[ad_1]

We are across the great divide! In terms of house prices and affordability.

We are all aware that inflation is soaring, since the Covid outbreak in 2020 and the massive overaction by The Federal Reserve and Federal government in terms of stimulus spending and economic lockdowns.

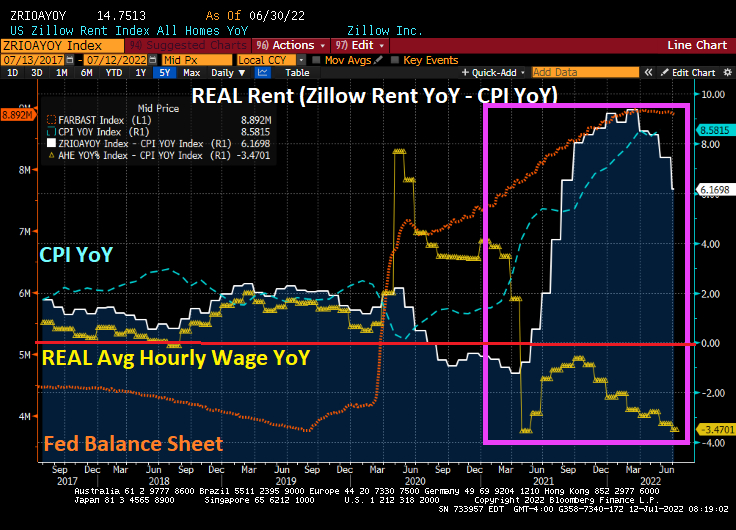

Things were “normal” before Covid in that REAL housing rent (white line) and REAL average hourly earnings YoY (yellow line) moved together. But after Covid shutdowns and Federal stimulus “relief” (orange line), we see that inflation (blue line) took off along with the growth in housing rent. The problem, of course, is that REAL average hourly earnings YoY has been declining. I call this “The Great Divide in housing affordability”.

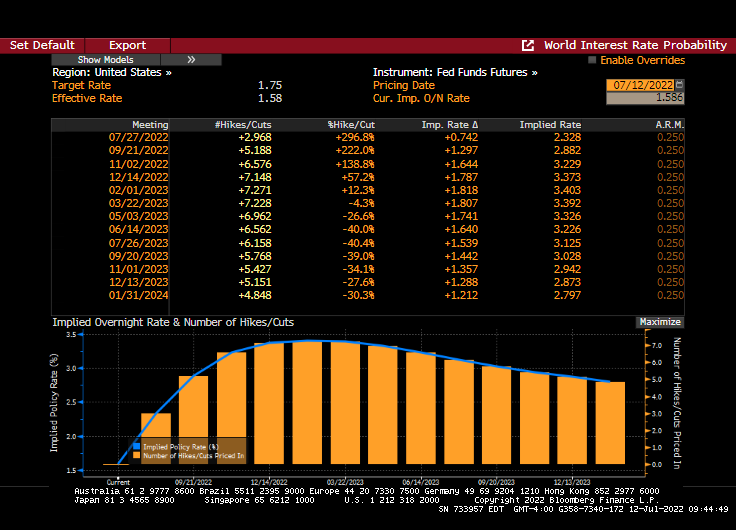

The question, of course, is whether The Federal Reserve will continue their “war on inflation” with a 75 basis point rate increase.

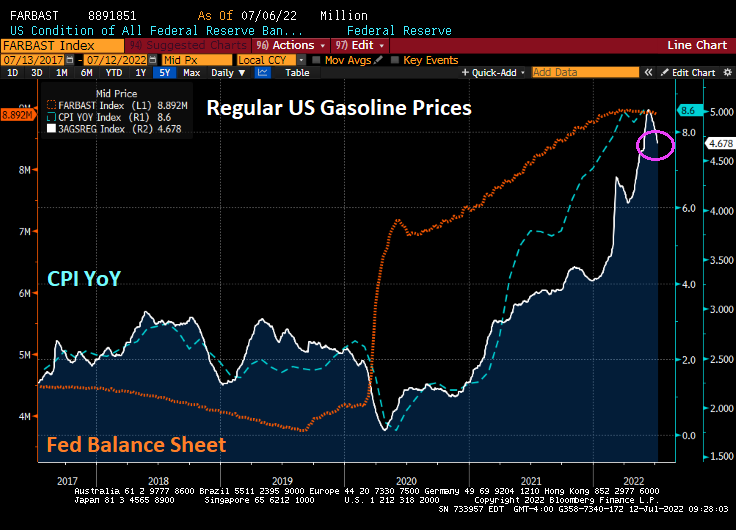

Inflation is at its fastest pace in 40 years, and is expected to increase even higher in tomorrow’s inflation report.

Gasoline prices have been dropping recently, but remain above $4.50 per gallon (regular gas price was $2.40 per gallon on Biden’s inauguration day. And no, it wasn’t the Biden Administration selling nearly 1 million barrels of crude oil from the strategic petroleum reserve to the Chinese government-owned Sinopec that Biden’s son Hunter is an investor (so, The Big Guy aka Joe Biden gets a 10% piece of the action). It is a slowing global economy that is helping to lower gasoline prices.

Between soaring gasoline prices and soaring home rents, it is little wonder that there is a serious homeless problem in places like New York and California.

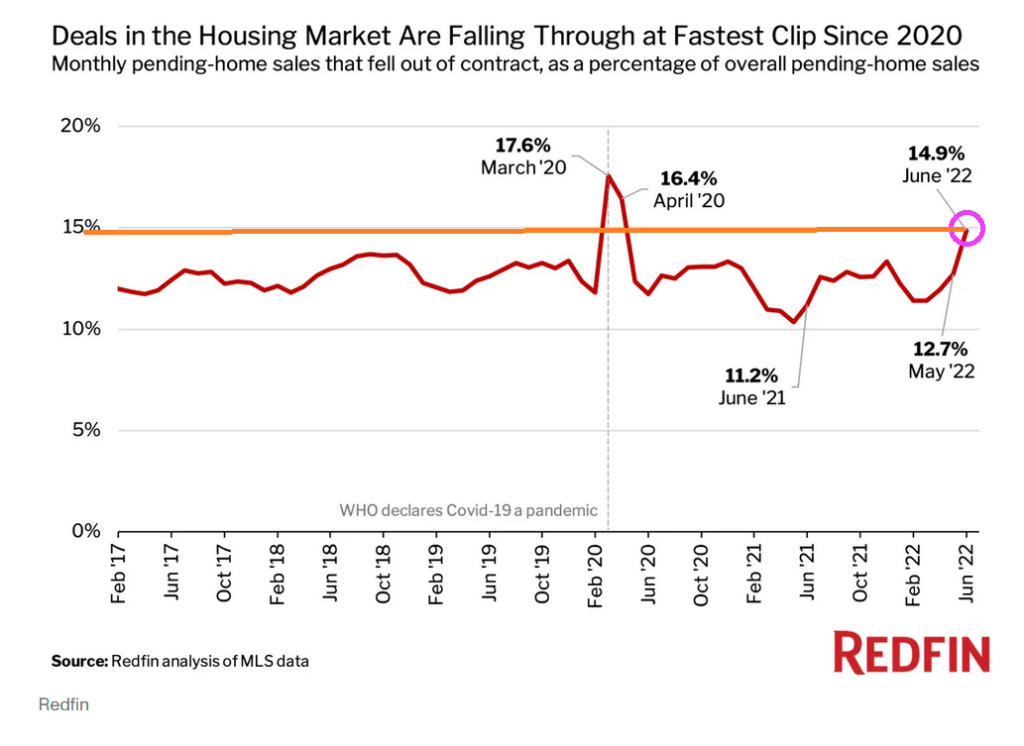

With rising mortgage rates, we are seeing a surge in pending home sales cancellations.

Atlanta Fed’s Raphael Bostic thinks that the US economy is so strong that it can easily handle a 75 basis point increase at the next FOMC meeting. Fortunately, he is not a voting member.

I wonder if Joe Biden sings “Carry On My Wayward Son” to Hunter?

[ad_2]

Image and article originally from confoundedinterest.net. Read the original article here.