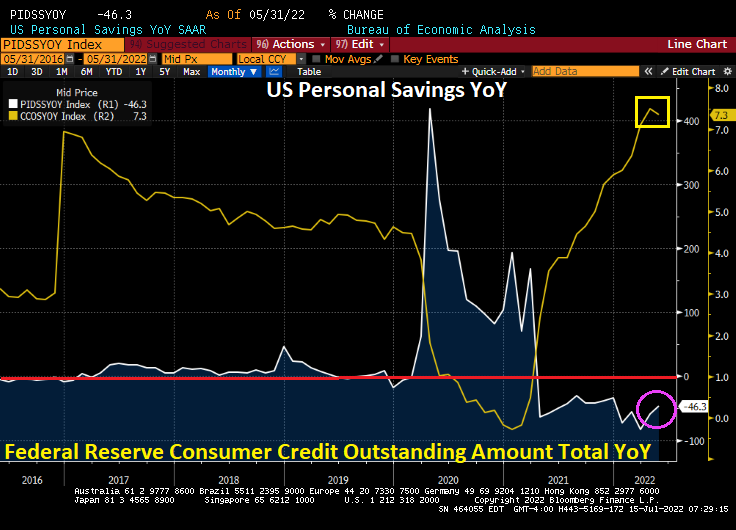

Inflation is ravaging consumers with the savings rate falling by -46.3% YoY while consumer credit rose 7.3% YoY. Yes, thanks to high inflation, consumers are saving less and borrowing more.

When even CORE flexible price inflation is 8.40% YoY, you know that The Fed and Federal government have made serious policy errors.

[ad_2]

Image and article originally from confoundedinterest.net. Read the original article here.