[ad_1]

Forex spreads explained: Main talking points

- Spreads are based on the buy and sell price of a currency pair.

- Costs are based on forex spreads and lot sizes.

- Forex spreads are variable and should be referenced from your trading platform.

It’s important for traders to be familiar with FX spreads as they are the primary cost of trading currencies. In this article we explore how forex spreads work, and how to calculate costs and keep an eye on changes in the spread to maximize your trading success.

What is a spread in forex trading?

Every market has a spread and so does forex. A spread is simply defined as the price difference between where a trader may purchase or sell an underlying asset. Traders that are familiar with equities will synonymously call this the Bid: Ask spread.

Below we can see an example of the forex spread being calculated for the EUR/USD. First, we will find the buy price at 1.13398 and then subtract the sell price of 1.3404. What we are left with after this process is a reading of .00006. Traders should remember that the pip value is then identified on the EUR/USD as the 4th digit after the decimal, making the final spread calculated as 0.6 pips.

Now we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders.

How to calculate the forex spread and costs

Before we calculate the cost of a spread, remember that the spread is just the ask price less (minus) the bid price of a currency pair. So, in our example above, 1.13404-1.13398 = 0.00006 or 0.6 pips.

Using the quotes above, we know we can currently buy the EUR/USD at 1.13404 and close the transaction at a sell price of 1.13398. That means as soon as our trade is open, a trader would incur 0.6 pips of spread.

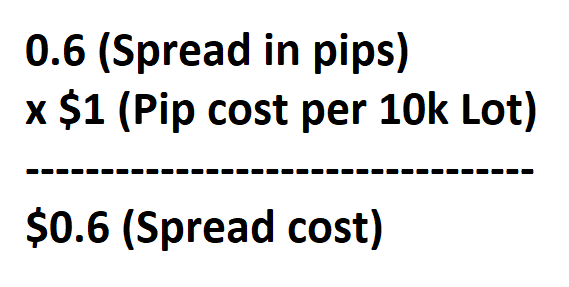

To find the total spread cost, we will now need to multiply this value by pip cost while considering the total amount of lots traded. When trading a 10k EUR/USD lot, you would incur a total cost of 0.00006 (0.6pips) X 10,000 (10k lot) = $0.6. If you were trading a standard lot (100,000 units of currency) your spread cost would be 0.00006pips (0.6pips) X 100,000 (1 standard lot) = $6.

If your account is denominated in another currency, like GBP, you would have to convert it to US Dollars.

Understanding a high spread and a low spread

It’s important to note that the FX spread can vary over the course of the day, ranging between a ‘high spread’ and a ‘low spread’.

This is because the spread can be influenced by multiple factors like volatility or liquidity. You will notice that some currency pairs, like emerging market currency pairs, have a greater spread than major currency pairs. Your major currency pairs trade in higher volumes compared to emerging market currencies, and higher trade volumes tend to lead to lower spreads under normal conditions.

Additionally, it’s well known that liquidity can dry up and spreads can widen in the lead up to major news events and in between trading sessions.

High spread

A high spread means there is a large difference between the bid and the ask price. Emerging market currency pairs generally have a high spread compared to major currency pairs.

A higher than normal spread generally indicates one of two things, high volatility in the market or low liquidity due to out-of-hours trading. Before news events, or during big shock (Brexit, US Elections), spreads can widen greatly.

Low spread

A low spread means there is a small difference between the bid and the ask price. It is preferable to trade when spreads are low like during the major forex sessions. A low spread generally indicates that volatility is low and liquidity is high.

Keeping an eye on changes in the spread

News is a notorious time of market uncertainty. Releases on the economic calendar happen sporadically and depending if expectations are met or not, can cause prices to fluctuate rapidly. Just like retail traders, large liquidity providers do not know the outcome of news events prior to their release! Because of this, they look to offset some of their risk by widening spreads.

Spreads can cause margin calls

If you are currently holding a position and the spread widens dramatically, you may be stopped out of your position or receive a margin call. The only way to protect yourself during times of widening spreads is to limit the amount of leverage used in your account. It is also sometimes beneficial to hold onto a trade during times of spread-widening until the spread has narrowed.

For more tips on how to successfully navigate the forex spread, take a look at our recommended forex spread trading strategies.

Further reading to take your forex trading to the next level

If you’re new to forex, we recommend downloading our free beginners forex trading guide which provides expert tips and insights on the market and ways to trade.

You can also tune into our live trading webinars for daily market insights and trading tips for insights on what may affect the spread, and stay up to date with the latest forex news and analysis.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.